M15, Underpayment of Estimated Income Tax for Individuals Form

What is the M15, Underpayment Of Estimated Income Tax For Individuals

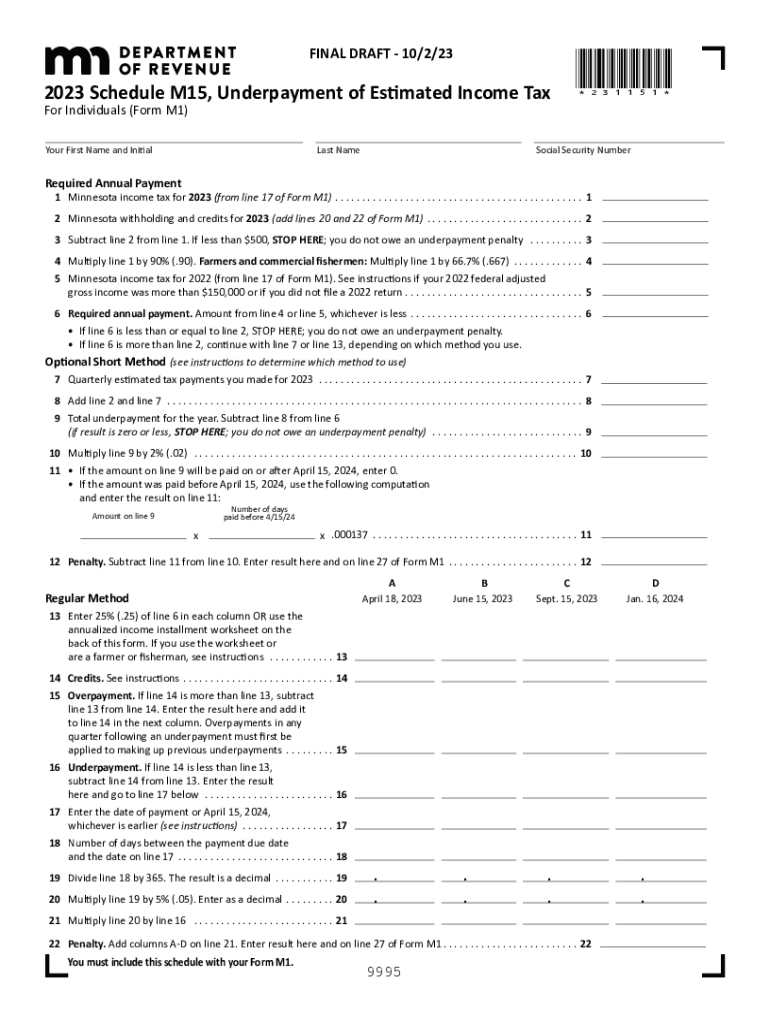

The MN Schedule M15 is a tax form used by individuals in Minnesota to report underpayment of estimated income tax. This form is specifically designed for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated payments. By filing the M15, individuals can calculate any penalties owed for underpayment and ensure compliance with state tax regulations. It is essential for taxpayers to understand the implications of underpayment, as it can lead to additional charges and interest on unpaid taxes.

How to use the M15, Underpayment Of Estimated Income Tax For Individuals

Using the MN Schedule M15 involves several steps to accurately report any underpayment of estimated income tax. Taxpayers should first determine if they owe a penalty by calculating their total tax liability for the year and comparing it to the amount they have paid. If the payments fall short, the M15 must be completed. The form requires information about total income, tax withheld, and any estimated payments made. After filling out the form, it should be submitted along with the tax return to ensure that any penalties are assessed correctly.

Steps to complete the M15, Underpayment Of Estimated Income Tax For Individuals

Completing the MN Schedule M15 involves a systematic approach:

- Gather necessary documents, including your tax return and records of estimated payments.

- Calculate your total tax liability for the year, including any credits and deductions.

- Determine the total amount of tax paid through withholding and estimated payments.

- Compare the total tax liability with the total payments made to identify any underpayment.

- Fill out the M15 form, providing accurate figures for each required section.

- Review the completed form for accuracy before submission.

Key elements of the M15, Underpayment Of Estimated Income Tax For Individuals

Several key elements are crucial when filling out the MN Schedule M15. Taxpayers must include:

- Total income for the year, which affects tax liability.

- Details of any tax withheld from wages or other income sources.

- Records of estimated tax payments made during the year.

- Calculations for any penalties based on the amount of underpayment.

Understanding these elements helps ensure that the M15 is completed accurately, minimizing the risk of penalties.

Filing Deadlines / Important Dates

Filing deadlines for the MN Schedule M15 align with the state tax return deadlines. Typically, the deadline for submitting this form is the same as the individual income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to deadlines, as timely filing can prevent additional penalties.

Penalties for Non-Compliance

Failure to file the MN Schedule M15 when required can result in significant penalties. Minnesota imposes a penalty for underpayment of estimated tax, which is calculated based on the amount of underpayment and the duration of the underpayment period. Additionally, interest may accrue on any unpaid amounts. Understanding these penalties emphasizes the importance of accurate and timely filing to avoid unnecessary financial burdens.

Quick guide on how to complete m15 underpayment of estimated income tax for individuals

Easily Prepare M15, Underpayment Of Estimated Income Tax For Individuals on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without delays. Handle M15, Underpayment Of Estimated Income Tax For Individuals on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Simplest Way to Modify and eSign M15, Underpayment Of Estimated Income Tax For Individuals Effortlessly

- Locate M15, Underpayment Of Estimated Income Tax For Individuals and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks on the device of your choice. Edit and eSign M15, Underpayment Of Estimated Income Tax For Individuals and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m15 underpayment of estimated income tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mn schedule m15 in relation to airSlate SignNow?

The mn schedule m15 refers to a specific document scheduling feature available in airSlate SignNow. This feature allows users to efficiently manage and send documents for eSignature, ensuring that all parties are notified and able to sign within the specified timelines. With airSlate SignNow, businesses can streamline their document workflows using mn schedule m15.

-

How does airSlate SignNow help with the mn schedule m15 feature?

AirSlate SignNow's mn schedule m15 feature automates the document sending process, reducing delays and increasing efficiency. Users can set predefined schedules for document dispatch, ensuring that important agreements are signed promptly. This helps businesses maintain a steady workflow and avoid bottlenecks in their operations.

-

Is there a cost associated with using mn schedule m15 in airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that include access to the mn schedule m15 feature. The plans are designed to cater to various business sizes and needs. By investing in airSlate SignNow, you gain access to cost-effective solutions that simplify the eSigning process while utilizing mn schedule m15.

-

What are the benefits of using airSlate SignNow with mn schedule m15?

Using airSlate SignNow with the mn schedule m15 feature provides numerous benefits, including time efficiency, improved collaboration, and enhanced document security. Businesses can ensure that their documents are signed faster and tracked easily. This effectiveness can lead to higher customer satisfaction and better compliance.

-

Does airSlate SignNow integrate with other applications while using mn schedule m15?

Absolutely! AirSlate SignNow seamlessly integrates with various third-party applications, enhancing the functionality of the mn schedule m15 feature. Whether you use CRM systems or project management tools, integrating them with airSlate SignNow can streamline your document handling processes.

-

Can I customize the mn schedule m15 settings in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their mn schedule m15 settings based on their specific requirements. This means you can set reminders, adjust timing, and personalize notifications to fit your workflow. Customization ensures that the document signing process aligns perfectly with your business operations.

-

Is mn schedule m15 suitable for small businesses?

Absolutely! The mn schedule m15 feature in airSlate SignNow is designed to be user-friendly and affordable, making it ideal for small businesses. With its capability to streamline document workflows, small businesses can effectively manage their signing processes without incurring high costs.

Get more for M15, Underpayment Of Estimated Income Tax For Individuals

- Any form of probation and the name under which the person was convicted or received the suspended sentence or probation sos ok

- 000 0500109 ite oklahoma individual estimated tax first quarter ow 8 es revised 10 a for tax year b quarter c taxpayers ssn d form

- Does electronic authorization for payroll deduction massachusetts form

- Affidavit of unauthorizedfraudulent use form

- Narrow amp anderson street apartments crhava org form

- Hud hardship exemption form

- Solidity contract template form

- Songwriter contract template form

Find out other M15, Underpayment Of Estimated Income Tax For Individuals

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online