It 611 New York State Department of Taxation and Finance Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accep Form

Understanding the IT 611 Claim for Brownfield Redevelopment Tax Credit

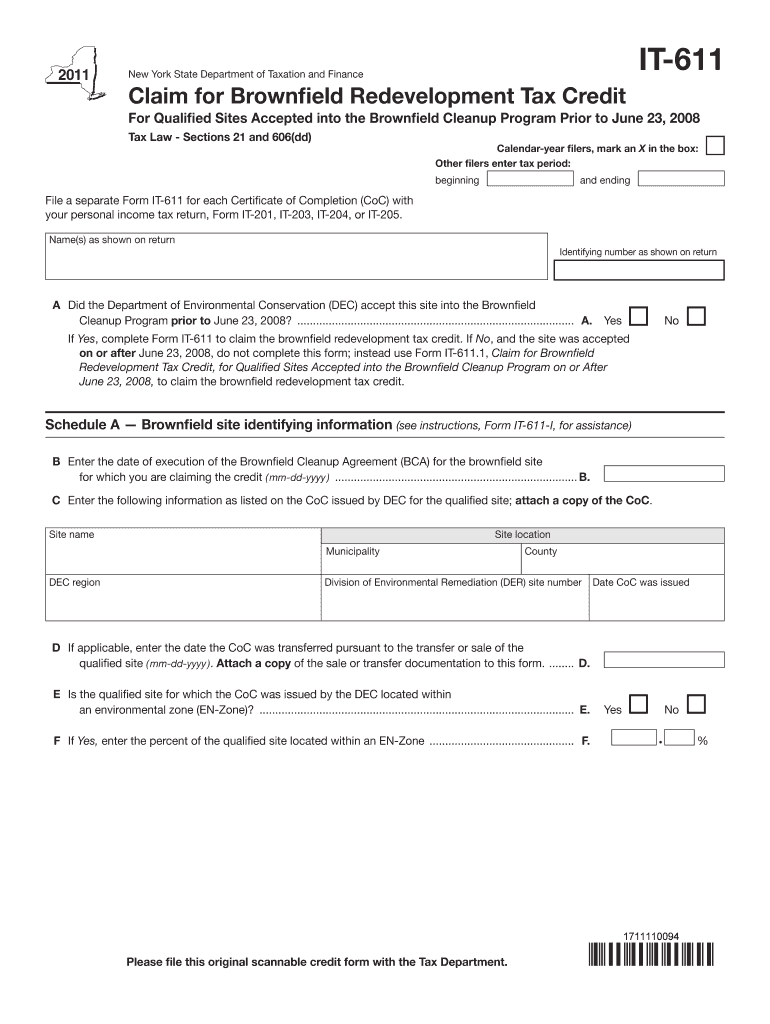

The IT 611 form, issued by the New York State Department of Taxation and Finance, is specifically designed for claiming the Brownfield Redevelopment Tax Credit. This credit is available for qualified sites that have been accepted into the Brownfield Cleanup Program prior to June 23, as outlined in Tax Law Sections 21 and 606dd. The purpose of this form is to provide tax relief to businesses that invest in the cleanup and redevelopment of contaminated properties, promoting environmental restoration and economic development in New York State.

Steps to Complete the IT 611 Form

Completing the IT 611 form requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including proof of eligibility for the Brownfield Cleanup Program.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the tax credit amount based on eligible expenses related to the cleanup and redevelopment.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to the appropriate tax authority.

Eligibility Criteria for the IT 611 Tax Credit

To qualify for the Brownfield Redevelopment Tax Credit using the IT 611 form, certain criteria must be met:

- The site must be accepted into the Brownfield Cleanup Program prior to June 23.

- Eligible expenses must be incurred for the cleanup and redevelopment of the site.

- The applicant must be the owner or developer of the property.

Required Documents for Submission

When submitting the IT 611 form, it is essential to include supporting documentation. This may include:

- Proof of acceptance into the Brownfield Cleanup Program.

- Invoices and receipts for all eligible cleanup expenses.

- Any additional documentation requested by the New York State Department of Taxation and Finance.

Form Submission Methods

The IT 611 form can be submitted through various methods, ensuring convenience for applicants. These methods include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Filing Deadlines for the IT 611 Form

Timely submission of the IT 611 form is crucial to ensure eligibility for the tax credit. The specific filing deadlines may vary, so it is important to check the current tax calendar for the applicable year. Generally, forms should be submitted by the end of the tax year in which the eligible expenses were incurred.

Quick guide on how to complete it 611 new york state department of taxation and finance claim for brownfield redevelopment tax credit for qualified sites

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, SMS, invite link, or download it to your computer.

Put an end to issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IT 611 New York State Department Of Taxation And Finance Claim For Brownfield Redevelopment Tax Credit For Qualified Sites Accep

Create this form in 5 minutes!

How to create an eSignature for the it 611 new york state department of taxation and finance claim for brownfield redevelopment tax credit for qualified sites

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 611 New York State Department Of Taxation And Finance Claim For Brownfield Redevelopment Tax Credit?

The IT 611 form is used to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program prior to June 23 under Tax Law Sections 21 and 606dd Calendar year. This credit offers financial incentives to encourage the cleanup and redevelopment of environmentally impacted properties in New York State.

-

How can airSlate SignNow help with IT 611 submission?

airSlate SignNow provides a streamlined solution for electronically signing and submitting the IT 611 New York State Department Of Taxation And Finance Claim For Brownfield Redevelopment Tax Credit forms. With its user-friendly interface, businesses can finalize documents quickly and securely, ensuring compliance and efficiency in their tax credit claim process.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your IT 611 New York State Department Of Taxation And Finance Claim helps reduce processing time and minimize errors. The platform's electronic signature capabilities ensure that your documents are legally binding and can be managed more effectively than traditional paper methods.

-

Are there any integration options available with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with popular applications and platforms such as Google Drive, Salesforce, and Dropbox. This allows for improved workflow automation when managing IT 611 New York State Department Of Taxation And Finance Claim For Brownfield Redevelopment Tax Credit forms and other vital documentation.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Various subscription tiers allow you to choose a plan that aligns with the volume of IT 611 New York State Department Of Taxation And Finance Claim submissions you expect, making it a cost-effective solution for both small and large organizations.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information related to the IT 611 New York State Department Of Taxation And Finance Claim. You can trust that your confidential tax documents are safe while using our platform.

-

Can I track the status of my IT 611 submissions with airSlate SignNow?

Yes, airSlate SignNow offers features that allow you to track the status of your IT 611 New York State Department Of Taxation And Finance Claim submissions in real time. You'll receive notifications on document actions, ensuring you are always informed about your filing process.

Get more for IT 611 New York State Department Of Taxation And Finance Claim For Brownfield Redevelopment Tax Credit For Qualified Sites Accep

Find out other IT 611 New York State Department Of Taxation And Finance Claim For Brownfield Redevelopment Tax Credit For Qualified Sites Accep

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online