Licensed Insurance Taxes Province of British Columbia Form

What is the Licensed Insurance Taxes Province Of British Columbia

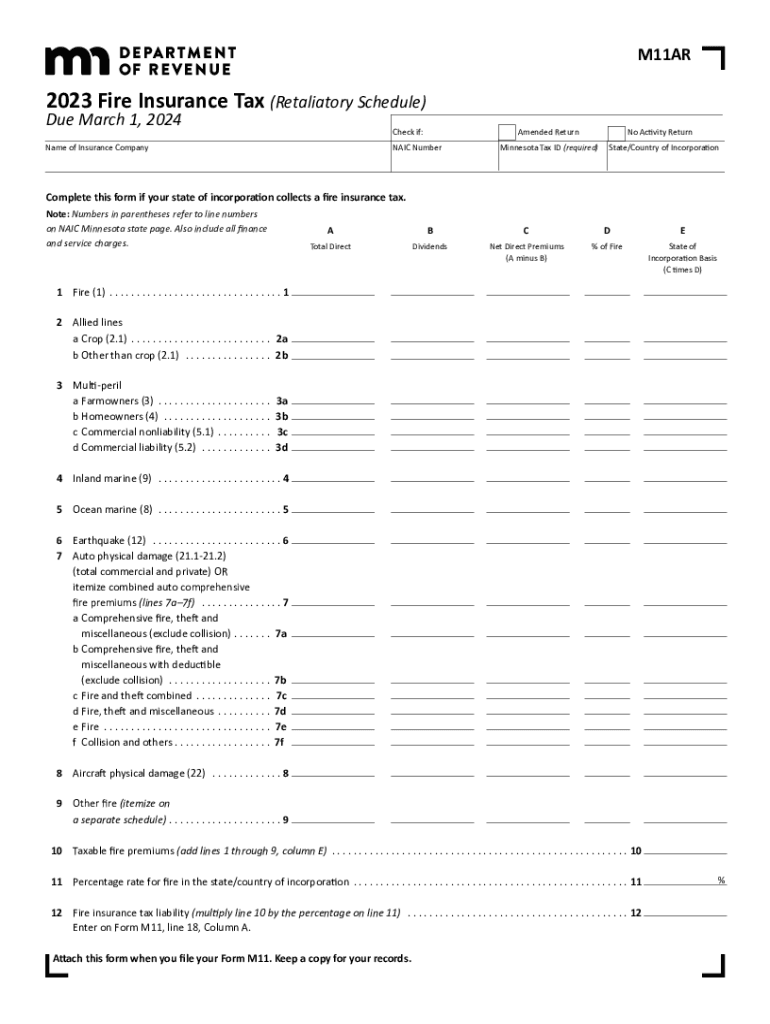

The Licensed Insurance Taxes in the Province of British Columbia refer to specific taxes imposed on insurance premiums collected by licensed insurance companies operating within the province. These taxes are designed to generate revenue for the provincial government and ensure that insurance providers comply with local regulations. The tax structure may vary based on the type of insurance offered, including property, casualty, and life insurance. Understanding these taxes is crucial for both insurers and policyholders, as they can impact the overall cost of insurance products.

How to obtain the Licensed Insurance Taxes Province Of British Columbia

To obtain the Licensed Insurance Taxes in the Province of British Columbia, insurance companies must first ensure they are properly licensed to operate within the province. This involves applying for a license through the British Columbia Financial Services Authority (BCFSA). Once licensed, insurers must register for tax purposes and provide necessary documentation to the provincial tax authority. This process typically includes submitting forms that detail the types of insurance offered and the premiums collected. It is advisable for companies to consult with tax professionals to ensure compliance with all regulations.

Steps to complete the Licensed Insurance Taxes Province Of British Columbia

Completing the Licensed Insurance Taxes involves several key steps:

- Ensure your insurance company is licensed in British Columbia.

- Register with the provincial tax authority to obtain a tax identification number.

- Gather necessary documentation, including records of premiums collected and types of insurance provided.

- Complete the required tax forms accurately, detailing all relevant information.

- Submit the completed forms to the provincial tax authority by the specified deadlines.

- Maintain records of submissions and any correspondence with tax authorities for future reference.

Key elements of the Licensed Insurance Taxes Province Of British Columbia

Key elements of the Licensed Insurance Taxes include the tax rates applicable to different types of insurance, the reporting requirements for insurers, and the deadlines for tax submissions. Insurers must be aware of the specific rates set by the provincial government, which can vary based on the insurance category. Additionally, accurate record-keeping is essential to ensure compliance and facilitate any audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Licensed Insurance Taxes in British Columbia are critical for compliance. Insurers are typically required to submit their tax returns on a quarterly or annual basis, depending on the volume of premiums collected. Important dates include the end of each reporting period and the due date for tax submissions. Failure to meet these deadlines can result in penalties or interest charges, making it essential for insurers to stay informed about their obligations.

Penalties for Non-Compliance

Non-compliance with the Licensed Insurance Taxes can lead to significant penalties for insurance companies. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is important for insurers to understand the implications of failing to file accurately and on time. Regular audits and reviews of tax submissions can help mitigate the risk of non-compliance and ensure adherence to provincial regulations.

Quick guide on how to complete licensed insurance taxes province of british columbia

Prepare Licensed Insurance Taxes Province Of British Columbia effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Handle Licensed Insurance Taxes Province Of British Columbia on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Licensed Insurance Taxes Province Of British Columbia with ease

- Find Licensed Insurance Taxes Province Of British Columbia and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form: through email, text message (SMS), invitation link, or download it to your PC.

Eliminate issues related to lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your preference. Edit and eSign Licensed Insurance Taxes Province Of British Columbia and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the licensed insurance taxes province of british columbia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Licensed Insurance Taxes in the Province of British Columbia?

Licensed Insurance Taxes in the Province of British Columbia refer to the fees and levies that licensed insurance providers must pay. These taxes are essential for maintaining regulatory compliance and ensuring the continued operation of insurance services within the province. Understanding these taxes is crucial for businesses operating in or dealing with the insurance industry in British Columbia.

-

How does airSlate SignNow simplify handling Licensed Insurance Taxes in British Columbia?

airSlate SignNow streamlines the process of managing Licensed Insurance Taxes in the Province of British Columbia by allowing insurance businesses to eSign documents quickly and efficiently. This digital solution reduces time spent on paperwork, ensuring timely compliance with tax regulations. By simplifying document management, users can focus more on their core insurance activities.

-

What are the pricing options for airSlate SignNow related to Licensed Insurance Taxes?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses dealing with Licensed Insurance Taxes in the Province of British Columbia. Each plan includes essential features that support document management and eSigning. Prospective customers can choose a plan that best fits their operational requirements and budget.

-

Can I integrate airSlate SignNow with other software for managing Licensed Insurance Taxes?

Yes, airSlate SignNow integrates seamlessly with popular software solutions, which is particularly beneficial for managing Licensed Insurance Taxes in the Province of British Columbia. This integration allows for easy transfer of data and documentation between platforms. By connecting SignNow with your existing systems, you can enhance efficiency and compliance in your tax processes.

-

What are the key features of airSlate SignNow that support Licensed Insurance Taxes compliance?

Key features of airSlate SignNow that support compliance with Licensed Insurance Taxes in the Province of British Columbia include robust eSigning capabilities, automated workflow management, and secure document storage. These tools enable businesses to handle their tax-related documents more effectively and maintain a high level of organization. Additionally, built-in compliance tracking ensures you stay updated with regulatory requirements.

-

What benefits does airSlate SignNow provide for businesses dealing with Licensed Insurance Taxes?

airSlate SignNow provides multiple benefits for businesses involved with Licensed Insurance Taxes in the Province of British Columbia, including increased efficiency, reduced processing time, and enhanced security. By digitizing document workflows, businesses can minimize errors and facilitate faster approvals. Furthermore, the platform’s user-friendly interface makes it accessible for all team members.

-

Is airSlate SignNow compliant with regulations for Licensed Insurance Taxes in British Columbia?

Yes, airSlate SignNow is designed to comply with regulations concerning Licensed Insurance Taxes in the Province of British Columbia. The platform incorporates features that support necessary compliance measures, such as audit trails and secure eSigning. Users can trust that their documents meet provincial requirements, providing peace of mind during tax season.

Get more for Licensed Insurance Taxes Province Of British Columbia

- Legal last will and testament form for domestic partner with adult and minor children from prior marriage maine

- Legal last will and testament form for married person with adult and minor children maine

- Legal last will and testament form for domestic partner with adult and minor children maine

- Mutual wills package with last wills and testaments for married couple with adult and minor children maine form

- Legal last will and testament form for a widow or widower with adult children maine

- Legal last will and testament form for widow or widower with minor children maine

- Legal last will form for a widow or widower with no children maine

- Legal last will and testament form for a widow or widower with adult and minor children maine

Find out other Licensed Insurance Taxes Province Of British Columbia

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word