84AGNebraska Ag Use Motor Fuels Tax Refund Claim Form

Understanding Form 4923

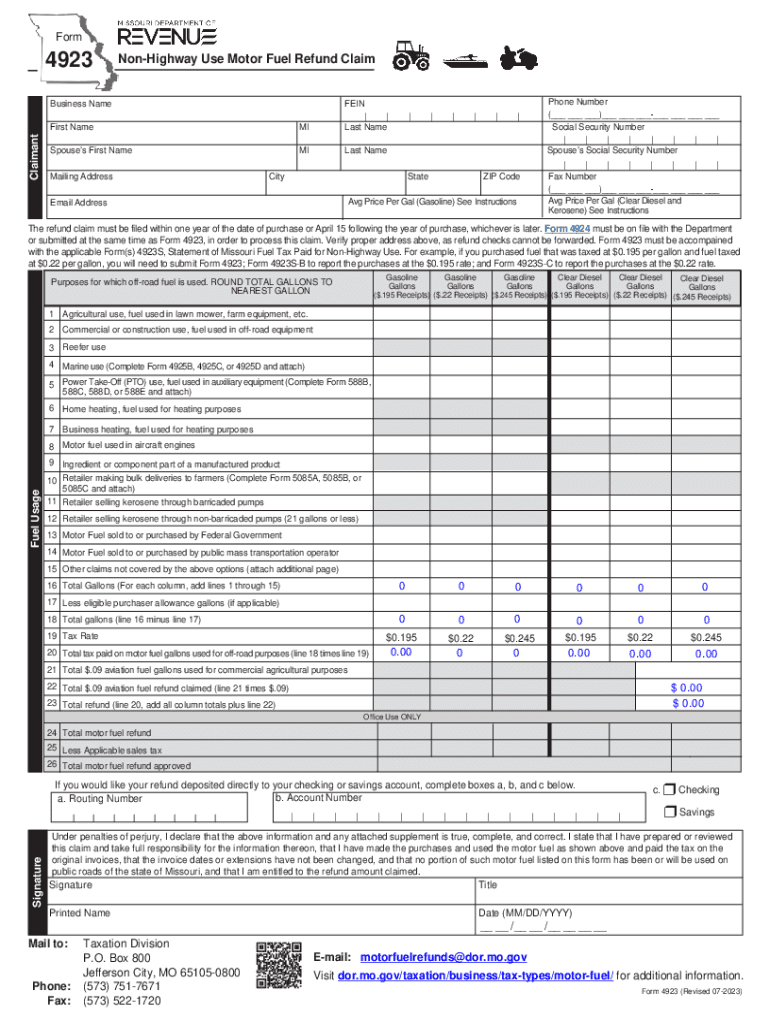

Form 4923, also known as the Missouri Motor Fuel Refund Form, is utilized by individuals and businesses in Missouri to claim refunds on motor fuel taxes. This form is essential for those who have purchased fuel for qualifying purposes, such as agricultural use or other exempt activities. By submitting this form, taxpayers can reclaim a portion of the taxes paid on fuel that was not used for taxable activities.

Steps to Complete Form 4923

Completing Form 4923 involves several key steps:

- Gather necessary documentation, including receipts for fuel purchases and proof of eligibility.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the refund amount based on the fuel purchased and the applicable tax rates.

- Sign and date the form to certify the information provided is true and correct.

Eligibility Criteria for Form 4923

To qualify for a refund using Form 4923, applicants must meet certain criteria:

- The fuel must have been purchased for specific exempt uses, such as agricultural operations.

- Applicants must be residents or businesses registered in Missouri.

- Documentation must support the claim, including invoices and usage logs.

Required Documents for Submission

When filing Form 4923, it is important to include the following documents:

- Receipts for all fuel purchases claimed for refund.

- Proof of eligibility for the refund, such as agricultural use documentation.

- A completed and signed Form 4923.

Form Submission Methods

Form 4923 can be submitted through various methods to accommodate different preferences:

- Online submission through the Missouri Department of Revenue's e-filing system.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at local Department of Revenue offices.

Filing Deadlines for Form 4923

It is crucial to be aware of the filing deadlines for Form 4923 to ensure timely processing of refunds. Typically, claims must be submitted within a specific period after the fuel purchase. Keeping track of these deadlines helps avoid delays in receiving refunds.

Quick guide on how to complete 84agnebraska ag use motor fuels tax refund claim

Complete 84AGNebraska Ag Use Motor Fuels Tax Refund Claim effortlessly on any gadget

Digital document handling has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage 84AGNebraska Ag Use Motor Fuels Tax Refund Claim on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign 84AGNebraska Ag Use Motor Fuels Tax Refund Claim hassle-free

- Locate 84AGNebraska Ag Use Motor Fuels Tax Refund Claim and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your preferred device. Alter and eSign 84AGNebraska Ag Use Motor Fuels Tax Refund Claim and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 84agnebraska ag use motor fuels tax refund claim

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form 4923?

Form 4923 is designed to facilitate the submission of specific documentation required for compliance purposes. It streamlines the process of gathering necessary information, making it easier for businesses to manage their paperwork efficiently. Utilizing airSlate SignNow for form 4923 helps businesses send and eSign documents seamlessly.

-

How can airSlate SignNow assist with filling out form 4923?

airSlate SignNow provides an intuitive platform for completing form 4923. Users can easily fill in required fields, add electronic signatures, and ensure all necessary data is captured. This empowers businesses to complete form 4923 quickly and accurately, reducing the chances of errors.

-

Is there a cost associated with using airSlate SignNow for form 4923?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost will depend on the features chosen and the volume of documents processed, including form 4923. Businesses can benefit from a cost-effective solution that scales with their document management requirements.

-

What features does airSlate SignNow provide for managing form 4923?

airSlate SignNow offers a variety of features for managing form 4923, including customizable templates, automated workflows, and advanced tracking. Users can also set reminders to ensure timely submissions and access audit trails for compliance verification. These features enhance the overall efficiency of handling form 4923.

-

Can form 4923 be integrated with other tools?

Absolutely! airSlate SignNow allows for seamless integration with various third-party applications. This means you can easily connect form 4923 management with tools such as CRM systems, accounting software, and productivity platforms, streamlining your overall workflow.

-

What are the benefits of using airSlate SignNow for form 4923?

Using airSlate SignNow for form 4923 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that documents are signed and stored securely, helping businesses comply with regulatory requirements while saving time and resources.

-

How does airSlate SignNow ensure the security of form 4923?

airSlate SignNow prioritizes security, employing encryption and secure data storage to protect documents, including form 4923. This means businesses can confidently share sensitive information, knowing that their data is safeguarded against unauthorized access. Compliance with industry standards further enhances this security.

Get more for 84AGNebraska Ag Use Motor Fuels Tax Refund Claim

Find out other 84AGNebraska Ag Use Motor Fuels Tax Refund Claim

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT