MLPBorrowerAffidavit DOC 425049, Applications Handbook Section 850, Increase in Lending Limitation to One Borrower for 1 4 Famil Form

What is the MLPBorrowerAffidavit doc 425049

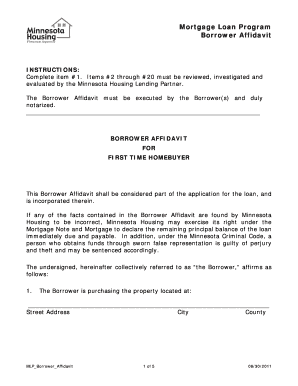

The MLPBorrowerAffidavit doc 425049 is a crucial document outlined in Applications Handbook Section 850. This affidavit is specifically designed for situations where there is an increase in lending limitations to a single borrower for one to four family residential real estate and small business loans. It serves to ensure compliance with federal lending regulations while providing a streamlined process for lenders and borrowers alike. The document's primary purpose is to affirm the borrower's eligibility under the specified lending conditions.

How to use the MLPBorrowerAffidavit doc 425049

Using the MLPBorrowerAffidavit doc 425049 involves several straightforward steps. First, borrowers need to fill out the affidavit accurately, ensuring that all personal and financial information is complete. This includes details about the property or business for which the loan is being sought. Once completed, the affidavit should be submitted to the lender as part of the loan application process. It is essential to keep a copy for personal records and future reference.

Steps to complete the MLPBorrowerAffidavit doc 425049

Completing the MLPBorrowerAffidavit doc 425049 requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal and financial information.

- Fill in the borrower’s details, including name, address, and contact information.

- Provide information about the property or business related to the loan.

- Review the affidavit for accuracy and completeness.

- Sign and date the document in the designated areas.

- Submit the affidavit to the lender along with the loan application.

Key elements of the MLPBorrowerAffidavit doc 425049

Several key elements are essential to the MLPBorrowerAffidavit doc 425049. These include:

- Borrower Information: Personal details of the borrower, including identification and contact information.

- Loan Details: Specifics about the loan being applied for, including the amount and purpose.

- Property Information: Description of the property or business associated with the loan.

- Compliance Statement: An affirmation that the borrower meets the eligibility criteria set forth in the lending regulations.

Legal use of the MLPBorrowerAffidavit doc 425049

The MLPBorrowerAffidavit doc 425049 holds significant legal weight in the lending process. It is essential for ensuring that all parties involved comply with applicable laws and regulations regarding lending limits. By signing the affidavit, borrowers acknowledge their understanding of the terms and conditions associated with the loan. This document can also serve as a legal record in case of disputes or audits related to the lending process.

Eligibility Criteria

To qualify for the MLPBorrowerAffidavit doc 425049, borrowers must meet specific eligibility criteria. These typically include:

- Being a legal resident of the United States.

- Demonstrating sufficient income to support loan repayment.

- Providing proof of ownership or interest in the property or business for which the loan is sought.

- Meeting any additional requirements set forth by the lender or regulatory bodies.

Quick guide on how to complete mlpborroweraffidavit doc 425049 applications handbook section 850 increase in lending limitation to one borrower for 1 4 family

Effortlessly set up [SKS] on any device

Managing documents online has gained popularity among both organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and possesses the same legal validity as a traditional wet-ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MLPBorrowerAffidavit doc 425049, Applications Handbook Section 850, Increase In Lending Limitation To One Borrower For 1 4 Famil

Create this form in 5 minutes!

How to create an eSignature for the mlpborroweraffidavit doc 425049 applications handbook section 850 increase in lending limitation to one borrower for 1 4 family

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MLPBorrowerAffidavit doc 425049?

The MLPBorrowerAffidavit doc 425049 is a crucial document that helps streamline the process of increasing lending limitations for one borrower, specifically in 1-4 family residential real estate and small business loans as outlined in Applications Handbook Section 850. This affidavit ensures compliance with necessary regulations while making the loan process smoother.

-

How does airSlate SignNow facilitate the completion of the MLPBorrowerAffidavit doc 425049?

airSlate SignNow provides an easy-to-use platform that allows you to create, send, and eSign the MLPBorrowerAffidavit doc 425049 quickly. Its straightforward interface simplifies document management and helps ensure that all requisite sections are completed accurately, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for managing real estate documents?

Using airSlate SignNow to manage documents like the MLPBorrowerAffidavit doc 425049 offers numerous benefits including improved efficiency, cost savings, and enhanced security. The platform ensures that your documents are securely stored and easily accessible, enabling better collaboration among all parties involved.

-

Can I integrate airSlate SignNow with other tools for better workflow?

Yes, airSlate SignNow seamlessly integrates with various tools and applications, enhancing your workflow. Whether you're using CRM systems, project management software, or cloud storage solutions, these integrations can be particularly beneficial when handling documents like MLPBorrowerAffidavit doc 425049.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers several pricing plans designed to fit different business needs and budgets. Each plan provides access to essential features for managing documents, including the MLPBorrowerAffidavit doc 425049, allowing you to choose the option that best suits your requirements.

-

Is there a way to track the status of my MLPBorrowerAffidavit doc 425049?

Absolutely! With airSlate SignNow, you can track the status of your MLPBorrowerAffidavit doc 425049 in real-time. This feature allows you to see who has viewed or signed the document, providing peace of mind and ensuring timely follow-ups.

-

What security measures does airSlate SignNow have in place?

Security is a priority for airSlate SignNow, which implements robust encryption and compliance protocols to protect your documents, including the MLPBorrowerAffidavit doc 425049. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for MLPBorrowerAffidavit doc 425049, Applications Handbook Section 850, Increase In Lending Limitation To One Borrower For 1 4 Famil

Find out other MLPBorrowerAffidavit doc 425049, Applications Handbook Section 850, Increase In Lending Limitation To One Borrower For 1 4 Famil

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF