Form MT 203 Distributor of Tobacco Products Tax Return Revised 3

Understanding the New York MT 203 Tobacco Products Tax Return

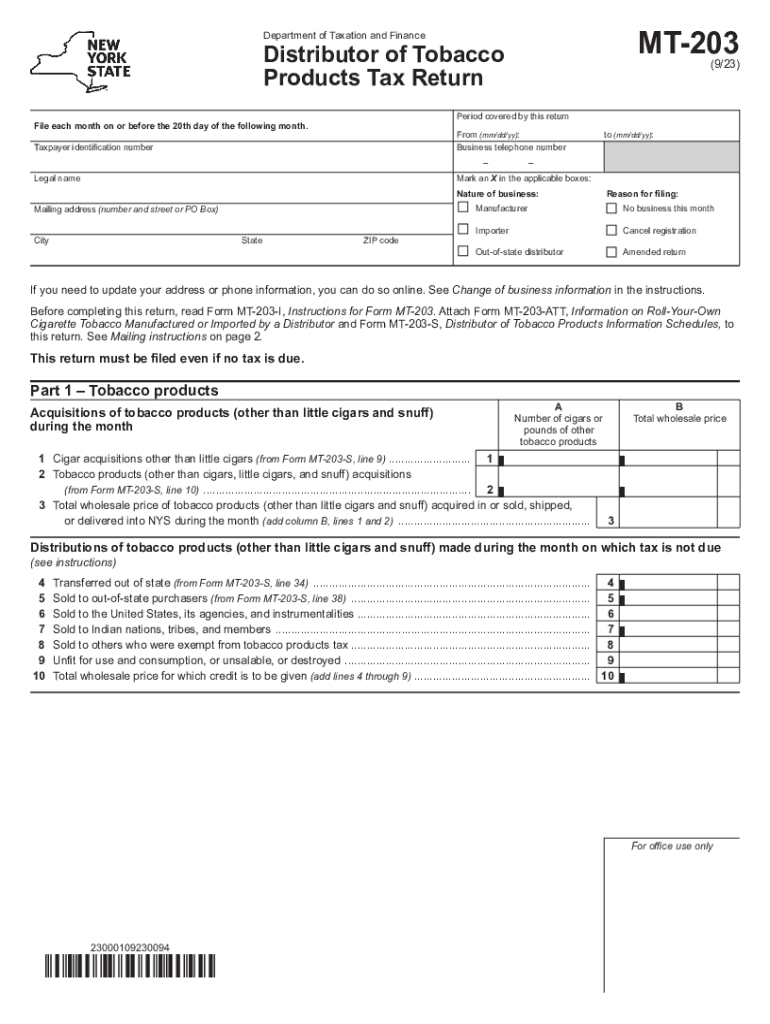

The New York MT 203 form, officially known as the Distributor of Tobacco Products Tax Return, is a crucial document for businesses involved in the distribution of tobacco products within New York State. This form is specifically designed for distributors to report and remit the taxes owed on tobacco products sold or distributed in the state. It is essential for compliance with state tax regulations and helps ensure that all tobacco products are taxed appropriately.

Steps for Completing the New York MT 203 Form

Completing the New York MT 203 form involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant data, including sales records, inventory levels, and previous tax returns.

- Fill Out the Form: Input the required information in the designated fields, ensuring that all figures are accurate and reflect your business activities.

- Calculate Taxes Owed: Determine the total tax liability by applying the appropriate tax rates to the quantities of tobacco products distributed.

- Review for Accuracy: Double-check all entries for errors or omissions before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Obtaining the New York MT 203 Form

The New York MT 203 form can be obtained through various channels. It is available on the New York State Department of Taxation and Finance website, where you can download a printable version. Additionally, businesses may request a physical copy from the local tax office or through authorized distributors. It is advisable to ensure you have the most recent version of the form to comply with current tax regulations.

Filing Deadlines for the New York MT 203 Form

Timely filing of the New York MT 203 form is crucial to avoid penalties. The filing deadlines are typically set on a quarterly basis, with specific due dates for each quarter. For example, the first quarter's return is usually due by April 20, the second by July 20, the third by October 20, and the fourth by January 20 of the following year. It is important to stay informed about any changes to these deadlines to ensure compliance.

Key Elements of the New York MT 203 Form

Understanding the key elements of the New York MT 203 form is essential for accurate completion. Important sections include:

- Distributor Information: Basic details about the business, including name, address, and tax identification number.

- Sales Information: A detailed account of the tobacco products sold or distributed during the reporting period.

- Tax Calculation: A section dedicated to calculating the total tax owed based on the quantities reported.

- Signature and Certification: A declaration that the information provided is accurate and complete, requiring the signature of an authorized representative.

Legal Use of the New York MT 203 Form

The New York MT 203 form serves a legal purpose in the taxation of tobacco products. It is a requirement for businesses engaged in the distribution of these products to accurately report their sales and remit the corresponding taxes. Failure to file this form or providing false information can result in significant penalties, including fines and potential legal action. Adhering to the regulations surrounding this form helps maintain compliance with state laws.

Quick guide on how to complete form mt 203 distributor of tobacco products tax return revised 3

Complete Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3 effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can retrieve the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to alter and eSign Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3 with ease

- Find Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3 and guarantee exceptional communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 203 distributor of tobacco products tax return revised 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New York MT 203 and how does it relate to airSlate SignNow?

New York MT 203 is a specific document format used for financial transaction reporting in New York. airSlate SignNow offers an efficient solution to create, sign, and manage New York MT 203 documents electronically, streamlining your business processes.

-

How much does airSlate SignNow cost for New York MT 203 document management?

airSlate SignNow provides various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, ensuring that handling New York MT 203 documents is both affordable and efficient.

-

What features does airSlate SignNow offer for New York MT 203 documents?

airSlate SignNow includes features such as customizable templates, secure eSignature, and document tracking specifically for New York MT 203 documents. These features help to ensure compliance and enhance document management efficiency.

-

Can I integrate airSlate SignNow with other software for New York MT 203 processes?

Yes, airSlate SignNow easily integrates with a variety of software solutions, allowing for seamless management of New York MT 203 documents. This integration helps to automate workflows and enhance productivity within your organization.

-

What are the benefits of using airSlate SignNow for New York MT 203 documents?

Using airSlate SignNow for New York MT 203 documents enables faster processing, increased security, and improved accuracy. By leveraging our platform, businesses can simplify their documentation processes without sacrificing compliance.

-

Is airSlate SignNow secure for handling sensitive New York MT 203 information?

Absolutely! airSlate SignNow prioritizes the security of your New York MT 203 documents by employing advanced encryption and strict security protocols. Rest assured that your sensitive information is protected throughout the signing process.

-

How user-friendly is airSlate SignNow for New York MT 203 document management?

airSlate SignNow is built with user experience in mind, making it accessible for all users. Creating, sending, and signing New York MT 203 documents can be done easily without any technical expertise, enhancing efficiency in your workflow.

Get more for Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3

- Legal last will and testament form for divorced and remarried person with mine yours and ours children alaska

- Legal last will and testament form with all property to trust called a pour over will alaska

- Written revocation of will alaska form

- Last will and testament for other persons alaska form

- Notice to beneficiaries of being named in will alaska form

- Estate planning questionnaire and worksheets alaska form

- Document locator and personal information package including burial information form alaska

- Demand to produce copy of will from heir to executor or person in possession of will alaska form

Find out other Form MT 203 Distributor Of Tobacco Products Tax Return Revised 3

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document