What is the TouchMouse Mode Feature Available in Form

Understanding the 2022 IL Schedule M

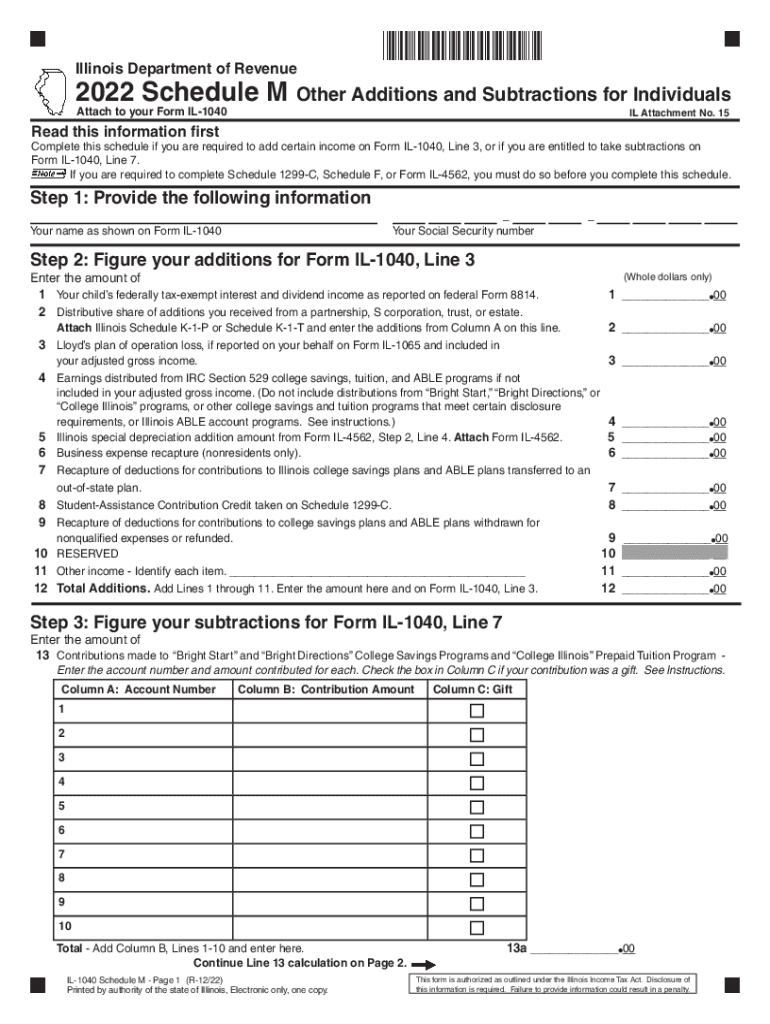

The 2022 IL Schedule M is a form used by Illinois residents to report additions and subtractions to their federal adjusted gross income when filing their state income tax return. This form is essential for accurately calculating your Illinois taxable income. It allows taxpayers to detail specific adjustments that may affect their overall tax liability.

Key components of the Schedule M include various categories for additions, such as income from state and local bonds, and subtractions, which may include contributions to qualified retirement plans. Understanding these elements is crucial for ensuring compliance with state tax laws.

Key Elements of the 2022 IL Schedule M

The 2022 IL Schedule M includes several important sections that taxpayers should be aware of:

- Additions: This section lists income that must be added to your federal adjusted gross income, such as certain types of interest income.

- Subtractions: Here, taxpayers can indicate amounts that can be subtracted from their federal adjusted gross income, including contributions to retirement accounts.

- Other Adjustments: This part of the form allows for additional adjustments that may not fall under the standard categories.

Each of these elements plays a significant role in determining your final tax obligation to the state of Illinois.

Filing Deadlines for the 2022 IL Schedule M

For the 2022 tax year, the deadline for filing the Illinois state income tax return, including the IL Schedule M, is typically April 15 of the following year. If you are unable to meet this deadline, you may apply for an extension, which usually extends the filing date to October 15. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents for Completing the 2022 IL Schedule M

When preparing to file the 2022 IL Schedule M, gather the following documents:

- Your federal income tax return (Form 1040) for 2022.

- Documentation for any additions or subtractions, such as W-2s, 1099s, and receipts for retirement contributions.

- Any other relevant financial documents that support your claims on the Schedule M.

Having these documents ready will streamline the filing process and help ensure accuracy in your tax return.

Common Scenarios for Using the 2022 IL Schedule M

Different taxpayers may have unique situations that necessitate the use of the 2022 IL Schedule M. Common scenarios include:

- Individuals who have received income from state or local bonds that must be reported as an addition.

- Taxpayers who have made contributions to retirement accounts that qualify for subtraction from their federal adjusted gross income.

- Residents who have received other types of income or deductions that require reporting on the Schedule M.

Identifying your specific situation can help ensure that you complete the form accurately and take advantage of all eligible adjustments.

IRS Guidelines Related to the 2022 IL Schedule M

While the 2022 IL Schedule M is specific to Illinois state tax, it is important to be aware of IRS guidelines that may influence your state tax return. The IRS provides detailed instructions on how to report income and deductions on your federal return, which directly impacts your state adjustments. Familiarizing yourself with IRS regulations can help you avoid discrepancies between your federal and state filings.

Quick guide on how to complete what is the touchmouse mode feature available in

Easily Prepare What Is The TouchMouse Mode Feature Available In on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools necessary to quickly create, modify, and electronically sign your documents without delays. Handle What Is The TouchMouse Mode Feature Available In on any device with the airSlate SignNow applications for Android or iOS and enhance your document-driven processes today.

How to Modify and Electronically Sign What Is The TouchMouse Mode Feature Available In Effortlessly

- Obtain What Is The TouchMouse Mode Feature Available In and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools offered by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for submitting your form—by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign What Is The TouchMouse Mode Feature Available In to ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is the touchmouse mode feature available in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 IL Schedule M and why is it important?

The 2022 IL Schedule M is a form used to calculate the amount of income subject to Illinois state tax. It's important because it helps determine tax liability, ensuring compliance with state regulations. Understanding how to complete this form accurately can save businesses time and money during tax season.

-

How can airSlate SignNow assist with filing the 2022 IL Schedule M?

airSlate SignNow offers a streamlined process for signing and sending tax documents, including the 2022 IL Schedule M. Our electronic signature solution ensures that documents are securely signed and easily accessible. By leveraging airSlate SignNow, users can expedite the filing process, saving valuable time and reducing administrative burdens.

-

What are the pricing options for airSlate SignNow when handling the 2022 IL Schedule M?

airSlate SignNow provides flexible pricing plans that cater to different business needs when handling documents like the 2022 IL Schedule M. Our competitive pricing ensures that even small businesses can afford an effective eSignature solution. Explore our plans to find the one that best fits your company’s requirements.

-

What features of airSlate SignNow are beneficial for managing the 2022 IL Schedule M?

Key features of airSlate SignNow that benefit users managing the 2022 IL Schedule M include user-friendly templates, secure cloud storage, and automated reminders for signatures. These features enhance efficiency by simplifying document management and ensuring timely completion of tax forms. Choose airSlate SignNow to handle your document needs seamlessly.

-

Can airSlate SignNow integrate with accounting software for the 2022 IL Schedule M?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, facilitating the easy preparation and submission of the 2022 IL Schedule M. This integration streamlines the process by allowing users to send and eSign documents directly from their accounting platforms. Take advantage of these integrations to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the 2022 IL Schedule M?

Using airSlate SignNow for the 2022 IL Schedule M offers numerous benefits, including time savings, increased document security, and enhanced accuracy. Our platform simplifies the signing process, making it more efficient than traditional methods. Additionally, businesses can ensure compliance with tax regulations by utilizing a reliable eSignature solution.

-

Is airSlate SignNow compliant with Illinois state laws for the 2022 IL Schedule M?

Absolutely! airSlate SignNow is compliant with Illinois state laws governing electronic signatures for documents like the 2022 IL Schedule M. Our platform adheres to industry standards, ensuring that all signed documents are legally binding and secure, providing peace of mind for users during tax season.

Get more for What Is The TouchMouse Mode Feature Available In

- Gba student mentoring report form monthly gracechatt

- Personnel requisition form shasta college

- Official name change request fort hays state university fhsu form

- Registration form cecil college cecil

- Field trip chaperone agreement form somerset academy

- Hold harmless form east central college

- Met annual kareem family science fair form

- Iupui foreign vendor packet form

Find out other What Is The TouchMouse Mode Feature Available In

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself