Irrevocable Standby LOC Non Pass DOC Form

What is the Irrevocable Standby LOC Non Pass doc

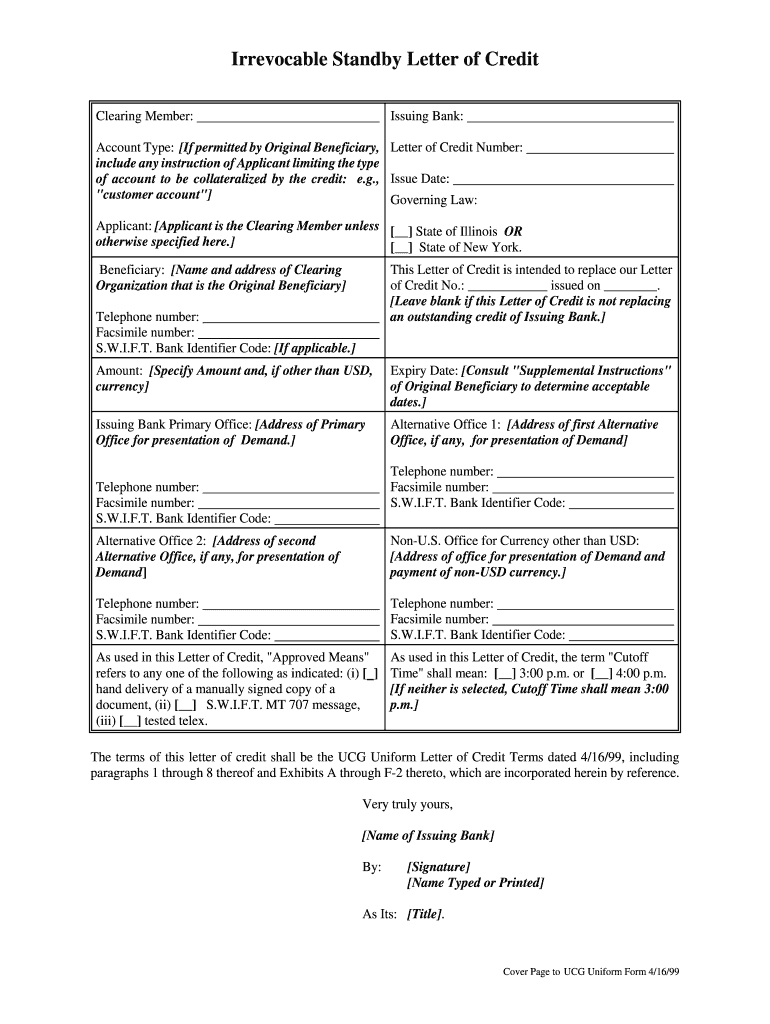

The Irrevocable Standby Letter of Credit (LOC) Non Pass document is a financial instrument used primarily in commercial transactions. It serves as a guarantee from a bank or financial institution that a specified amount will be paid to a beneficiary if certain conditions are met. Unlike traditional letters of credit, this document does not allow for the withdrawal of funds before the specified terms are satisfied. This characteristic provides a layer of security for the beneficiary, ensuring that the funds are only released upon fulfillment of the agreed-upon conditions.

How to use the Irrevocable Standby LOC Non Pass doc

To effectively use the Irrevocable Standby LOC Non Pass document, parties involved must first agree on the terms and conditions under which the funds will be released. This includes defining the events that trigger payment, such as failure to perform contractual obligations. Once the terms are established, the applicant requests the bank to issue the standby letter of credit. The beneficiary can then present the document to the bank to claim payment when the specified conditions are met. It is essential for all parties to understand the document's stipulations to avoid any disputes during the transaction.

Steps to complete the Irrevocable Standby LOC Non Pass doc

Completing the Irrevocable Standby LOC Non Pass document involves several key steps:

- Identify the parties involved: Clearly outline the applicant, beneficiary, and issuing bank.

- Define the terms: Specify the conditions under which the funds will be released, including any deadlines.

- Draft the document: Ensure all necessary information is included, such as amounts, dates, and signatures.

- Submit to the bank: Present the completed document to the issuing bank for approval and issuance.

