Form MTA 5 1Reconciliation of Estimated Metropolitan Tax Ny

What is the Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

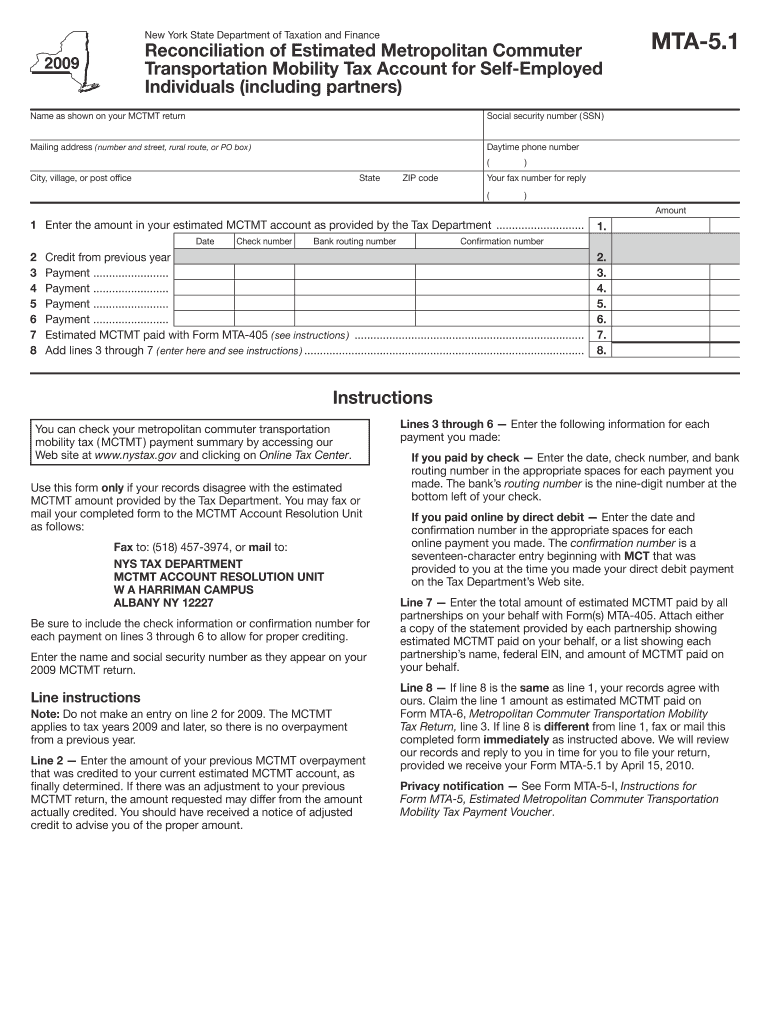

The Form MTA 5 1 is a crucial document used for the reconciliation of estimated Metropolitan taxes in New York. This form is specifically designed for businesses and individuals who are subject to the Metropolitan Commuter Transportation Mobility Tax (MCTMT). The MCTMT is applicable to employers and self-employed individuals who earn income within the Metropolitan Transportation Authority (MTA) region. The form allows taxpayers to reconcile their estimated tax payments with their actual tax liability, ensuring compliance with state tax regulations.

Steps to complete the Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

Completing the Form MTA 5 1 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, fill out the personal and business information sections accurately. Calculate your total estimated Metropolitan tax payments made during the tax year and compare this with your actual tax liability. Make sure to report any adjustments or credits that apply. Finally, review the completed form for accuracy before submission.

How to obtain the Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

The Form MTA 5 1 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, businesses can access the form through various tax preparation software that supports New York state tax filings. Ensure that you are using the most current version of the form to avoid any compliance issues.

Key elements of the Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

Key elements of the Form MTA 5 1 include sections for reporting income, estimated tax payments, and any adjustments to your tax liability. The form requires detailed information about the taxpayer, including their identification number and business details. It also includes calculations for determining the total MCTMT owed and any credits that may reduce the tax liability. Understanding these elements is essential for accurate completion and compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form MTA 5 1 are typically aligned with the annual tax filing deadlines in New York. Taxpayers should be aware of specific dates, such as the due date for estimated payments and the final reconciliation deadline. It is important to keep track of these dates to avoid penalties and interest on unpaid taxes. Generally, the form must be filed annually, but quarterly estimated payments may also be required throughout the year.

Penalties for Non-Compliance

Failure to file the Form MTA 5 1 or to pay the Metropolitan tax owed can result in significant penalties. Non-compliance may lead to interest charges on unpaid taxes, as well as additional fines for late filing. It is crucial for taxpayers to understand their obligations and ensure timely submission of the form to avoid these financial repercussions. Staying informed about compliance requirements can help mitigate risks associated with penalties.

Quick guide on how to complete form mta 5 1reconciliation of estimated metropolitan tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document administration has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign [SKS] without effort

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using tools specifically designed for this purpose by airSlate SignNow.

- Produce your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your adjustments.

- Select your preferred method to deliver your form, whether through email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and maintain excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form mta 5 1reconciliation of estimated metropolitan tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny?

Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny is a tax form used by businesses to reconcile their estimated metropolitan taxes owed in New York. It is essential for compliance and ensures that the correct amount of tax is reported and paid. Properly using this form helps avoid penalties and ensures accurate filing.

-

How can airSlate SignNow help with Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny?

airSlate SignNow offers a seamless solution for eSigning and sending documents related to Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny. Our platform allows you to prepare, sign, and manage tax documents quickly and securely. This simplifies the reconciliation process and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow with Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny?

airSlate SignNow provides various pricing plans tailored to fit the needs of different users, including individuals and businesses. Each plan facilitates the easy handling of documents like Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny, ensuring you get great value for your investment. Check our pricing page for detailed information on features included in each plan.

-

What features does airSlate SignNow offer to support Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny submissions?

airSlate SignNow includes features such as customizable templates, workflows, and real-time tracking to streamline the submission of Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny. Our intuitive interface makes it easy to manage documents and stay organized throughout the reconciliation process. This can save you valuable time and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other software for managing Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny?

Yes, airSlate SignNow integrates seamlessly with various applications to further enhance your document management process for Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny. You can connect it with popular CRM systems, accounting software, and more to ensure a cohesive workflow. These integrations help keep all your essential documents in sync.

-

What are the benefits of using airSlate SignNow for Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny?

Using airSlate SignNow for your Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny provides multiple benefits such as improved efficiency, enhanced security, and easier compliance. With electronic signatures and document tracking, you can ensure timely submissions while minimizing the risk of loss or unauthorized access. This streamlines your tax handling process signNowly.

-

Is airSlate SignNow secure for handling Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny?

Absolutely, airSlate SignNow takes security seriously when it comes to handling documents like Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny. Our platform employs industry-leading encryption and complies with various security regulations to protect your sensitive information. You can trust us to keep your tax documents safe and secure.

Get more for Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

- 1040ez form example

- Housing benefit form 22372146

- Voluntary surrender of vehicle form

- Dmv hearing request sample letter form

- Safety task assignment form

- Basic economic concepts worksheet activity 1 2 form

- Statutory declaration template word document uk form

- Grades 9 12 individualized home instruction plan ihip form

Find out other Form MTA 5 1Reconciliation Of Estimated Metropolitan Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors