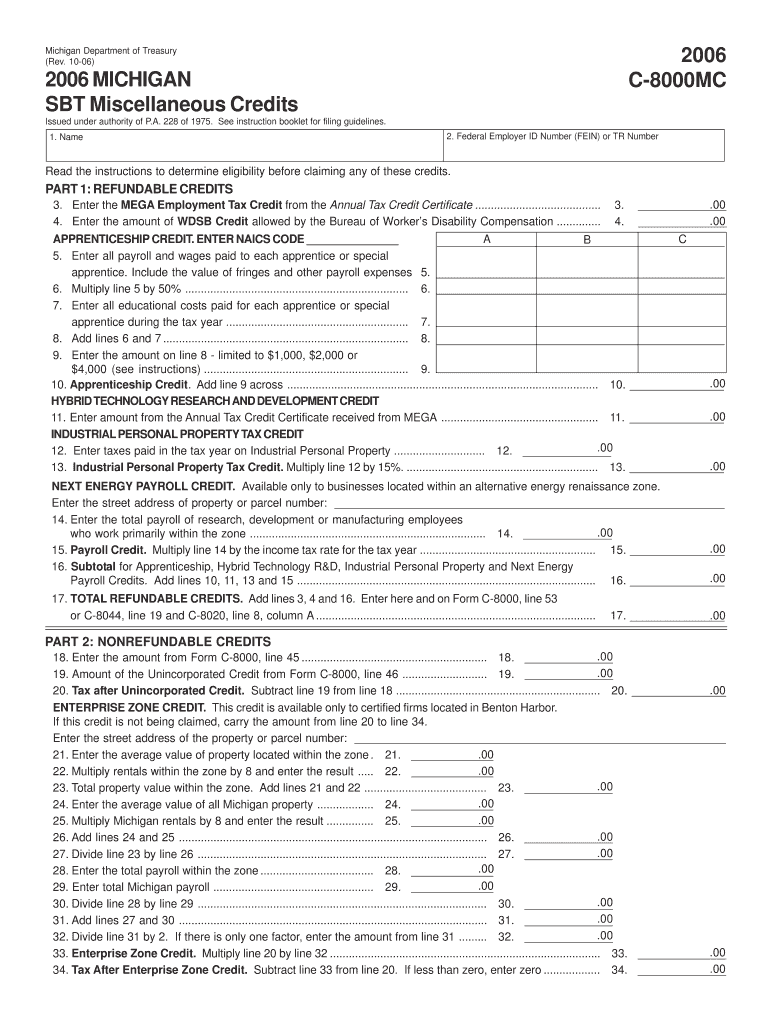

Read the Instructions to Determine Eligibility Before Claiming Any of These Credits Form

Understanding the Eligibility Criteria

The eligibility criteria for claiming various credits are crucial to ensure that individuals and businesses can benefit from available tax relief. Each credit has specific requirements that must be met, which may include factors such as income level, filing status, and residency. It is essential to read the instructions thoroughly to understand these criteria, as failing to meet them can result in denied claims or penalties.

Steps to Complete the Eligibility Determination

Completing the eligibility determination involves several steps. First, gather all necessary financial documents, including income statements and tax returns. Next, review the specific instructions for each credit to identify the eligibility requirements. After confirming your eligibility, fill out the required forms accurately, ensuring that all information is complete and correct. Finally, submit your forms according to the guidelines provided, whether online, by mail, or in person.

Required Documents for Claiming Credits

To claim any credits, specific documentation is typically required. Common documents include proof of income, tax returns from previous years, and any relevant forms that support your eligibility. For instance, if claiming education credits, you may need to provide proof of enrollment or tuition payments. Ensuring that you have all required documents ready can streamline the process and reduce the likelihood of delays.

IRS Guidelines for Claiming Credits

The Internal Revenue Service (IRS) provides detailed guidelines for claiming credits. These guidelines outline the eligibility requirements, necessary documentation, and submission methods. It is important to consult the IRS website or the instructions accompanying the specific credit forms to stay informed about any changes or updates. Following these guidelines helps ensure compliance and maximizes your chances of a successful claim.

Filing Deadlines and Important Dates

Filing deadlines are critical when claiming credits. Each credit may have different deadlines for submission, often aligned with the annual tax filing date. It is essential to be aware of these dates to avoid missing out on potential credits. Keeping a calendar of important deadlines can help you stay organized and ensure timely submissions.

Examples of Commonly Claimed Credits

Several credits are commonly claimed by taxpayers, including the Earned Income Tax Credit (EITC), Child Tax Credit, and education-related credits. Each of these credits has specific eligibility requirements and benefits. Understanding these examples can help taxpayers identify which credits they may qualify for, ultimately leading to potential tax savings.

Quick guide on how to complete read the instructions to determine eligibility before claiming any of these credits

Complete [SKS] effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The most efficient way to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, taking mere seconds and carrying the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Bid farewell to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the read the instructions to determine eligibility before claiming any of these credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help my business?

airSlate SignNow is a powerful tool that empowers businesses to send and eSign documents efficiently. It offers an easy-to-use interface that simplifies the signing process while ensuring compliance. To maximize your use of the platform, be sure to read the instructions to determine eligibility before claiming any of these credits.

-

Are there any costs associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Each plan provides a range of features designed for efficiency and ease of use. Always read the instructions to determine eligibility before claiming any of these credits to ensure you make the best choice.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features like document management, electronic signatures, templates, and real-time tracking. These functionalities help streamline your workflow and improve document turnaround times. Remember to read the instructions to determine eligibility before claiming any of these credits to understand how these features can be beneficial.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various popular applications, enhancing its usability. Whether you use CRM tools, project management software, or payment gateways, airSlate SignNow can seamlessly integrate with them. Always read the instructions to determine eligibility before claiming any of these credits to see how these integrations may work for your business.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes the security of your documents by utilizing encryption and secure storage. Additionally, it complies with various regulations to ensure your data remains protected. It's essential to read the instructions to determine eligibility before claiming any of these credits to understand the security features pertinent to your specific use case.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow provides a mobile app that allows you to manage documents on the go. This flexibility enables you to send and sign documents from anywhere, ensuring productivity does not slow down. Always read the instructions to determine eligibility before claiming any of these credits to maximize your mobile experience.

-

What support options are available for airSlate SignNow users?

airSlate SignNow offers a variety of support options, including a knowledge base, email support, and live chat. To ensure you get the most out of the platform, take advantage of these resources. Don’t forget to read the instructions to determine eligibility before claiming any of these credits, which may guide you to additional support channels.

Get more for Read The Instructions To Determine Eligibility Before Claiming Any Of These Credits

- Ne standard drawing ne100 40 002 concrete pipe support for concrete pipe 18 quot 48 quot dia form

- Design assumptions for form

- 18quot 48quot reinforced concrete pipe and appurtenances form

- Livestock pipeline in dam dam pipelines for livestock form

- Sql05 use of deep rooted crops to break up soil compaction form

- Rent increase approval letter elderly form

- 990 example form

- Get the state of new york c 105 fillable form labor ny

Find out other Read The Instructions To Determine Eligibility Before Claiming Any Of These Credits

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free