Form 25 100 Annual Insurance Premium Tax Report

What is the Form 25 100 Annual Insurance Premium Tax Report

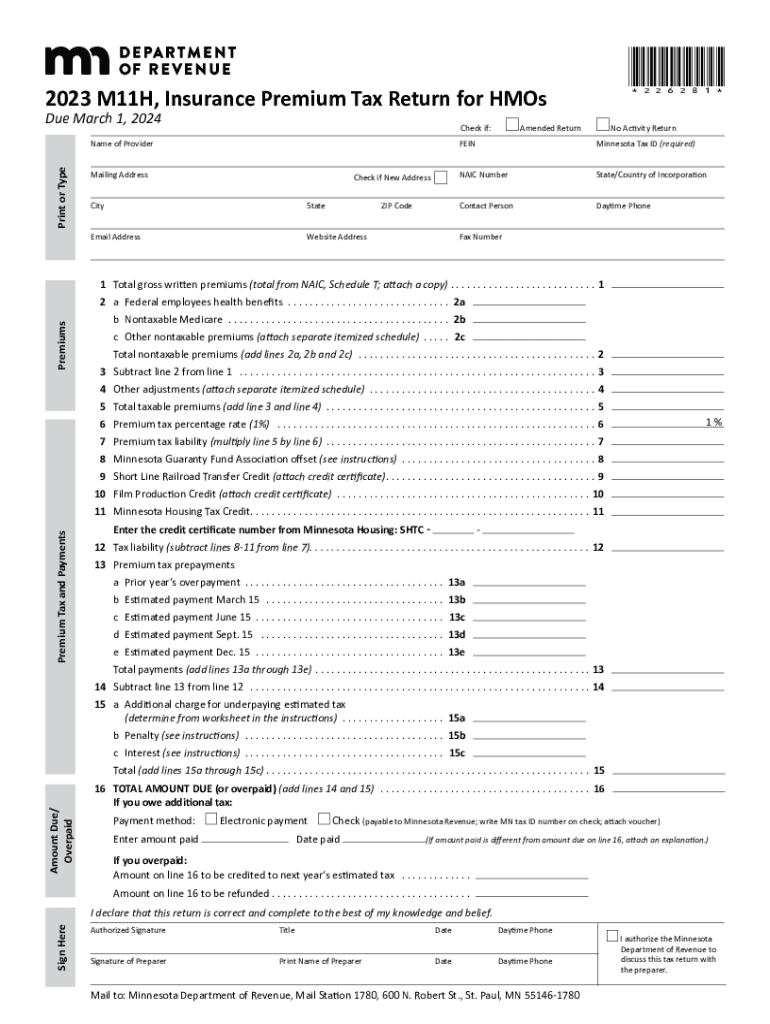

The Form 25 100 Annual Insurance Premium Tax Report is a document used by insurance companies to report the amount of insurance premium taxes owed to the state. This form is essential for ensuring compliance with state tax regulations. It provides a comprehensive overview of the premiums collected and the corresponding tax liabilities. By accurately completing this form, insurance providers can avoid penalties and ensure they meet their financial obligations to the state.

Steps to complete the Form 25 100 Annual Insurance Premium Tax Report

Completing the Form 25 100 requires careful attention to detail. Here are the key steps involved:

- Gather necessary information, including total premiums collected and applicable tax rates.

- Fill in the identification section with the insurance company's details, such as name, address, and tax identification number.

- Report the total premiums written for the year in the designated section.

- Calculate the total tax owed based on the premiums reported, applying the correct tax rate.

- Review the completed form for accuracy before submission.

How to obtain the Form 25 100 Annual Insurance Premium Tax Report

The Form 25 100 can typically be obtained from the state’s department of revenue or taxation website. Many states provide downloadable PDF versions of the form that can be printed and filled out manually. Additionally, some states may offer an online version that allows for electronic submission. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 25 100 Annual Insurance Premium Tax Report vary by state. Generally, the form must be submitted annually, with specific due dates set by the state’s revenue department. It is crucial for insurance companies to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important dates can help ensure timely filing.

Legal use of the Form 25 100 Annual Insurance Premium Tax Report

The Form 25 100 serves a legal purpose by ensuring that insurance companies comply with state tax laws. Filing this report is a legal requirement for insurers operating within the state. Failure to submit the form or inaccuracies in reporting can lead to legal repercussions, including fines or increased scrutiny from tax authorities. Understanding the legal implications of this form is essential for maintaining compliance.

Key elements of the Form 25 100 Annual Insurance Premium Tax Report

The Form 25 100 includes several key elements that must be accurately completed. These elements typically consist of:

- Insurance company identification information.

- Total premiums collected during the reporting period.

- Applicable tax rates based on the state’s regulations.

- Calculation of total tax liability.

- Signature of an authorized representative certifying the accuracy of the information provided.

Quick guide on how to complete form 25 100 annual insurance premium tax report

Accomplish Form 25 100 Annual Insurance Premium Tax Report effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage Form 25 100 Annual Insurance Premium Tax Report across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Form 25 100 Annual Insurance Premium Tax Report with ease

- Locate Form 25 100 Annual Insurance Premium Tax Report and then click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 25 100 Annual Insurance Premium Tax Report and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 25 100 annual insurance premium tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 25 100 Annual Insurance Premium Tax Report?

The Form 25 100 Annual Insurance Premium Tax Report is a document required by certain jurisdictions to report and pay taxes on insurance premiums. It is essential for insurance providers to submit this report accurately to comply with local regulations and avoid penalties.

-

How can airSlate SignNow help with the Form 25 100 Annual Insurance Premium Tax Report?

airSlate SignNow offers a streamlined platform for creating, eSigning, and managing the Form 25 100 Annual Insurance Premium Tax Report. By using our solution, you can ensure that your reports are prepared efficiently, accurately, and securely, saving you time and effort in the process.

-

Is airSlate SignNow suitable for businesses of all sizes when filing the Form 25 100 Annual Insurance Premium Tax Report?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, from small firms to large corporations. Our user-friendly solution makes it easy for any business to handle the Form 25 100 Annual Insurance Premium Tax Report, regardless of their existing software or resources.

-

What are the key features of airSlate SignNow for handling the Form 25 100 Annual Insurance Premium Tax Report?

Key features include customizable templates for the Form 25 100 Annual Insurance Premium Tax Report, automated workflows, and secure cloud storage. These features help streamline your reporting process, ensuring compliance and enhancing productivity.

-

Are there any integrations available with airSlate SignNow for the Form 25 100 Annual Insurance Premium Tax Report?

airSlate SignNow integrates seamlessly with various applications and platforms, making it easy to incorporate the Form 25 100 Annual Insurance Premium Tax Report into your existing workflows. You can connect with CRM systems, cloud storage solutions, and other essential tools to enhance your reporting capabilities.

-

What is the pricing structure for airSlate SignNow when using it for the Form 25 100 Annual Insurance Premium Tax Report?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose from a range of options based on your usage requirements, ensuring cost-effectiveness when preparing and submitting the Form 25 100 Annual Insurance Premium Tax Report.

-

How secure is airSlate SignNow for managing the Form 25 100 Annual Insurance Premium Tax Report?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods and compliance measures to ensure that your Form 25 100 Annual Insurance Premium Tax Report and other sensitive documents are protected from unauthorized access.

Get more for Form 25 100 Annual Insurance Premium Tax Report

- Quitclaim deed by two individuals to llc connecticut form

- Warranty deed from two individuals to llc connecticut form

- Ct corporation llc 497301003 form

- Affidavit of original contractor by individual connecticut form

- Quitclaim deed by two individuals to corporation connecticut form

- Warranty deed from two individuals to corporation connecticut form

- Ct corporation llc 497301008 form

- Ct notice 497301010 form

Find out other Form 25 100 Annual Insurance Premium Tax Report

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast