FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO

Understanding the formulir asuransi

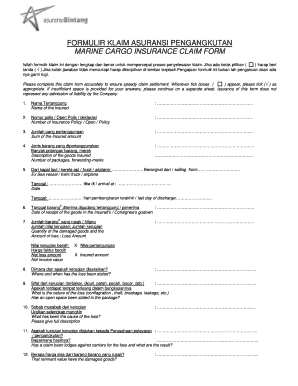

The formulir asuransi serves as a crucial document in the insurance claim process. It is designed to formally request compensation for losses covered under an insurance policy. This form collects essential information about the incident, the insured party, and the specifics of the claim. Understanding its components is vital for ensuring a smooth claims process.

Steps to complete the formulir asuransi

Completing the formulir asuransi requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including your policy number, details of the incident, and any supporting documents.

- Fill out the form accurately, providing all requested information. Double-check for any errors or omissions.

- Attach any required documentation, such as photographs, police reports, or receipts related to the claim.

- Review the completed form to ensure all sections are filled out correctly.

- Submit the form according to your insurance provider's guidelines, whether online, by mail, or in person.

Legal use of the formulir asuransi

The formulir asuransi is legally binding once submitted, provided it meets specific legal requirements. It must be filled out truthfully and accurately to avoid potential legal issues, such as claims of fraud. Compliance with state regulations and insurance laws is essential for the form to be considered valid.

Key elements of the formulir asuransi

Several key elements are essential to include in the formulir asuransi to ensure its effectiveness:

- Personal Information: Full name, address, and contact details of the insured party.

- Policy Information: Policy number and type of coverage.

- Incident Details: Date, time, and description of the incident leading to the claim.

- Loss Description: A detailed account of the damages or losses incurred.

- Supporting Documents: Any additional paperwork that substantiates the claim.

How to obtain the formulir asuransi

The formulir asuransi can typically be obtained through your insurance provider's website or customer service department. Many insurers offer downloadable versions of the form, while others may require you to request it directly. Ensure you have the correct version that corresponds to your specific claim type.

Form submission methods

Submitting the formulir asuransi can be done through various methods, depending on the preferences of the insurance company:

- Online Submission: Many insurers allow you to fill out and submit the form electronically through their website.

- Mail: You can print the completed form and send it via postal service to the designated claims address.

- In-Person: Some insurance companies may allow you to submit the form at a local office.

Quick guide on how to complete formulir klaim asuransi pengangkutan marine cargo

Effortlessly Complete FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Modify and Electronically Sign FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO with Ease

- Locate FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulir klaim asuransi pengangkutan marine cargo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a formulir asuransi and how does airSlate SignNow help with it?

A formulir asuransi is a crucial document used in insurance processes. airSlate SignNow simplifies the creation and management of formulir asuransi, allowing businesses to send and eSign documents swiftly and securely. Our platform ensures that all insurance forms are filled out accurately and can be tracked seamlessly.

-

How much does airSlate SignNow cost for managing formulir asuransi?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Whether you're an individual or a large organization dealing with formulir asuransi, we provide flexible options that can fit any budget. Our cost-effective solution ensures you don’t compromise on quality while managing important documents.

-

What features does airSlate SignNow offer for formulir asuransi?

airSlate SignNow comes equipped with robust features for handling formulir asuransi, including customizable templates, automated workflows, and secure eSignature capabilities. These tools make it easier to draft, send, and store your insurance forms, enhancing efficiency and compliance. Our intuitive interface helps you manage your documents without hassle.

-

Can I integrate airSlate SignNow with other software for formulir asuransi?

Yes, airSlate SignNow offers seamless integrations with various applications that can be beneficial for managing formulir asuransi. This includes CRM platforms, cloud storage solutions, and other productivity tools. By integrating with your existing systems, you can streamline your workflow and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for formulir asuransi?

Using airSlate SignNow for formulir asuransi brings numerous benefits, such as faster processing times and improved accuracy. The platform reduces paperwork and eliminates the need for physical signatures, allowing for a more efficient workflow. Additionally, the secure storage ensures that all your important insurance documents remain safe and accessible.

-

How secure is airSlate SignNow for sending formulir asuransi?

Security is a top priority at airSlate SignNow, especially for sensitive documents like formulir asuransi. Our platform utilizes advanced encryption and complies with legal standards to protect your data. You can trust that your information remains confidential while you handle insurance forms digitally.

-

Is customer support available when using airSlate SignNow for formulir asuransi?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any queries or issues related to formulir asuransi. Our support team is available via various channels, ensuring you get the help you need promptly. We are committed to ensuring your experience with our solution is smooth and enjoyable.

Get more for FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO

Find out other FORMULIR KLAIM ASURANSI PENGANGKUTAN MARINE CARGO

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form