Mo V Tax Form

What is the Missouri Vendor Use Tax?

The Missouri Vendor Use Tax is a tax imposed on the storage, use, or consumption of tangible personal property in Missouri. This tax applies to items purchased from out-of-state vendors that are not subject to Missouri sales tax. The purpose of the use tax is to ensure that local businesses are not disadvantaged by out-of-state sellers who do not charge sales tax. The tax rate typically aligns with the state sales tax rate, but local jurisdictions may impose additional taxes.

Steps to Complete the Missouri Vendor Use Tax Form

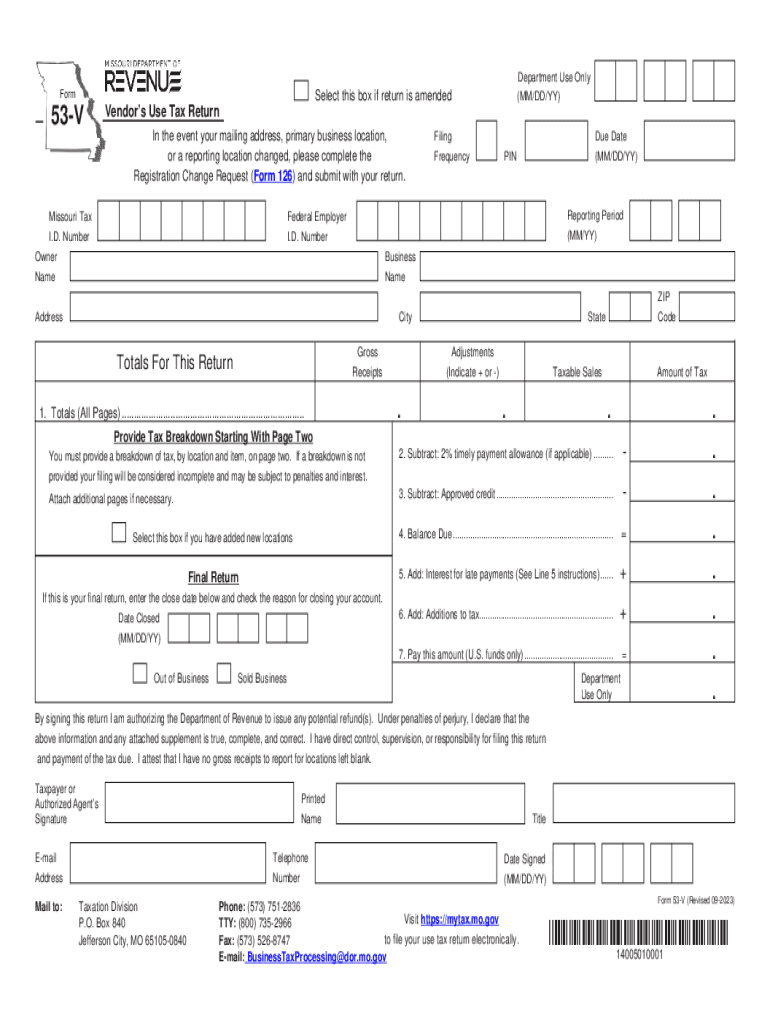

Completing the Missouri Vendor Use Tax Form (Form 53-V) involves several key steps:

- Gather all relevant purchase documentation, including receipts and invoices.

- Determine the total amount of taxable purchases made from out-of-state vendors.

- Fill out the Missouri Form 53-V with accurate details, including your business information and the total use tax owed.

- Calculate the total vendor use tax based on the applicable tax rate.

- Submit the completed form along with payment to the Missouri Department of Revenue by the specified deadline.

Key Elements of the Missouri Vendor Use Tax

Understanding the key elements of the Missouri Vendor Use Tax is essential for compliance. Important aspects include:

- The tax applies to tangible personal property purchased for use in Missouri.

- Out-of-state purchases that are not taxed at the point of sale are subject to this tax.

- Businesses must report and remit the tax to the state, even if they have not received a bill from the vendor.

- Failure to comply can result in penalties and interest on unpaid taxes.

Legal Use of the Missouri Vendor Use Tax

The legal framework governing the Missouri Vendor Use Tax is established by state law. Businesses are required to accurately report their use tax liabilities to avoid legal repercussions. This tax is applicable to all businesses that purchase taxable goods from out-of-state vendors, ensuring that they contribute to the state's revenue in a manner similar to local businesses that collect sales tax.

Filing Deadlines for the Missouri Vendor Use Tax

Filing deadlines for the Missouri Vendor Use Tax are crucial for compliance. Typically, businesses must file their use tax returns on a monthly or quarterly basis, depending on their total tax liability. The deadlines are as follows:

- Monthly filers must submit their returns by the 20th of the following month.

- Quarterly filers must submit their returns by the 20th of the month following the end of the quarter.

- It is important to stay informed about any changes to these deadlines, as they may vary based on state regulations.

Required Documents for Filing the Missouri Vendor Use Tax

When filing the Missouri Vendor Use Tax, specific documents are required to support your claim. These include:

- Receipts or invoices for all out-of-state purchases.

- Any documentation that verifies the tax-exempt status of certain items, if applicable.

- Previous tax returns, if this is not the first filing.

Form Submission Methods for the Missouri Vendor Use Tax

Businesses have several options for submitting the Missouri Vendor Use Tax Form. These methods include:

- Online submission through the Missouri Department of Revenue's e-filing system.

- Mailing a paper copy of the completed Form 53-V to the appropriate address.

- In-person submission at local Department of Revenue offices, if preferred.

Quick guide on how to complete mo v tax

Complete Mo V Tax seamlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Mo V Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Mo V Tax effortlessly

- Obtain Mo V Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Mo V Tax and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo v tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for Missouri use of airSlate SignNow?

The pricing for Missouri use of airSlate SignNow is designed to be budget-friendly, offering various plans that cater to different organizational needs. You can choose from monthly or annual subscriptions, with options for small businesses to enterprise-level solutions. Each plan includes comprehensive features, ensuring you get the best value for your investment.

-

What features are available for Missouri use?

airSlate SignNow offers a robust set of features for Missouri use, including document sharing, eSigning, and templates for faster workflows. Users can customize their documents, set signing orders, and track usage in real-time. These features signNowly enhance the efficiency of your document management processes.

-

How can airSlate SignNow benefit businesses in Missouri?

Businesses in Missouri can greatly benefit from airSlate SignNow by streamlining their document workflows, reducing turnaround times, and minimizing paper usage. The ease of use and accessibility means that teams can collaborate more effectively from anywhere. Plus, the cost-effectiveness of the solution helps organizations save money while boosting productivity.

-

Is airSlate SignNow compliant with Missouri regulations?

Yes, airSlate SignNow is fully compliant with Missouri regulations regarding electronic signatures. This means you can confidently use the platform to sign legal documents, contracts, and agreements within the state. Compliance ensures your documents are valid and enforceable under Missouri law.

-

What integrations does airSlate SignNow offer for Missouri users?

For Missouri users, airSlate SignNow offers extensive integrations with popular business tools such as Google Workspace, Microsoft Office, and Salesforce. These integrations help streamline your workflow and ensure that documents flow smoothly between platforms. This connectivity enhances user experience and productivity.

-

Can I use airSlate SignNow on mobile for Missouri use?

Absolutely! airSlate SignNow provides mobile compatibility, allowing users in Missouri to access documents and send eSignatures on-the-go. This flexibility ensures that you can manage your document workflows from anywhere, making it ideal for busy professionals who are always on the move.

-

How secure is airSlate SignNow for Missouri use?

Security is a top priority for airSlate SignNow, particularly for Missouri users who handle sensitive information. The platform uses advanced encryption methods and complies with industry standards to protect your documents and data. You can trust that your information remains safe while using airSlate SignNow for eSigning.

Get more for Mo V Tax

Find out other Mo V Tax

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document