Illinois Equal Pay Certification a Practical Guide for Form

Understanding the W-4 Employee Withholding Certificate

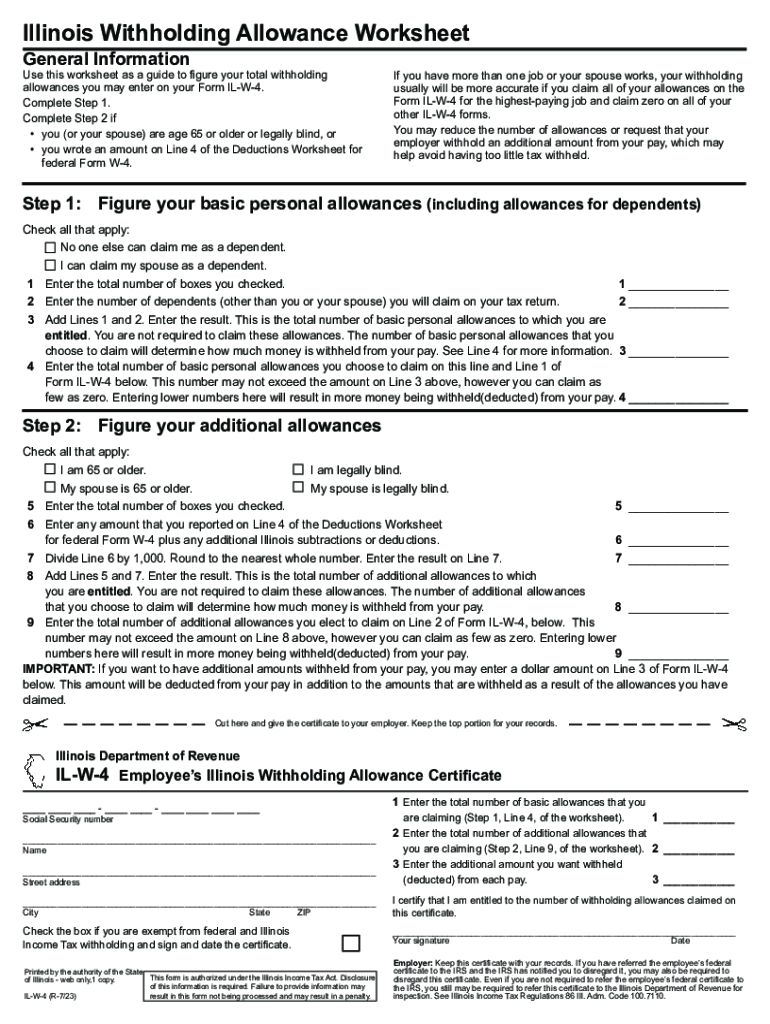

The W-4 Employee Withholding Certificate is a crucial tax form used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form allows employees to adjust their withholding based on personal circumstances such as marital status, number of dependents, and any additional income. Proper completion of the W-4 is essential to ensure that the correct amount of taxes is withheld, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the W-4 Employee Withholding Certificate

Completing the W-4 form involves several straightforward steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status. This section identifies you and your tax situation.

- Multiple Jobs or Spouse Works: If you have more than one job or your spouse works, use the IRS’s online estimator or the worksheet provided in the form to determine the correct withholding.

- Claim Dependents: If applicable, indicate the number of dependents you have and the corresponding tax credits you can claim.

- Other Adjustments: You can specify any additional amount you want withheld from each paycheck or claim any deductions you expect to take.

- Signature: Sign and date the form to validate it. This step is crucial as it confirms that the information provided is accurate and complete.

IRS Guidelines for the W-4 Form

The IRS provides specific guidelines for completing the W-4 form to ensure accurate withholding. It is important to review these guidelines annually or whenever there is a change in personal circumstances, such as marriage, divorce, or the birth of a child. The IRS recommends using the online withholding calculator to help determine the appropriate amount to withhold based on your individual tax situation. Additionally, keeping track of any changes in tax laws or personal finances can help maintain the accuracy of your withholding throughout the year.

Filing Deadlines for the W-4 Form

While there is no specific deadline for submitting the W-4 form, it is advisable to complete it as soon as you start a new job or experience a significant life change that affects your tax situation. Employers typically need the W-4 on file before they can begin withholding the correct amount of federal income tax from your paychecks. If you need to make adjustments later in the year, you can submit a new W-4 at any time.

Form Submission Methods for the W-4

The W-4 form can be submitted to your employer in several ways. Most commonly, employees provide a printed copy of the completed form directly to their HR or payroll department. Some employers may also allow electronic submission through their payroll systems. It is essential to confirm the preferred method with your employer to ensure timely processing of your withholding adjustments.

Penalties for Non-Compliance with W-4 Regulations

Failure to accurately complete and submit the W-4 form can lead to significant financial consequences. If too little tax is withheld, you may owe a large sum at tax time and could be subject to penalties for underpayment. Conversely, over-withholding may result in a smaller paycheck and delayed access to your earnings. It is vital to review and update your W-4 regularly to avoid these issues and maintain compliance with IRS regulations.

Quick guide on how to complete illinois equal pay certification a practical guide for

Complete Illinois Equal Pay Certification A Practical Guide For with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Illinois Equal Pay Certification A Practical Guide For on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Illinois Equal Pay Certification A Practical Guide For effortlessly

- Obtain Illinois Equal Pay Certification A Practical Guide For and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of missing or lost files, tedious form searching, or mistakes that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Illinois Equal Pay Certification A Practical Guide For to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois equal pay certification a practical guide for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the W4 employee withholding certificate?

The W4 employee withholding certificate is used by employees to specify the amount of federal income tax to be withheld from their paychecks. By filling out this form accurately, employees can ensure that they have the correct amount withheld, which can help them avoid owing taxes at the end of the year.

-

How does airSlate SignNow help with the W4 employee withholding certificate process?

airSlate SignNow simplifies the process of managing the W4 employee withholding certificate by allowing users to send, eSign, and store documents securely online. This way, employees can complete their W4 forms electronically, making it quicker and easier to submit with your HR department.

-

Are there any costs associated with using airSlate SignNow for W4 documents?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides features that enhance the management of documents like the W4 employee withholding certificate, ensuring cost-effectiveness while streamlining administrative tasks.

-

Can I integrate airSlate SignNow with other HR software for W4 processing?

Absolutely! airSlate SignNow provides robust integrations with various HR software systems, allowing for seamless management of the W4 employee withholding certificate. This integration helps you to automate workflows and reduce manual data entry, thus saving time and increasing accuracy.

-

What are the benefits of eSigning the W4 employee withholding certificate?

eSigning the W4 employee withholding certificate offers numerous benefits, including faster processing times and enhanced security. With airSlate SignNow, signed documents are stored securely, preventing loss or unauthorized access while ensuring compliance with regulations.

-

How can I ensure compliance when using airSlate SignNow for W4 forms?

Using airSlate SignNow helps ensure compliance with the W4 employee withholding certificate process by providing features like audit trails and secure storage. All signed documents are tracked, which helps you demonstrate compliance during audits and maintain accurate records.

-

Is it easy to update my W4 employee withholding certificate with airSlate SignNow?

Yes, updating your W4 employee withholding certificate using airSlate SignNow is straightforward. Users can easily access their documents, make necessary changes, and eSign the updated forms, allowing for quick adjustments to withholding as personal situations change.

Get more for Illinois Equal Pay Certification A Practical Guide For

Find out other Illinois Equal Pay Certification A Practical Guide For

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself