Filing Extensions and Tax Return Preparation Assistance Form

Understanding the Filing Extensions and Tax Return Preparation Assistance

The Filing Extensions and Tax Return Preparation Assistance is a crucial resource for individuals and businesses looking to manage their tax obligations effectively. This assistance helps taxpayers extend their filing deadlines, ensuring they have ample time to prepare accurate returns. It is especially beneficial for those who may encounter unforeseen circumstances that hinder timely filing, such as personal emergencies or complex financial situations.

Steps to Complete the Filing Extensions and Tax Return Preparation Assistance

Completing the Filing Extensions and Tax Return Preparation Assistance involves several key steps:

- Determine your eligibility for an extension based on your specific circumstances.

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill out the appropriate extension form, ensuring all information is accurate and complete.

- Submit the form to the IRS by the specified deadline, either electronically or by mail.

- Keep a copy of the submitted form for your records, along with any confirmation of receipt.

Required Documents for Filing Extensions

To successfully apply for the Filing Extensions and Tax Return Preparation Assistance, you will need to prepare several documents:

- Your previous year’s tax return, which provides a basis for your current filing.

- Income statements such as W-2s or 1099s that report your earnings.

- Any additional documentation that supports your income and deductions, such as receipts or bank statements.

IRS Guidelines for Filing Extensions

The IRS provides clear guidelines regarding the Filing Extensions and Tax Return Preparation Assistance. It is important to understand the following:

- Extensions typically grant an additional six months to file your tax return.

- Filing an extension does not extend the time to pay any taxes owed; payments are still due by the original deadline.

- Failure to file or pay on time may result in penalties and interest charges.

Eligibility Criteria for Filing Extensions

Eligibility for the Filing Extensions and Tax Return Preparation Assistance generally includes:

- Individuals and businesses who are unable to file their tax returns on time due to valid reasons.

- Taxpayers who owe taxes but need more time to prepare their returns accurately.

Penalties for Non-Compliance

Not adhering to the filing deadlines can lead to significant penalties. Key points to consider include:

- Late filing penalties can accumulate quickly, typically starting at five percent of the unpaid tax amount for each month the return is late.

- Interest on unpaid taxes continues to accrue until the balance is paid in full.

Quick guide on how to complete filing extensions and tax return preparation assistance

Easily Prepare Filing Extensions And Tax Return Preparation Assistance on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly and efficiently. Manage Filing Extensions And Tax Return Preparation Assistance on any platform with the airSlate SignNow apps for Android or iOS and streamline your document-centric processes today.

The Easiest Way to Modify and eSign Filing Extensions And Tax Return Preparation Assistance

- Find Filing Extensions And Tax Return Preparation Assistance and click on Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize specific sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Filing Extensions And Tax Return Preparation Assistance and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the filing extensions and tax return preparation assistance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

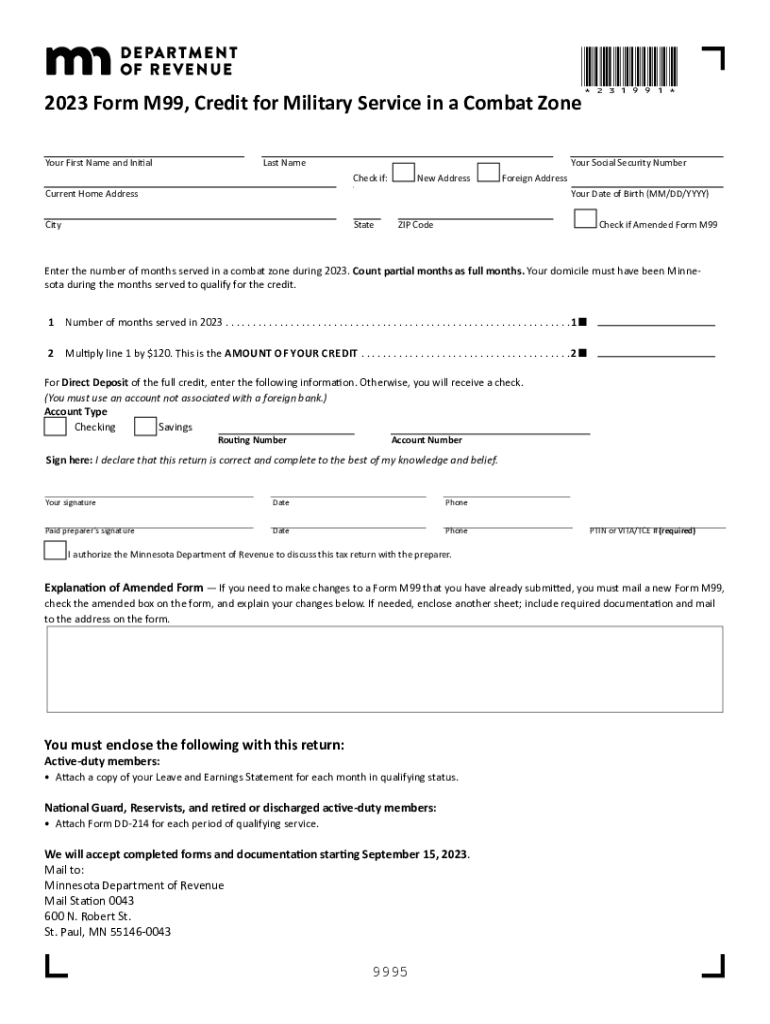

What is form m99 and how is it used?

Form m99 is a specific document format utilized for various administrative and legal purposes. airSlate SignNow simplifies the process by allowing users to easily create, send, and eSign form m99 documents from anywhere, enhancing workflow efficiency.

-

How can I integrate form m99 with other applications?

With airSlate SignNow, integrating form m99 with other applications is straightforward. The platform offers various integration options, allowing seamless connectivity with tools you already use, such as Google Drive, Salesforce, and more, to streamline your document management.

-

What are the pricing options for using form m99 on airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to different business needs, including the use of form m99. You can choose from monthly or annual subscriptions, with each plan giving access to essential features for managing and eSigning documents.

-

Can I customize form m99 templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize form m99 templates to fit specific requirements. You can easily add fields, logos, and personalized messages to ensure that the templates meet your branding and operational needs.

-

What are the key features of form m99 in airSlate SignNow?

The key features of form m99 in airSlate SignNow include easy eSigning, template creation, and real-time tracking. This ensures that you can manage your documents efficiently while keeping all parties updated throughout the signing process.

-

Is form m99 legally binding when signed through airSlate SignNow?

Yes, form m99 signed through airSlate SignNow is legally binding. The platform complies with eSignature laws, ensuring that your signed documents hold up in court and provide the necessary legal protections for all parties involved.

-

What benefits does airSlate SignNow offer for managing form m99?

Using airSlate SignNow for managing form m99 offers numerous benefits, including streamlined workflows, reduced paperwork, and improved turnaround times. This can signNowly enhance productivity and customer satisfaction by simplifying the signing process.

Get more for Filing Extensions And Tax Return Preparation Assistance

- In accordance with national defence security policy form dnd 2570 detailed

- Florida supreme court approved family law form 12 960 motion for civil contemptenforcement florida supreme court approved

- Fidelity fund certificate pdf form

- Perc nj notification of intention to commence negotiations form

- Annual consumer reporting form crf delaware health and dhss delaware

- Iu health fmla department form

- Application for terminal inspection chp 365 chp ca form

- Form ct 3 ac tax ny

Find out other Filing Extensions And Tax Return Preparation Assistance

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe