All Sales and Use Tax Filers Missouri Department of Revenue Form

Understanding the Missouri Use Tax Form

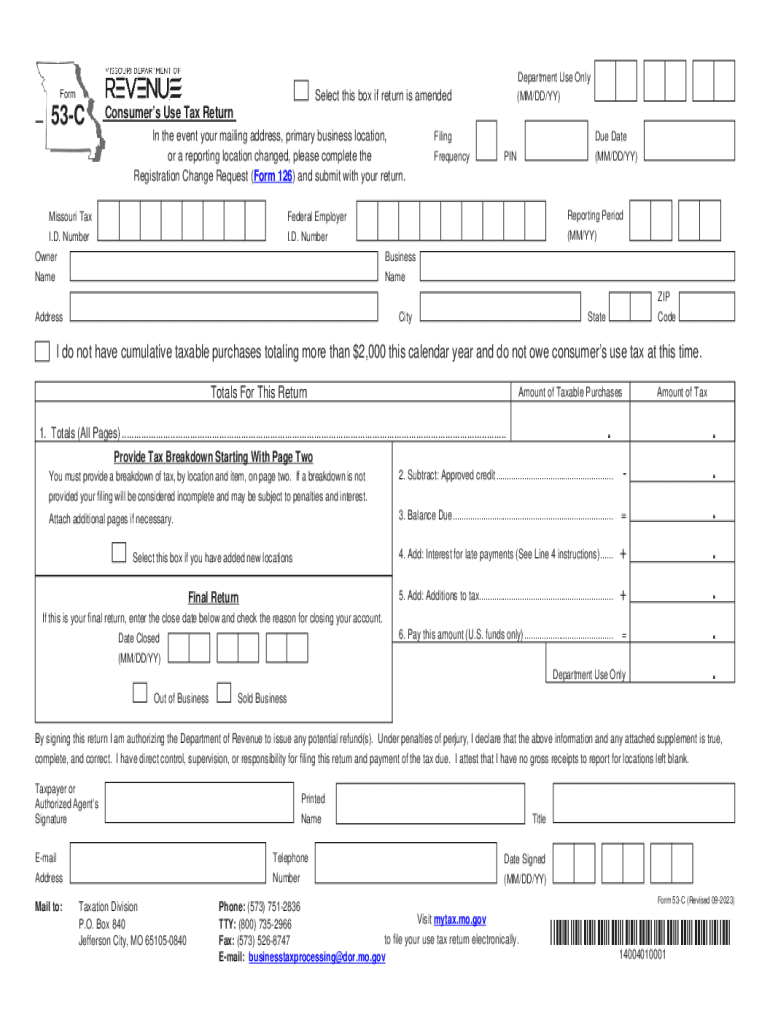

The Missouri use tax form, often referred to as the MO use tax form, is a crucial document for individuals and businesses that purchase items from out-of-state vendors for use within Missouri. This form is essential for reporting and paying taxes on goods that are not subject to sales tax at the time of purchase. The Missouri Department of Revenue (DOR) oversees the collection of this tax, ensuring compliance with state tax laws.

Steps to Complete the Missouri Use Tax Form

Filling out the Missouri use tax form involves several key steps:

- Gather all relevant purchase documentation, including receipts and invoices.

- Determine the total amount of taxable purchases made during the reporting period.

- Calculate the use tax owed based on the current state tax rate.

- Complete the form accurately, ensuring all sections are filled out correctly.

- Submit the form by the specified deadline, either online or via mail.

Required Documents for Filing

When completing the Missouri use tax form, it is important to have the following documents on hand:

- Receipts for all out-of-state purchases.

- Invoices from vendors detailing the items purchased.

- Any previous tax returns that may be relevant.

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Filing Deadlines for the Missouri Use Tax Form

Understanding the deadlines for filing the Missouri use tax form is essential to avoid penalties. Typically, the form must be submitted by the same deadline as the individual income tax return, which is usually April 15. However, it is advisable to check the Missouri Department of Revenue's website for any updates or changes to these dates.

Penalties for Non-Compliance

Failure to file the Missouri use tax form or pay the associated taxes can result in significant penalties. These may include:

- Interest on unpaid taxes.

- Late filing penalties, which can increase the total amount owed.

- Potential legal action for persistent non-compliance.

To avoid these consequences, it is important to file on time and pay any taxes owed promptly.

Digital Submission Options

Submitting the Missouri use tax form can be done in various ways, including online, by mail, or in person. The online submission process is often the most efficient, allowing for quicker processing times. To file online, users need to access the Missouri Department of Revenue's website and follow the instructions provided for electronic filing.

Quick guide on how to complete all sales and use tax filers missouri department of revenue

Effortlessly Prepare All Sales And Use Tax Filers Missouri Department Of Revenue on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage All Sales And Use Tax Filers Missouri Department Of Revenue on any platform using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

The simplest way to modify and electronically sign All Sales And Use Tax Filers Missouri Department Of Revenue without hassle

- Find All Sales And Use Tax Filers Missouri Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional hand-signed signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of delivery for your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and electronically sign All Sales And Use Tax Filers Missouri Department Of Revenue to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the all sales and use tax filers missouri department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO use tax form, and why do I need it?

The MO use tax form is essential for reporting taxes on items purchased out of state for use in Missouri. Even if you didn't pay sales tax at the time of purchase, you're required to report this use tax when filing your annual taxes. By properly using the MO use tax form, you can stay compliant with state tax regulations.

-

How can airSlate SignNow help with completing the MO use tax form?

airSlate SignNow allows you to create, send, and eSign the MO use tax form quickly and efficiently. You can easily upload your completed tax documents, add necessary signatures, and send them for eSigning. This streamlined process saves time and reduces paper clutter.

-

Is airSlate SignNow a cost-effective solution for managing MO use tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses processing MO use tax forms. With various pricing plans available, you can choose one that fits your budget and needs. Plus, the ease of use can lead to reduced administrative costs for your tax document operations.

-

Are there any integrations available for the MO use tax form with airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easier to access and file your MO use tax form. This interoperability ensures that you can manage your tax documents alongside other financial data without hassle.

-

What features does airSlate SignNow offer for eSigning the MO use tax form?

airSlate SignNow provides a range of features for eSigning the MO use tax form, including drag-and-drop document fields, customizable templates, and real-time tracking of your document's status. These tools help make the signing process straightforward and efficient, ensuring all parties can sign quickly.

-

Can I access my MO use tax forms on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your MO use tax forms from any device. This flexibility means you can sign, send, and track your documents on the go, making it convenient for busy professionals.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation, including the MO use tax form, offers numerous benefits such as reduced processing time, improved accuracy, and enhanced security. The platform ensures that your documents are protected and that you can collaborate efficiently without traditional mailing delays.

Get more for All Sales And Use Tax Filers Missouri Department Of Revenue

- Missouri power attorney form

- Mo revocation form

- Missouri missouri change of registered agent form

- Ms notice form

- Final notice form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and form

- Bill of sale of automobile and odometer statement alaska form

- Bill of sale for automobile or vehicle including odometer statement and promissory note alaska form

Find out other All Sales And Use Tax Filers Missouri Department Of Revenue

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now