Montana Individual Income Tax Return Form

What is the Montana Individual Income Tax Return

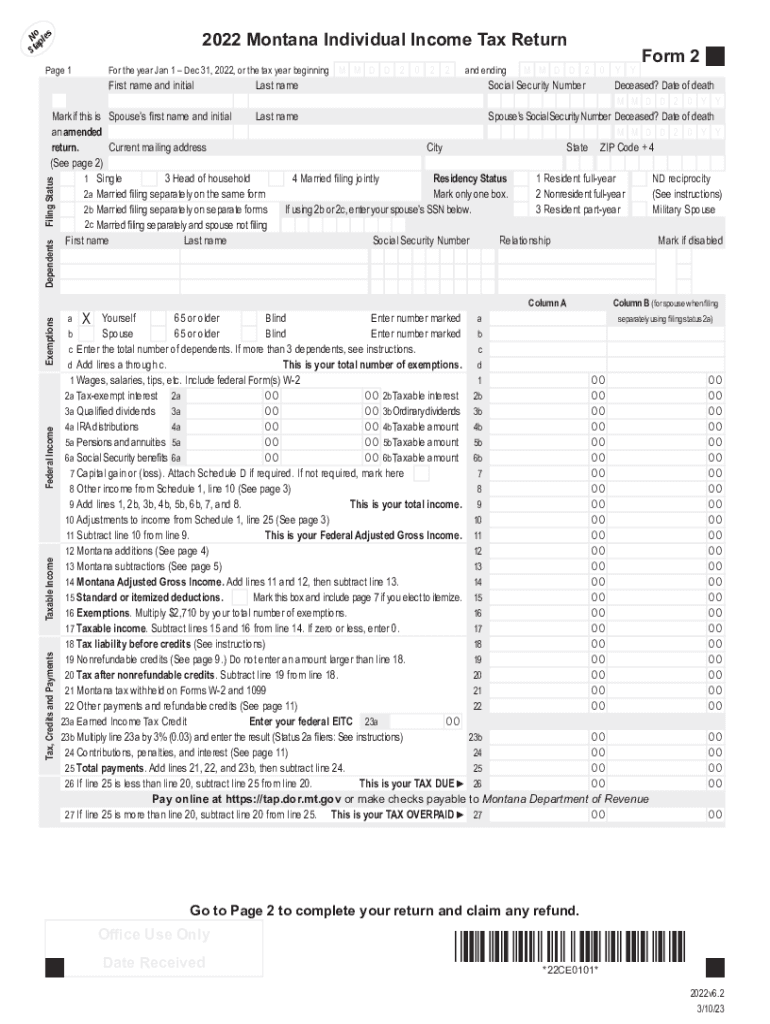

The Montana Individual Income Tax Return, commonly referred to as the 2022 MT return, is a tax form used by residents of Montana to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Montana, as it ensures compliance with state tax laws. The return includes various sections for reporting wages, interest, dividends, and other sources of income, as well as deductions and credits that may reduce the overall tax owed.

Steps to complete the Montana Individual Income Tax Return

Completing the 2022 Montana return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out the form accurately, ensuring all income sources are reported and deductions are claimed appropriately.

- Double-check your calculations to avoid errors that could lead to penalties.

- Sign and date the return before submission.

Filing Deadlines / Important Dates

For the 2022 tax year, the deadline to file the Montana Individual Income Tax Return is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, as late filings can result in penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Montana Individual Income Tax Return, taxpayers must gather various documents, including:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work or interest income.

- Documentation for any deductions claimed, such as mortgage interest statements or medical expenses.

- Proof of any tax credits that may apply.

Form Submission Methods

The 2022 Montana return can be submitted through multiple methods to accommodate different preferences:

- Online filing through the Montana Department of Revenue's website or approved tax software.

- Mailing a paper return to the appropriate address provided in the form instructions.

- In-person submission at designated tax offices, if available.

Key elements of the Montana Individual Income Tax Return

The Montana Individual Income Tax Return includes several key elements that taxpayers should be aware of:

- Identification information, including your name, address, and Social Security number.

- Income reporting sections for various sources of income.

- Deductions and credits that can reduce taxable income.

- Calculation of total tax owed or refund due.

Quick guide on how to complete montana individual income tax return

Prepare Montana Individual Income Tax Return seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without any delays. Manage Montana Individual Income Tax Return on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Montana Individual Income Tax Return effortlessly

- Find Montana Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Montana Individual Income Tax Return while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the montana individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2022 MT return and why do I need to file it?

A 2022 MT return is the tax form required for residents of Montana to report their income for the tax year 2022. Filing this return is crucial for ensuring compliance with state tax laws and to calculate any taxes owed or refunds due. Using airSlate SignNow can simplify the signing and submission of your documents associated with this return.

-

How can airSlate SignNow help with my 2022 MT return?

airSlate SignNow provides an efficient platform for electronically signing and sending your 2022 MT return documents. Its user-friendly interface allows you to manage your paperwork easily, reducing delays and ensuring you meet important filing deadlines. Additionally, it offers secure storage for all your important tax documents.

-

What are the costs associated with using airSlate SignNow for my 2022 MT return?

airSlate SignNow offers various pricing plans to suit your business needs when processing your 2022 MT return. These plans are cost-effective and designed to provide excellent value, especially when compared to traditional methods of document handling. You can choose from monthly or annual subscriptions based on your frequency of use.

-

Are there specific features in airSlate SignNow that benefit my 2022 MT return filing?

Yes, airSlate SignNow includes features specifically beneficial for filing your 2022 MT return, such as reusable templates for tax forms and document tracking. The platform also allows for in-app signing, which speeds up the process signNowly. These features are designed to streamline your document management experience.

-

Can I integrate airSlate SignNow with other accounting software for my 2022 MT return?

Absolutely! airSlate SignNow offers integrations with popular accounting platforms, making it easier to sync your financial data and streamline the filing of your 2022 MT return. This capability ensures you can manage all your financial documents in one place, enhancing efficiency and accuracy.

-

Is my data secure when using airSlate SignNow for my 2022 MT return?

Yes, security is a top priority at airSlate SignNow. When handling your 2022 MT return, all documents are encrypted to protect your sensitive information. The platform also complies with various industry standards, ensuring that your data remains secure throughout the entire filing process.

-

How does electronic signing help expedite my 2022 MT return?

Electronic signing through airSlate SignNow signNowly accelerates the process of completing your 2022 MT return. It eliminates the need for printing and mailing documents, allowing for immediate signatures and submission. Quick interactions can lead to faster processing of your return and quicker access to any refunds.

Get more for Montana Individual Income Tax Return

- Legal documents for the guardian of a minor package colorado form

- New state resident package colorado form

- Health declaration form

- Commercial property sales package colorado form

- Colorado revocation 497300668 form

- General partnership package colorado form

- Contract for deed package colorado form

- Colorado revised statutes 497300671 form

Find out other Montana Individual Income Tax Return

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word