- Notify the beneficiary: Once issued, inform the beneficiary of the standby letter of credit's availability.

Key elements of the Irrevocable Standby LOC Non Pass doc

The Irrevocable Standby LOC Non Pass document includes several critical elements that ensure its effectiveness:

- Parties involved: Clearly defined roles of the applicant, beneficiary, and issuing bank.

- Amount: The specific monetary value guaranteed by the bank.

- Conditions for payment: Detailed terms outlining what triggers the release of funds.

- Expiration date: The date until which the standby letter of credit remains valid.

- Signature and seal: Required endorsements from the issuing bank and relevant parties.

Legal use of the Irrevocable Standby LOC Non Pass doc

The legal use of the Irrevocable Standby LOC Non Pass document is governed by the Uniform Commercial Code (UCC) in the United States. This framework establishes the rights and obligations of all parties involved. It is crucial for businesses to comply with these regulations to ensure the document's enforceability in legal contexts. Additionally, understanding the legal implications of the standby letter of credit helps mitigate risks associated with non-compliance or disputes over terms.

Examples of using the Irrevocable Standby LOC Non Pass doc

There are various scenarios where the Irrevocable Standby LOC Non Pass document can be beneficial:

- Construction projects: Contractors may use it to guarantee payment to subcontractors upon completion of specific milestones.

- International trade: Exporters can secure payment from foreign buyers, ensuring funds are available upon shipment.

- Lease agreements: Tenants might provide a standby letter of credit to landlords as a security deposit alternative.

Quick guide on how to complete irrevocable standby loc non pass doc

Complete [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Irrevocable Standby LOC Non Pass doc

Create this form in 5 minutes!

How to create an eSignature for the irrevocable standby loc non pass doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Irrevocable Standby LOC Non Pass doc?

An Irrevocable Standby LOC Non Pass doc is a financial document that guarantees payment from a bank on behalf of a client, provided specific conditions are met. This type of document is often used in business transactions to assure the recipient of payment security. Understanding how to utilize this document effectively can be crucial for businesses looking to mitigate risk.

-

How can airSlate SignNow help with Irrevocable Standby LOC Non Pass docs?

airSlate SignNow provides businesses with a streamlined platform to create, send, and eSign Irrevocable Standby LOC Non Pass docs efficiently. The solution ensures that your documents remain secure while simplifying the signing process for all parties involved. This means faster transaction times and improved compliance with legal requirements.

-

What features does airSlate SignNow offer for managing Irrevocable Standby LOC Non Pass docs?

With airSlate SignNow, you get advanced features such as customizable templates, automated workflows, and real-time tracking for your Irrevocable Standby LOC Non Pass docs. These features help improve efficiency, allowing you to focus on your core business activities. Users can also integrate their existing tools for a seamless experience.

-

Is there a cost associated with using airSlate SignNow for Irrevocable Standby LOC Non Pass docs?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features you require for managing Irrevocable Standby LOC Non Pass docs. We offer different plans tailored to meet the needs of businesses of all sizes, ensuring you find the option that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with my existing systems for Irrevocable Standby LOC Non Pass docs?

Absolutely! airSlate SignNow offers robust integrations with multiple third-party applications, enhancing your ability to manage Irrevocable Standby LOC Non Pass docs. You can connect it seamlessly with popular tools such as CRM systems, project management software, and more for an optimized workflow.

-

What are the benefits of using airSlate SignNow for Irrevocable Standby LOC Non Pass docs?

Using airSlate SignNow for Irrevocable Standby LOC Non Pass docs offers numerous benefits, including improved efficiency, document security, and reduced turnaround time. The platform's user-friendly interface ensures that even non-technical users can navigate easily. It's a cost-effective solution that can help streamline your document management process.

-

Is the signing process secure for Irrevocable Standby LOC Non Pass docs on airSlate SignNow?

Yes, the signing process for Irrevocable Standby LOC Non Pass docs on airSlate SignNow is highly secure. We implement strong encryption protocols and comply with industry standards to protect your sensitive data. You can conduct your business with confidence, knowing that your documents are safeguarded throughout the signing process.

Get more for Irrevocable Standby LOC Non Pass doc

Find out other Irrevocable Standby LOC Non Pass doc

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF