Declaration of Transmission Form

What is the Declaration of Transmission Form

The declaration of transmission form is a legal document used to formally communicate the transfer of ownership or rights from one party to another. This form is essential in various contexts, such as real estate transactions, business ownership transfers, and estate settlements. It serves as a record of the transfer, ensuring that all parties involved are aware of the change in ownership and that it is executed in compliance with relevant laws.

Steps to Complete the Declaration of Transmission Form

Completing the declaration of transmission form involves several key steps to ensure accuracy and legal compliance. Start by gathering all necessary information, including the names and addresses of the parties involved, the description of the property or rights being transferred, and any relevant identification numbers. Next, fill out the form completely, ensuring that all sections are accurate and legible. Once completed, review the form for any errors or omissions before signing it. Finally, submit the form according to the specific requirements of your jurisdiction, which may include filing with a government office or providing copies to involved parties.

Legal Use of the Declaration of Transmission Form

The declaration of transmission form must be used in accordance with applicable laws to be considered legally binding. This includes adhering to state-specific regulations regarding property transfers and ensuring that all signatures are obtained from the relevant parties. Additionally, it is crucial to maintain compliance with federal and state laws governing electronic signatures, as these can affect the validity of the form when submitted digitally. Understanding these legal requirements helps prevent disputes and ensures that the transfer is recognized by all legal entities.

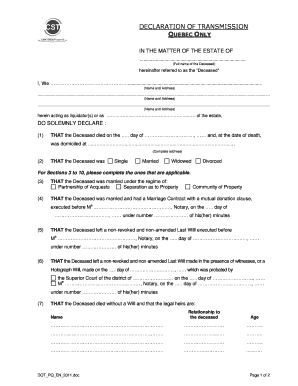

Key Elements of the Declaration of Transmission Form

Several key elements must be included in the declaration of transmission form to ensure its validity. These elements typically include:

- Identifying Information: Names and addresses of the transferor and transferee.

- Description of the Asset: Clear identification of the property or rights being transferred.

- Effective Date: The date on which the transfer is to take effect.

- Signatures: Signatures of all parties involved, along with dates.

- Witness or Notary Information: Depending on the jurisdiction, a witness or notary may be required to validate the document.

How to Use the Declaration of Transmission Form

Using the declaration of transmission form effectively involves understanding its purpose and the correct process for submission. After completing the form, ensure that all necessary parties have signed it. Depending on the nature of the transmission, you may need to file the form with a local government office or provide copies to financial institutions or other relevant entities. It is also advisable to keep copies for your records, as they may be needed for future reference or in case of disputes.

Form Submission Methods

The declaration of transmission form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing through official government websites.

- Mail: You can send the completed form via postal service to the appropriate office.

- In-Person: Submitting the form in person may be required in certain situations, especially for notarization.

Quick guide on how to complete declaration of transmission quebec

Effortlessly Manage declaration of transmission quebec on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without inconvenience. Manage declaration of transmission on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign déclaration de transmission with Ease

- Find forms transmission and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Modify and electronically sign declaration of transmission form and ensure exceptional communication throughout the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to declaration of transmission form

Create this form in 5 minutes!

How to create an eSignature for the declaration of transmission quebec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask déclaration de transmission

-

What is a declaration of transmission in the context of airSlate SignNow?

A declaration of transmission refers to the process of officially sending documents that require signatures through airSlate SignNow. This feature ensures that all parties receive and can easily access the necessary documents for eSigning, enhancing both speed and security in transactions.

-

How does airSlate SignNow facilitate the creation of a declaration of transmission?

airSlate SignNow simplifies the creation of a declaration of transmission by providing user-friendly templates and customizable options. Users can quickly generate a declaration, ensuring all pertinent information is included before sending it for signatures.

-

What are the pricing options for airSlate SignNow's declaration of transmission service?

airSlate SignNow offers flexible pricing options to cater to businesses of all sizes. Choose from monthly or annual plans that include features for a wide range of document transactions, including declarations of transmission, at competitive rates.

-

Can I integrate airSlate SignNow with other software for managing declarations of transmission?

Yes, airSlate SignNow supports integrations with various business applications to streamline your workflow. This includes popular CRMs and project management tools, making it easier to manage declarations of transmission alongside your other business processes.

-

What benefits does airSlate SignNow provide for managing declarations of transmission?

Using airSlate SignNow for managing declarations of transmission offers numerous benefits, including increased efficiency and reduced turnaround time. The platform also ensures compliance and security throughout the eSigning process, fostering trust and reliability.

-

Is it safe to use airSlate SignNow for sensitive declarations of transmission?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to keep your declarations of transmission secure. You can trust that your information and documents are protected from unauthorized access during the entire signing process.

-

How can I track the status of my declaration of transmission in airSlate SignNow?

airSlate SignNow provides real-time tracking features that allow you to monitor the status of your declaration of transmission. You can easily see when documents are sent, viewed, and signed, giving you complete visibility into your signing process.

Get more for forms transmission

- Authorisation form for foreign domestic worker work pass

- Crls transcript request form 07142023

- Making a claim for noise induced hearing losswsib form

- Mental health crisis hold tracking form

- Illinois lottery retailer applicant checklist form

- Service request my utility account form

- Commissioner of the revenuepetersburg va official form

- Department of homeland security omb control no 16 622108780 form

Find out other declaration of transmission form

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy