1350 Dor Sc Gov2023STATE of SOUTH CAROLINADEPARTME Form

Understanding the 2022 South Carolina Estimated Tax

The 2022 South Carolina estimated tax is a method for taxpayers to pay their expected tax liability in advance. This is particularly relevant for individuals who do not have taxes withheld from their income, such as self-employed individuals or those with significant investment income. By making estimated tax payments, taxpayers can avoid penalties for underpayment when they file their annual tax return.

Steps to Complete the 2022 SC Estimated Tax Form

To complete the 2022 SC estimated tax form, follow these steps:

- Gather your financial information, including income sources and deductions.

- Use the South Carolina Department of Revenue guidelines to calculate your estimated tax liability.

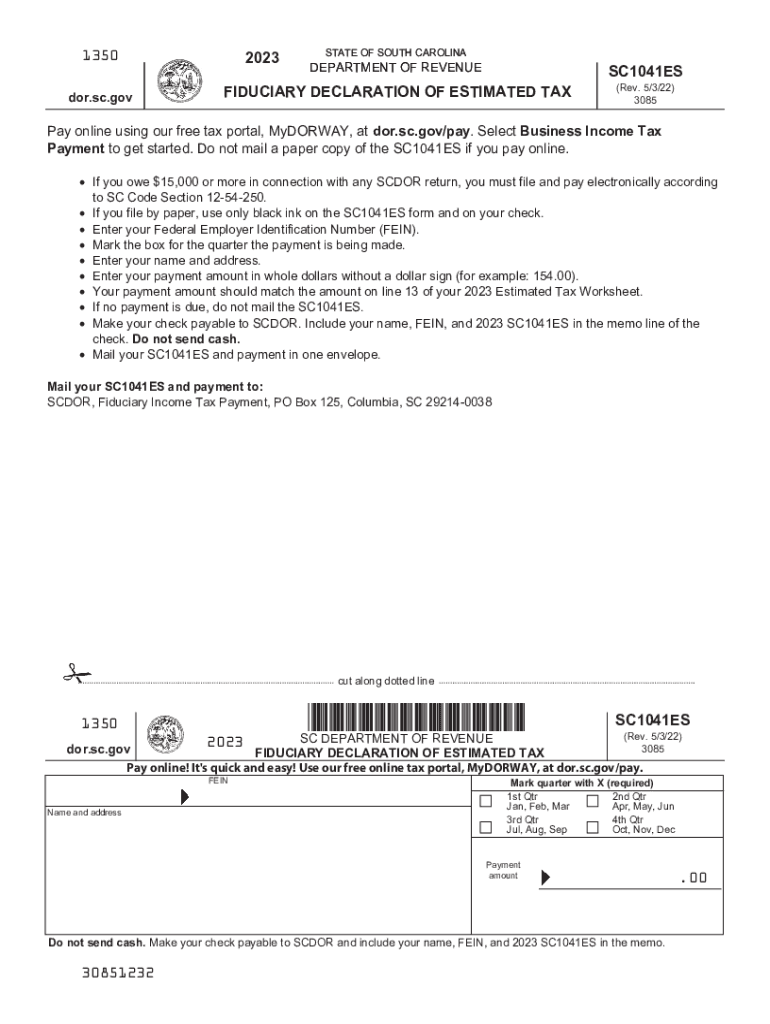

- Fill out the SC1041ES form, ensuring all required information is accurate.

- Submit the form along with your payment, if applicable, by the specified deadlines.

Filing Deadlines for 2022 SC Estimated Tax Payments

Timely filing of your estimated tax payments is crucial to avoid penalties. For the 2022 tax year, the deadlines for estimated tax payments are typically:

- First payment: April 15, 2022

- Second payment: June 15, 2022

- Third payment: September 15, 2022

- Fourth payment: January 15, 2023

Required Documents for Filing Estimated Taxes

When preparing to file your estimated taxes, ensure you have the following documents:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

Penalties for Non-Compliance with Estimated Tax Payments

Failure to make timely estimated tax payments can result in penalties. The South Carolina Department of Revenue may impose a penalty if:

- Your total estimated tax payments are less than the required amount.

- You do not pay your estimated taxes by the due dates.

It is advisable to calculate your estimated tax accurately to mitigate any potential penalties.

Eligibility Criteria for Making Estimated Tax Payments

Not all taxpayers are required to make estimated tax payments. Generally, you must make estimated payments if:

- You expect to owe $100 or more in tax after subtracting withholding and refundable credits.

- Your withholding and refundable credits will be less than the smaller of ten percent of your current year tax or your previous year tax.

Understanding these criteria can help you determine your obligation to file estimated taxes.

Quick guide on how to complete wv state code 17c 6 1

Effortlessly prepare wv state code 17c 6 1 on any device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle 2022 sc estimated on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and electronically sign tax income with ease

- Obtain eagle feather repository application and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign south carolina sc1041es and facilitate excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to sc sc1041es form

Create this form in 5 minutes!

How to create an eSignature for the sc1041es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask eagle repository

-

What is airSlate SignNow and how does it relate to 2022 sc estimated?

airSlate SignNow is a digital solution that empowers businesses to send and eSign documents securely and efficiently. The term '2022 sc estimated' is often referenced in regards to the pricing and cost estimates for our services, making it easy for businesses to budget for their document management needs.

-

How does airSlate SignNow's pricing align with the 2022 sc estimated costs?

The pricing plans for airSlate SignNow are designed to be cost-effective, matching or exceeding the 2022 sc estimated costs for similar services. Our flexible payment options ensure that businesses of all sizes can find a plan that fits their budget while also providing robust electronic signature capabilities.

-

What features does airSlate SignNow offer that are beneficial for 2022 sc estimated budget planning?

airSlate SignNow offers a comprehensive suite of features including document customization, multiple signing options, and automation tools that align with the 2022 sc estimated budget expectations. These features help businesses streamline their document workflows, ultimately saving them time and money.

-

Is airSlate SignNow easy to integrate with existing systems in line with 2022 sc estimated requirements?

Yes, airSlate SignNow provides seamless integrations with popular business applications, making it easy to align with the 2022 sc estimated requirements for technological compatibility. Whether you use CRM systems or cloud storage, our solution fits smoothly into your existing workflows.

-

What benefits can businesses expect from using airSlate SignNow concerning 2022 sc estimated values?

Businesses using airSlate SignNow can expect signNow improvements in efficiency, reduced turnaround times for documents, and lower operational costs, all aligning perfectly with the 2022 sc estimated values. This leads to higher levels of customer satisfaction and enhanced productivity across teams.

-

How does airSlate SignNow ensure security while staying within the 2022 sc estimated framework?

Security is paramount at airSlate SignNow. We implement industry-leading encryption and compliance measures that not only protect your documents but also fit within the 2022 sc estimated security standards expected by businesses today.

-

Can airSlate SignNow help with compliance issues related to 2022 sc estimated practices?

Absolutely! airSlate SignNow is designed to help businesses stay compliant with various regulations which are often part of the 2022 sc estimated practices. Our solution incorporates audit trails and secure storage to ensure that your document management processes meet compliance requirements.

Get more for national eagle repository

Find out other eagle repository phone number

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement