The Ins and Outs of the Child and Dependent Care Credit Form

Understanding the 2023 Minnesota Child Credit

The 2023 Minnesota child credit is a financial benefit designed to support families with children. This credit aims to reduce the tax burden for eligible families, providing direct financial assistance based on the number of qualifying children. It is essential for families to understand the eligibility criteria and the amount they can claim to maximize their benefits.

Eligibility Criteria for the Minnesota Child Credit

To qualify for the 2023 Minnesota child credit, families must meet specific requirements. Generally, the child must be under the age of 17 at the end of the tax year and must be claimed as a dependent on the taxpayer's return. Additionally, the family's income must fall within certain thresholds, which can affect the amount of credit received. It is advisable to review the latest guidelines from the Minnesota Department of Revenue to ensure compliance with all eligibility requirements.

Steps to Claim the Minnesota Child Credit

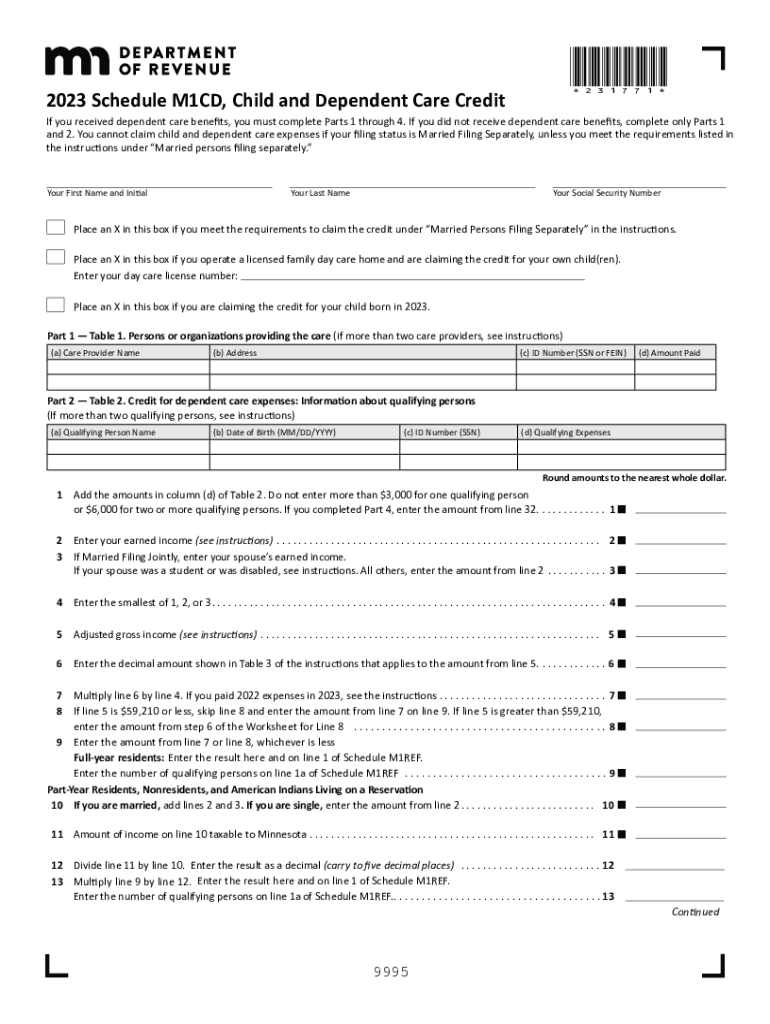

Claiming the 2023 Minnesota child credit involves several straightforward steps. First, ensure that you have all necessary documentation, including your tax return and information about your dependents. Next, complete the appropriate tax forms, such as the Minnesota Form M1, where you will report your qualifying children. Finally, submit your tax return by the designated deadline to receive the credit. Utilizing digital tools can simplify this process, allowing for efficient completion and submission of forms.

Required Documents for the Minnesota Child Credit

When applying for the 2023 Minnesota child credit, certain documents are essential. Taxpayers should gather their Social Security numbers, proof of income, and documentation verifying the relationship to the qualifying child. This may include birth certificates or adoption papers. Having these documents ready can streamline the application process and help ensure that all requirements are met.

Filing Deadlines for the Minnesota Child Credit

Filing deadlines for the 2023 Minnesota child credit align with the general tax filing dates. Typically, individual income tax returns must be filed by April 15 of the following year. However, extensions may be available. It is crucial to stay informed about any changes to these deadlines to avoid penalties or missed opportunities for claiming the credit.

IRS Guidelines Related to the Minnesota Child Credit

The IRS provides guidelines that are important for understanding how the Minnesota child credit interacts with federal tax credits. While the Minnesota credit is state-specific, it is essential to consider how it affects your overall tax situation, including potential eligibility for federal credits like the Child Tax Credit. Familiarizing yourself with both state and federal guidelines can help ensure that you maximize your benefits.

Quick guide on how to complete the ins and outs of the child and dependent care credit

Effortlessly prepare The Ins And Outs Of The Child And Dependent Care Credit on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without interruptions. Handle The Ins And Outs Of The Child And Dependent Care Credit across any platform using the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

How to modify and eSign The Ins And Outs Of The Child And Dependent Care Credit without any hassle

- Obtain The Ins And Outs Of The Child And Dependent Care Credit and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive data with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign The Ins And Outs Of The Child And Dependent Care Credit and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the ins and outs of the child and dependent care credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Minnesota child credit?

The 2023 Minnesota child credit is a tax benefit designed to support families by providing financial relief for each qualifying child. This credit aims to reduce the tax burden on families with children, making it easier for them to manage expenses related to childcare and education.

-

How does the 2023 Minnesota child credit work?

The 2023 Minnesota child credit works by allowing eligible families to claim a credit based on their adjusted gross income and the number of qualifying children. This credit is designed to provide direct financial benefits, effectively lowering the amount of taxes owed each year, especially beneficial for families in the state.

-

Who is eligible for the 2023 Minnesota child credit?

To be eligible for the 2023 Minnesota child credit, families must meet certain income thresholds and have dependent children under 17 years of age. It's essential to review the specific guidelines provided by the Minnesota Department of Revenue to ensure eligibility and maximize benefits.

-

Can I claim the 2023 Minnesota child credit if I live outside Minnesota?

No, to claim the 2023 Minnesota child credit, you must be a resident of Minnesota and meet all the eligibility requirements. Families living in other states should check their respective state tax credits for similar benefits.

-

How does the 2023 Minnesota child credit affect my tax return?

Claiming the 2023 Minnesota child credit will directly reduce your taxable income, potentially resulting in a lower tax liability or a higher refund. It's crucial to accurately report your income and the number of qualifying children to benefit fully from the credit.

-

What documents do I need to apply for the 2023 Minnesota child credit?

When applying for the 2023 Minnesota child credit, you will need to provide documentation such as proof of residency and information on your qualifying children, including Social Security numbers. Keeping your financial records organized will streamline the application process.

-

Is the 2023 Minnesota child credit refundable?

Yes, the 2023 Minnesota child credit can be refundable for eligible families, meaning if your credit exceeds your tax liability, you may receive the difference as a refund. This aspect of the credit is particularly beneficial for low- to moderate-income families.

Get more for The Ins And Outs Of The Child And Dependent Care Credit

Find out other The Ins And Outs Of The Child And Dependent Care Credit

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template