New India Rtgs Form

What is the New India Rtgs Form

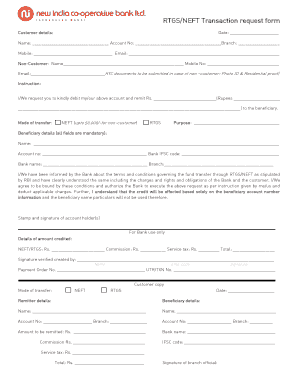

The New India Rtgs Form is a standardized document used for initiating Real Time Gross Settlement (RTGS) transactions within the banking system. This form facilitates the transfer of funds between banks in real-time, ensuring immediate processing of transactions. It is essential for individuals and businesses looking to make high-value payments efficiently. The form typically includes details such as the sender's and recipient's bank information, account numbers, and the amount to be transferred.

How to use the New India Rtgs Form

Using the New India Rtgs Form involves several straightforward steps. First, ensure you have the necessary details at hand, including your bank account information and the recipient's details. Next, fill out the form accurately, providing all required information to avoid delays. After completing the form, you can submit it through your bank's online portal or in person at a branch. It's important to double-check all entries for accuracy before submission to ensure a smooth transaction.

Steps to complete the New India Rtgs Form

Completing the New India Rtgs Form requires attention to detail. Here are the steps to follow:

- Gather necessary information: Collect details such as your bank account number, the recipient's account number, and the amount you wish to transfer.

- Access the form: Obtain the New India Rtgs Form either online through your bank's website or at a physical branch.

- Fill out the form: Enter all required information accurately, including your personal details and the transaction specifics.

- Review the form: Check for any errors or omissions to ensure all information is correct.

- Submit the form: Send the completed form through the designated submission method, whether online or in person.

Legal use of the New India Rtgs Form

The New India Rtgs Form is legally binding when completed and submitted correctly. It is essential to comply with all regulations governing electronic transactions to ensure the legality of the transfer. This includes providing accurate information and obtaining necessary authorizations. By using a secure platform for submission, you can further enhance the legal standing of your transaction, ensuring it meets all compliance requirements.

Key elements of the New India Rtgs Form

Understanding the key elements of the New India Rtgs Form is crucial for successful transactions. Important components include:

- Sender's Information: This includes the sender's name, account number, and bank details.

- Recipient's Information: Essential details about the recipient, such as their name, account number, and bank branch.

- Transaction Amount: The total amount to be transferred, which must be clearly stated.

- Purpose of Transfer: Some forms may require a brief description of the reason for the transaction.

Form Submission Methods

The New India Rtgs Form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online Submission: Many banks offer online platforms where users can fill out and submit the form electronically.

- In-Person Submission: Customers can visit their bank branch to submit the form directly to a teller.

- Mail Submission: Some banks may allow users to send the completed form via postal mail, though this method may result in delays.

Quick guide on how to complete new india rtgs form

Prepare New India Rtgs Form easily on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle New India Rtgs Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign New India Rtgs Form effortlessly

- Locate New India Rtgs Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the information and then select the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device. Edit and eSign New India Rtgs Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new india rtgs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new India bank RTGS form?

The new India bank RTGS form is a document required for processing Real Time Gross Settlement (RTGS) transactions at New India Bank. This form ensures that all necessary details for transferring funds securely are provided. By completing the new India bank RTGS form, customers can facilitate quick and efficient transactions.

-

How can I obtain the new India bank RTGS form?

You can obtain the new India bank RTGS form directly from the New India Bank website or by visiting any branch. It's typically available for download in PDF format to ensure easy access and completion. Make sure to fill out the new India bank RTGS form carefully to avoid any delays in processing.

-

What are the key features of the new India bank RTGS form?

The new India bank RTGS form includes essential features such as sender and receiver details, transaction amount, and purpose of transfer. It is designed to ensure that all the required information is captured accurately to process transactions smoothly. Utilizing the new India bank RTGS form helps in minimizing errors and enhancing transaction efficiency.

-

What are the benefits of using the new India bank RTGS form?

By using the new India bank RTGS form, customers can enjoy benefits like immediate fund transfer and greater security for large transactions. This form simplifies the process for users, ensuring funds are transferred without delays. Additionally, the new India bank RTGS form supports seamless integration with digital banking services.

-

Are there any fees associated with the new India bank RTGS form?

Yes, there are typically fees associated with transactions processed using the new India bank RTGS form. These fees may vary based on the amount being transferred and the bank's policy. It is advisable to check with New India Bank directly for the latest fee structure related to the new India bank RTGS form.

-

Can I use the new India bank RTGS form for international transactions?

The new India bank RTGS form is primarily meant for domestic transactions within India. For international transfers, different procedures and forms are generally required. It's important to consult with New India Bank for information on the correct forms needed for international wire transfers.

-

How long does it take for a transaction via the new India bank RTGS form to process?

Transactions processed through the new India bank RTGS form are typically completed within a few hours during banking hours. However, it is crucial to submit the form correctly and during operational hours to avoid delays. Once submitted, you can confirm the status of the transaction with New India Bank.

Get more for New India Rtgs Form

- Acceptable identification documents texas dps form

- Sheriff service of process intake form

- A roadmap for mental health for all thrivenyc form

- Pleasecompleteallsectionsandsubmitthis formtothe calendarunitwi ththe petition

- Assessment form for approval of overnight visiting in hotels

- All applicants must complete the section below form

- Work progress program new service provider application form

- Intake sheet welcome to nycgov city of new york form

Find out other New India Rtgs Form

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast