IRS Posts Form 4972, Used to Claim Special Tax

Understanding the IRS Form 4972

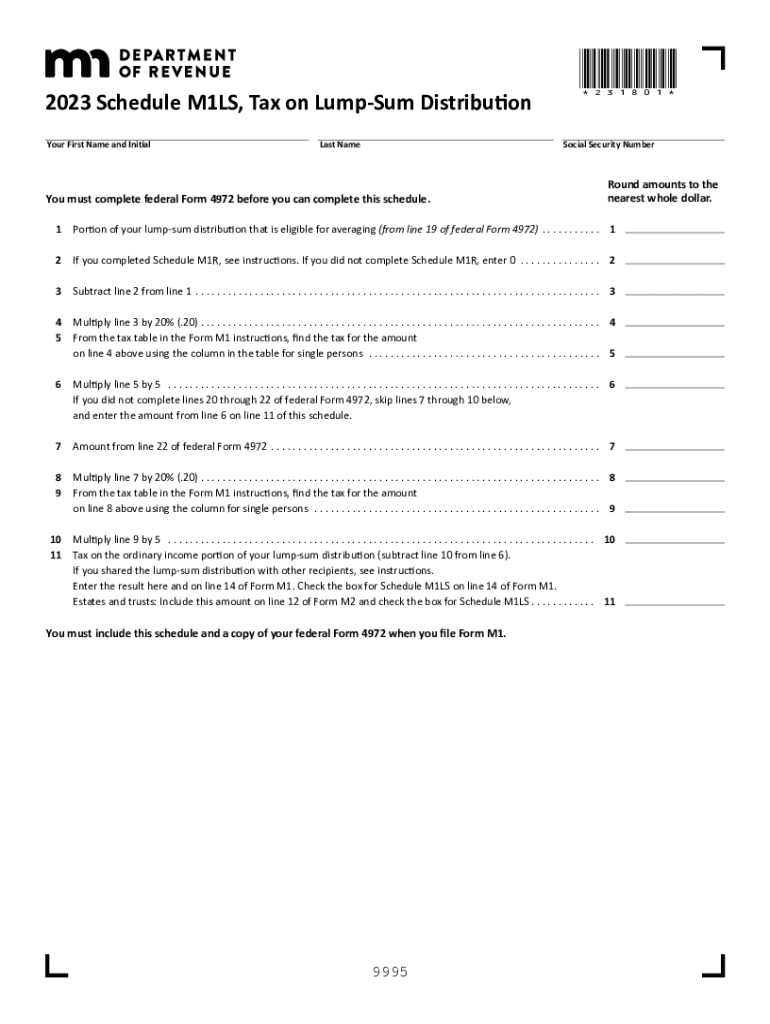

The IRS Form 4972 is designed for individuals who wish to claim a special tax on a lump sum distribution from a qualified retirement plan. This form allows taxpayers to report the distribution and potentially reduce their tax liability by utilizing special tax treatment under Section 402(e)(1) of the Internal Revenue Code. Understanding the purpose and implications of this form is crucial for ensuring compliance and maximizing tax benefits.

Steps to Complete the IRS Form 4972

Completing the IRS Form 4972 involves several key steps:

- Gather Required Information: Collect details about the lump sum distribution, including the amount received and the plan from which it was distributed.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Report Distribution Details: Indicate the amount of the lump sum distribution and any applicable tax withheld.

- Calculate Tax Liability: Use the provided worksheets to determine your tax liability based on the distribution.

- Sign and Date the Form: Ensure you sign and date the form before submission to validate your claim.

Eligibility Criteria for Using IRS Form 4972

To use the IRS Form 4972, certain eligibility criteria must be met. The individual must have received a lump sum distribution from a qualified retirement plan. This includes plans like 401(k)s or pensions. Additionally, the distribution must meet specific conditions outlined by the IRS, such as being eligible for special tax treatment. It's important to review these criteria carefully to ensure compliance and proper filing.

Filing Deadlines for IRS Form 4972

Filing deadlines for the IRS Form 4972 generally align with the standard tax filing deadlines. Typically, this form must be submitted by April 15 of the year following the tax year in which the distribution was received. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these dates to avoid penalties for late filing.

Form Submission Methods for IRS Form 4972

The IRS Form 4972 can be submitted through various methods, including:

- Online Submission: Taxpayers may use e-filing options through approved tax software that supports Form 4972.

- Mail Submission: The completed form can be printed and mailed to the appropriate IRS address, as indicated in the form instructions.

- In-Person Submission: Taxpayers may also visit local IRS offices to submit the form directly, though appointments may be necessary.

Common Mistakes to Avoid When Filing IRS Form 4972

When completing the IRS Form 4972, it is important to avoid common mistakes that can lead to delays or penalties. These include:

- Incorrect Information: Ensure all personal and distribution information is accurate to prevent processing errors.

- Missing Signatures: Failing to sign and date the form can result in rejection or delays.

- Late Submission: Be mindful of filing deadlines to avoid penalties.

Quick guide on how to complete irs posts form 4972 used to claim special tax

Complete IRS Posts Form 4972, Used To Claim Special Tax seamlessly on any device

Digital document management has gained immense popularity among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow provides all the tools necessary to design, modify, and eSign your documents swiftly without any hold-ups. Handle IRS Posts Form 4972, Used To Claim Special Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign IRS Posts Form 4972, Used To Claim Special Tax without any hassle

- Locate IRS Posts Form 4972, Used To Claim Special Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign IRS Posts Form 4972, Used To Claim Special Tax to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs posts form 4972 used to claim special tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lump sum distribution form?

A lump sum distribution form is a document used to request the total distribution of funds from a retirement account or pension plan. By completing this form, you can initiate the process of receiving your retirement benefits in a single, lump sum payment, simplifying your financial management.

-

How can airSlate SignNow help with the lump sum distribution form?

airSlate SignNow provides a user-friendly platform for creating, signing, and sending your lump sum distribution form electronically. This streamlines the process and ensures that your document is securely handled, making it easier to manage your retirement funds efficiently.

-

Is there a cost associated with using airSlate SignNow for lump sum distribution forms?

Yes, airSlate SignNow offers affordable pricing plans to suit various business needs. Costs can vary based on features and the number of users, but they provide a cost-effective solution for handling your lump sum distribution forms without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for my lump sum distribution form?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to connect your lump sum distribution form process with tools you already use. This integration enhances efficiency and ensures that your workflow remains smooth across different platforms.

-

What are the benefits of using airSlate SignNow for my lump sum distribution form?

Using airSlate SignNow for your lump sum distribution form offers several benefits, including enhanced security, faster processing times, and the ability to track document status in real-time. This makes managing retirement distributions simpler and more reliable.

-

How do I get started with airSlate SignNow for my lump sum distribution form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin creating and sending your lump sum distribution form immediately. The platform's intuitive design ensures that you can navigate and complete your tasks with minimal training.

-

Are there templates available for the lump sum distribution form?

Yes, airSlate SignNow offers customizable templates for the lump sum distribution form. These templates make it easy to prepare your documents quickly and correctly, ensuring all necessary information is included without starting from scratch.

Get more for IRS Posts Form 4972, Used To Claim Special Tax

- Quitclaim deed from husband and wife to llc connecticut form

- Warranty deed from husband and wife to llc connecticut form

- Connecticut judgment 497301024 form

- Tenant notice remove form

- Letter tenant notice 497301027 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497301028 form

- Tenant landlord notice repair form

- Connecticut landlord notice form

Find out other IRS Posts Form 4972, Used To Claim Special Tax

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template