NFP Exemption from Real Estate Taxation for Property Owned by Form

Understanding the NFP Exemption From Real Estate Taxation

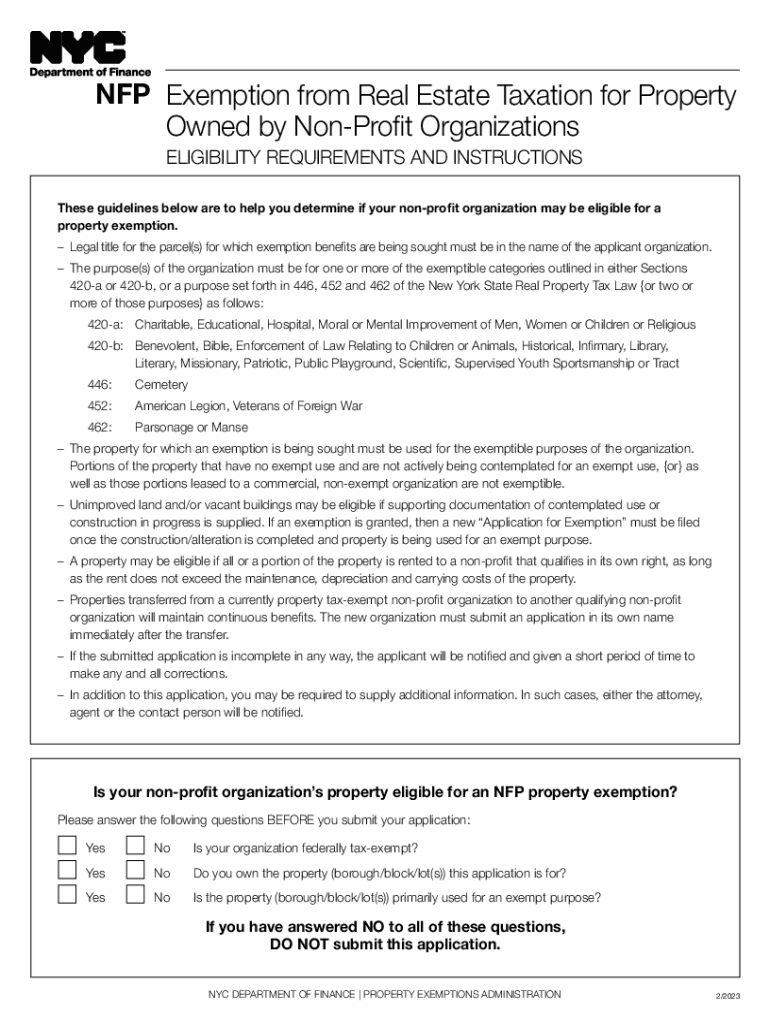

The NFP exemption is designed for properties owned by non-profit organizations in New York City, allowing them to be exempt from certain real estate taxes. This exemption supports organizations that provide valuable services to the community, such as education, healthcare, and social services. To qualify, the property must be used exclusively for exempt purposes, and the organization must be recognized as a non-profit under federal law.

Steps to Obtain the NFP Exemption From Real Estate Taxation

To obtain the NFP exemption, organizations must complete a series of steps:

- Determine eligibility by confirming non-profit status and intended use of the property.

- Gather necessary documentation, including proof of non-profit status and a description of the property’s use.

- Complete the required application form, typically provided by the NYC Department of Finance.

- Submit the application along with all supporting documents to the appropriate city office.

- Await confirmation of approval or request for additional information from the city.

Required Documents for the NFP Exemption Application

When applying for the NFP exemption, organizations must provide several key documents:

- Proof of non-profit status, such as IRS determination letters.

- A detailed description of how the property will be used for exempt purposes.

- Financial statements or budgets that demonstrate the organization's operational status.

- Any additional documentation requested by the NYC Department of Finance.

Eligibility Criteria for the NFP Exemption

Eligibility for the NFP exemption hinges on specific criteria:

- The organization must be classified as a non-profit under IRS regulations.

- The property must be used exclusively for charitable, educational, or other exempt purposes.

- The organization must not operate for profit or distribute earnings to members.

Legal Use of the NFP Exemption

The legal framework surrounding the NFP exemption is grounded in New York State and City laws. Non-profit organizations must adhere to regulations that govern their operations and ensure compliance with property use requirements. Misuse of the exemption can lead to penalties, including the retroactive payment of taxes. Organizations should maintain accurate records and be prepared for potential audits.

Examples of Using the NFP Exemption

Common examples of properties that may qualify for the NFP exemption include:

- Churches and places of worship that serve the community.

- Schools and educational institutions providing free or subsidized education.

- Healthcare facilities that offer services to low-income individuals.

- Community centers that provide recreational and social services.

Quick guide on how to complete nfp exemption from real estate taxation for property owned by

Complete NFP Exemption From Real Estate Taxation For Property Owned By effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your papers swiftly without any hold-ups. Manage NFP Exemption From Real Estate Taxation For Property Owned By on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to adjust and eSign NFP Exemption From Real Estate Taxation For Property Owned By with ease

- Find NFP Exemption From Real Estate Taxation For Property Owned By and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to secure your changes.

- Select how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign NFP Exemption From Real Estate Taxation For Property Owned By and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nfp exemption from real estate taxation for property owned by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC DOF NFP?

NYC DOF NFP stands for New York City Department of Finance Not-For-Profit. It is a regulatory body that oversees financial practices and compliance for not-for-profit organizations in New York City, ensuring they operate in accordance with city guidelines.

-

How can airSlate SignNow assist with NYC DOF NFP documentation?

AirSlate SignNow provides a seamless platform to send and eSign documents required by NYC DOF NFP. By using our solution, not-for-profits can easily manage their paperwork, ensuring timely submissions and compliance with regulatory standards.

-

Is airSlate SignNow cost-effective for NYC DOF NFP organizations?

Yes, airSlate SignNow offers competitive pricing tailored to the needs of NYC DOF NFP organizations. Our affordable plans ensure that even small not-for-profits can leverage electronic signatures and document management without breaking the budget.

-

What features does airSlate SignNow offer for NYC DOF NFP?

AirSlate SignNow offers features tailored for NYC DOF NFP organizations including customizable templates, automated workflows, and secure cloud storage. These tools enhance productivity and streamline the document signing process, critical for maintaining compliance.

-

Are there any integrations available with airSlate SignNow for NYC DOF NFP?

Absolutely! AirSlate SignNow integrates seamlessly with popular platforms like Google Drive, Dropbox, and Salesforce, which can be particularly beneficial for NYC DOF NFP organizations. This enables a smooth flow of information and keeps all documentation easily accessible.

-

How does airSlate SignNow ensure the security of NYC DOF NFP documents?

Security is a top priority for airSlate SignNow, especially for sensitive NYC DOF NFP documents. Our platform uses advanced encryption protocols, along with detailed audit trails, to ensure that all documents are securely transmitted and stored.

-

Can airSlate SignNow help NYC DOF NFP organizations reduce paperwork?

Yes, airSlate SignNow can signNowly reduce the amount of paperwork for NYC DOF NFP organizations. By digitizing the signing process, organizations can streamline their workflows and minimize physical document handling, saving time and resources.

Get more for NFP Exemption From Real Estate Taxation For Property Owned By

Find out other NFP Exemption From Real Estate Taxation For Property Owned By

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit