Long Term Care Insurance Income Tax Credit Form

Understanding the Long Term Care Insurance Income Tax Credit

The Long Term Care Insurance Income Tax Credit is designed to provide financial relief to individuals who pay for long-term care insurance premiums. This credit can help offset the costs associated with maintaining a long-term care insurance policy, which is essential for those who may need extended care services in the future. By reducing taxable income, this credit can make a significant difference in the overall financial burden of long-term care.

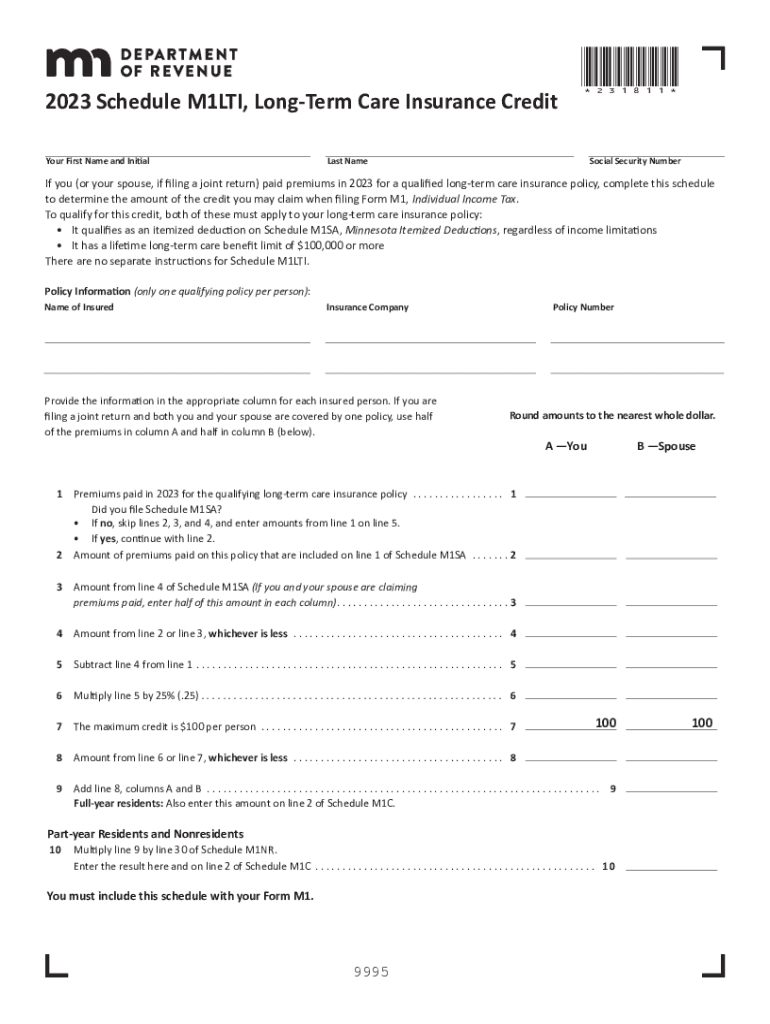

Steps to Complete the Long Term Care Insurance Income Tax Credit

Completing the Long Term Care Insurance Income Tax Credit involves several key steps:

- Gather documentation of your long-term care insurance premiums paid during the tax year.

- Review eligibility criteria to ensure you qualify for the credit.

- Fill out the appropriate tax forms, including any necessary schedules that pertain to the credit.

- Calculate the amount of the credit based on your premium payments and any applicable limits.

- Submit your tax return, ensuring all information is accurate and complete.

Eligibility Criteria for the Long Term Care Insurance Income Tax Credit

To qualify for the Long Term Care Insurance Income Tax Credit, taxpayers must meet specific eligibility requirements. These typically include:

- Being a resident of the state offering the credit.

- Having a long-term care insurance policy that meets state regulations.

- Paying premiums for the policy during the tax year in question.

It is important to review state-specific rules as they may vary significantly.

Required Documents for Claiming the Credit

When claiming the Long Term Care Insurance Income Tax Credit, you will need to provide certain documentation to support your claim. Essential documents include:

- Proof of premium payments, such as invoices or receipts from your insurance provider.

- A copy of your long-term care insurance policy.

- Tax forms that detail your income and any deductions or credits claimed.

Examples of Using the Long Term Care Insurance Income Tax Credit

Understanding how to apply the Long Term Care Insurance Income Tax Credit can help taxpayers maximize their benefits. For instance:

- A retiree paying $2,000 annually for long-term care insurance may reduce their taxable income by the same amount, potentially lowering their overall tax liability.

- A self-employed individual can apply the credit against their business income, providing additional tax savings.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines for the Long Term Care Insurance Income Tax Credit to avoid penalties. Generally, tax returns must be submitted by April 15 of the following year. However, extensions may be available, and it is advisable to check specific state guidelines for any variations.

Quick guide on how to complete long term care insurance income tax credit

Effortlessly Prepare Long term Care Insurance Income Tax Credit on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Long term Care Insurance Income Tax Credit on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Long term Care Insurance Income Tax Credit Effortlessly

- Obtain Long term Care Insurance Income Tax Credit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors requiring the reprinting of new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you select. Modify and eSign Long term Care Insurance Income Tax Credit while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the long term care insurance income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mn long term care credit?

The mn long term care credit is a tax credit designed to provide financial relief for individuals who incur long-term care expenses. By taking advantage of this credit, residents in Minnesota can offset some of their costs associated with long-term care services, improving their overall financial situation.

-

Who is eligible for the mn long term care credit?

Eligibility for the mn long term care credit typically includes individuals or families that have paid qualified long-term care expenses. To qualify, the expenses must meet certain criteria set by the state, so it’s essential to review the specific requirements related to income and healthcare services.

-

How can airSlate SignNow help with mn long term care credit documentation?

airSlate SignNow simplifies the process of preparing and signing documents necessary for claiming the mn long term care credit. Our platform offers easy-to-use eSigning features that allow you to manage your documents securely, ensuring compliance and accuracy throughout the submission process.

-

Are there any costs associated with obtaining the mn long term care credit?

Obtaining the mn long term care credit does not have direct costs; however, there may be fees related to long-term care services that you are paying for. It’s important to consider these costs while determining your eligibility and potential tax savings associated with the mn long term care credit.

-

What kind of long-term care expenses are covered by the mn long term care credit?

Covered expenses under the mn long term care credit may include costs for nursing home care, assisted living facilities, and home healthcare services. Make sure to check the specific criteria for eligible expenses, as this can signNowly influence your claim and potential credit amount.

-

Can I use airSlate SignNow for multiple signers when applying for the mn long term care credit?

Yes, airSlate SignNow allows for multiple signers on documents related to the mn long term care credit application. This feature enables families or representatives to easily collaborate and authorize necessary documentation, streamlining the overall process of getting the credit.

-

How can I track the status of my mn long term care credit claim?

To track the status of your mn long term care credit claim, you should contact the Minnesota Department of Revenue for updates. Using airSlate SignNow, you can keep all related documents organized and easily accessible, allowing for efficient follow-ups and adjustments if necessary.

Get more for Long term Care Insurance Income Tax Credit

- Quitclaim deed grantor 497311325 form

- Quitclaim deed two individuals to three individuals michigan form

- Quitclaim deed from an individual to two individuals michigan form

- Personal deed form

- Notice commencement form 497311329

- Michigan notice furnishing form

- Quitclaim deed by two individuals to llc michigan form

- Warranty deed from two individuals to llc michigan form

Find out other Long term Care Insurance Income Tax Credit

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document