Form CT 3M4M , General Business Corporation MTA Surcharge Tax Ny

Understanding the Form CT 3M4M

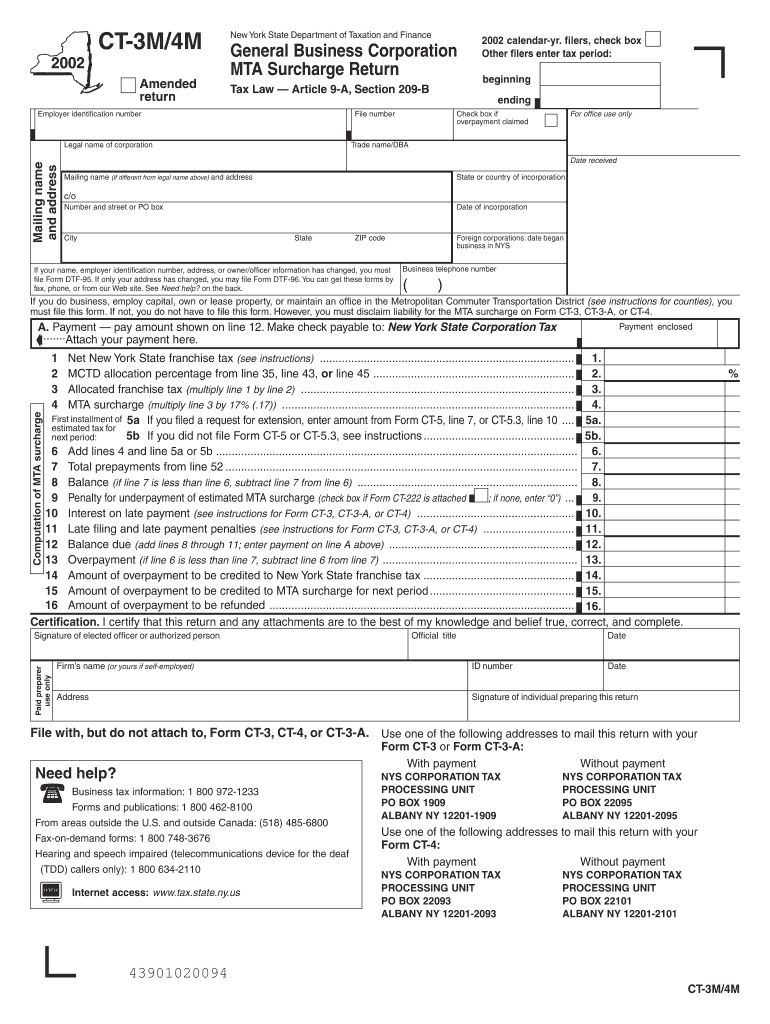

The Form CT 3M4M, known as the General Business Corporation MTA Surcharge Tax form in New York, is used by corporations that are subject to the Metropolitan Transportation Authority (MTA) surcharge. This form is essential for reporting the surcharge based on a corporation's gross income, which is applicable to businesses operating within the MTA region. The MTA surcharge is designed to help fund public transportation initiatives in New York City and its surrounding areas.

Steps to Complete the Form CT 3M4M

Completing the Form CT 3M4M involves several key steps:

- Gather necessary financial information, including total gross income and any applicable deductions.

- Fill out the form accurately, ensuring all sections are completed as required.

- Calculate the MTA surcharge based on the provided instructions, which typically involves applying a specific rate to your gross income.

- Review the completed form for accuracy before submission.

Obtaining the Form CT 3M4M

The Form CT 3M4M can be obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, businesses may also find the form through authorized tax preparation software that supports New York tax forms.

Legal Use of the Form CT 3M4M

Using the Form CT 3M4M is legally required for any corporation subject to the MTA surcharge. Failure to file this form or inaccuracies in reporting can lead to penalties and interest on unpaid amounts. It is crucial for businesses to ensure compliance with all state tax regulations to avoid legal repercussions.

Filing Deadlines for the Form CT 3M4M

Corporations must file the Form CT 3M4M by the due date specified by the New York State Department of Taxation and Finance. Typically, the filing deadline aligns with the corporation's annual tax return due date. It is essential to stay informed about any changes to deadlines to ensure timely submission.

Key Elements of the Form CT 3M4M

The Form CT 3M4M includes several key elements that businesses must complete:

- Identification information for the corporation, including name, address, and employer identification number (EIN).

- Sections for reporting gross income and calculating the MTA surcharge.

- Signature and date fields, confirming the accuracy of the information provided.

Examples of Using the Form CT 3M4M

Businesses that operate within the MTA region and generate gross income are required to use the Form CT 3M4M. For example, a corporation that earns revenue from sales, services, or other business activities in New York City must report this income and pay the corresponding MTA surcharge. This form helps ensure that these corporations contribute to the funding of essential public transportation services.

Quick guide on how to complete many the daily 3m4m

Prepare many the daily 3m4m effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage many the daily 3m4m on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related tasks today.

How to modify and electronically sign many the daily 3m4m with ease

- Find many the daily 3m4m and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign many the daily 3m4m and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to many the daily 3m4m

Create this form in 5 minutes!

How to create an eSignature for the many the daily 3m4m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask many the daily 3m4m

-

What is airSlate SignNow and how does it relate to many the daily 3m4m?

airSlate SignNow is a powerful electronic signature solution that allows businesses to streamline their document management processes. With many the daily 3m4m, users can easily send and eSign documents, making workflows faster and more efficient. This tool is designed to cater to the needs of businesses of all sizes.

-

How much does airSlate SignNow cost, especially for many the daily 3m4m users?

Pricing for airSlate SignNow is designed to be budget-friendly while offering robust features tailored to many the daily 3m4m users. Plans vary based on the number of users and features included, allowing you to choose the option that best meets your business needs. Check our website for current pricing details and any promotional offers.

-

What are the key features of airSlate SignNow for many the daily 3m4m?

airSlate SignNow offers a variety of features including customizable templates, real-time tracking, and advanced security options. For many the daily 3m4m, these features ensure that document handling is not only efficient but also secure. These capabilities help businesses improve compliance and reduce turnaround time.

-

How can airSlate SignNow benefit my business using many the daily 3m4m?

By implementing airSlate SignNow, many the daily 3m4m users can experience improved operational efficiency through faster document processing. This solution enhances customer satisfaction by speeding up the signing process, allowing for quicker business transactions. Additionally, its user-friendly interface makes it accessible to all team members.

-

What integrations does airSlate SignNow offer for many the daily 3m4m?

AirSlate SignNow integrates seamlessly with numerous business applications such as Google Workspace, Salesforce, and Microsoft Office. For many the daily 3m4m users, this means that you can easily incorporate electronic signatures into your existing workflows. These integrations enhance productivity and simplify document management across platforms.

-

Is airSlate SignNow secure enough for sensitive documents in many the daily 3m4m?

Yes, airSlate SignNow is highly secure, employing industry-standard encryption protocols to protect your sensitive documents. For many the daily 3m4m users, this ensures that all signed documents are stored safely and that signature processes comply with legal regulations. Confidentiality and data integrity are top priorities.

-

Can I use airSlate SignNow on mobile devices for many the daily 3m4m?

Absolutely! airSlate SignNow is fully compatible with mobile devices, allowing many the daily 3m4m users to manage their documents on-the-go. The mobile app provides a streamlined experience for sending and signing documents, ensuring that business processes remain uninterrupted regardless of location.

Get more for many the daily 3m4m

Find out other many the daily 3m4m

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF