Nys Income Tax Forms

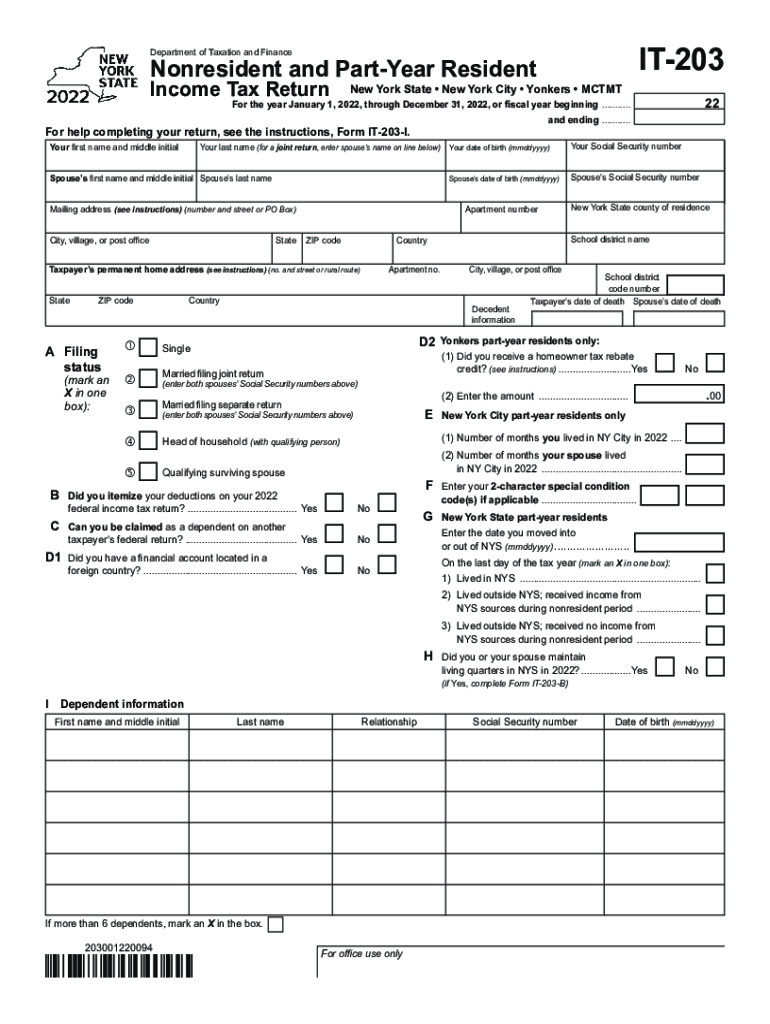

What is the New York State Income Tax Form IT-203?

The New York State Income Tax Form IT-203 is specifically designed for non-residents and part-year residents who earn income in New York. This form allows individuals to report their income, calculate their tax liability, and claim any applicable credits or deductions. It is essential for those who have worked in New York but do not reside there, ensuring compliance with state tax laws.

Steps to Complete the New York State Income Tax Form IT-203

Completing the IT-203 form involves several key steps:

- Gather necessary documents: Collect W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Detail your income sources, including wages, interest, and dividends.

- Calculate tax liability: Use the provided tax tables to determine your tax owed based on your reported income.

- Claim credits and deductions: Include any eligible credits or deductions to reduce your tax burden.

- Review and sign: Ensure all information is accurate before signing and dating the form.

How to Obtain the New York State Income Tax Form IT-203

The IT-203 form can be obtained through various means to ensure accessibility for all taxpayers. You can download a fillable PDF version directly from the New York State Department of Taxation and Finance website. Alternatively, physical copies are available at local tax offices and public libraries. Some tax preparation software also includes the IT-203 form, allowing for easy completion and filing.

Filing Deadlines for the New York State Income Tax Form IT-203

It is crucial to be aware of the filing deadlines associated with the IT-203 form. Generally, the form must be filed by April fifteenth of the year following the tax year in question. For example, for the 2022 tax year, the form is due by April 15, 2023. If you anticipate needing more time, you can request an extension, but it is important to pay any taxes owed by the original deadline to avoid penalties.

Key Elements of the New York State Income Tax Form IT-203

The IT-203 form includes several key elements that taxpayers must understand:

- Personal Information: Essential details such as name, address, and Social Security number.

- Income Reporting: Sections for various types of income, including wages, business income, and investment income.

- Tax Calculation: A structured format for calculating your total tax liability based on reported income.

- Credits and Deductions: Areas to claim any applicable tax credits or deductions that may reduce your overall tax bill.

Legal Use of the New York State Income Tax Form IT-203

The IT-203 form is legally required for non-residents who earn income in New York. Filing this form ensures compliance with state tax laws, allowing the state to assess and collect taxes owed. Failure to file the IT-203 when required can result in penalties, interest on unpaid taxes, and potential legal repercussions. It is important for taxpayers to understand their obligations and file accurately and on time.

Quick guide on how to complete nys income tax forms

Execute Nys Income Tax Forms seamlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents swiftly without interruptions. Manage Nys Income Tax Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Nys Income Tax Forms effortlessly

- Locate Nys Income Tax Forms and click Obtain Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Complete button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Adjust and eSign Nys Income Tax Forms while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'ny it 203 2022' and how does it relate to airSlate SignNow?

'Ny it 203 2022' refers to New York legislation affecting electronic transactions and signatures. airSlate SignNow complies with these regulations, ensuring that your electronic signatures are both legal and secure. This compliance helps businesses operate efficiently while adhering to state laws.

-

What features does airSlate SignNow offer that comply with 'ny it 203 2022'?

airSlate SignNow provides a range of features that align with 'ny it 203 2022', including robust eSignature capabilities, authentication options, and document management tools. These features not only meet legal standards but also enhance the user experience by making document signing seamless and efficient.

-

How does airSlate SignNow ensure security for electronically signed documents under 'ny it 203 2022'?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption methods and complies with 'ny it 203 2022' to protect your sensitive information. This means you can confidently send and sign documents knowing they are secure and legally binding.

-

What is the pricing structure for airSlate SignNow in relation to 'ny it 203 2022'?

Our pricing for airSlate SignNow is competitive and designed to provide value while ensuring compliance with 'ny it 203 2022'. We offer various plans tailored to meet the needs of businesses, making it easy to choose the best option based on your requirements.

-

Can airSlate SignNow integrate with other applications while adhering to 'ny it 203 2022'?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow while complying with 'ny it 203 2022'. This allows users to streamline processes across different platforms, maintaining efficiency and legal standards.

-

What benefits does airSlate SignNow provide for businesses under 'ny it 203 2022'?

By using airSlate SignNow, businesses benefit from increased efficiency and reduced turnaround times for document signing while meeting 'ny it 203 2022' compliance requirements. Our intuitive platform facilitates faster decision-making and helps to maintain a professional workflow.

-

Is there customer support available for airSlate SignNow users in relation to 'ny it 203 2022'?

Absolutely! Our dedicated customer support team is available to assist with any inquiries related to 'ny it 203 2022' and the use of airSlate SignNow. We ensure you have the resources and assistance needed to navigate compliance effectively.

Get more for Nys Income Tax Forms

- Declaration and certification of finances northwood form

- Add drop withdrawal office of the registrar ut arlington form

- Proctor approval form van education center

- Tuition remission form for undergraduate courses lenoir rhyne hr lr

- Laguardia community college immunization form 462902055

- Club name change request form eastcentral edu

- James madison university sport clubs forms

- Mercer university transcript request form

Find out other Nys Income Tax Forms

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval