CITY of YORK ACCOMMODATIONS TAX REPORTING FORM Tax

What is the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

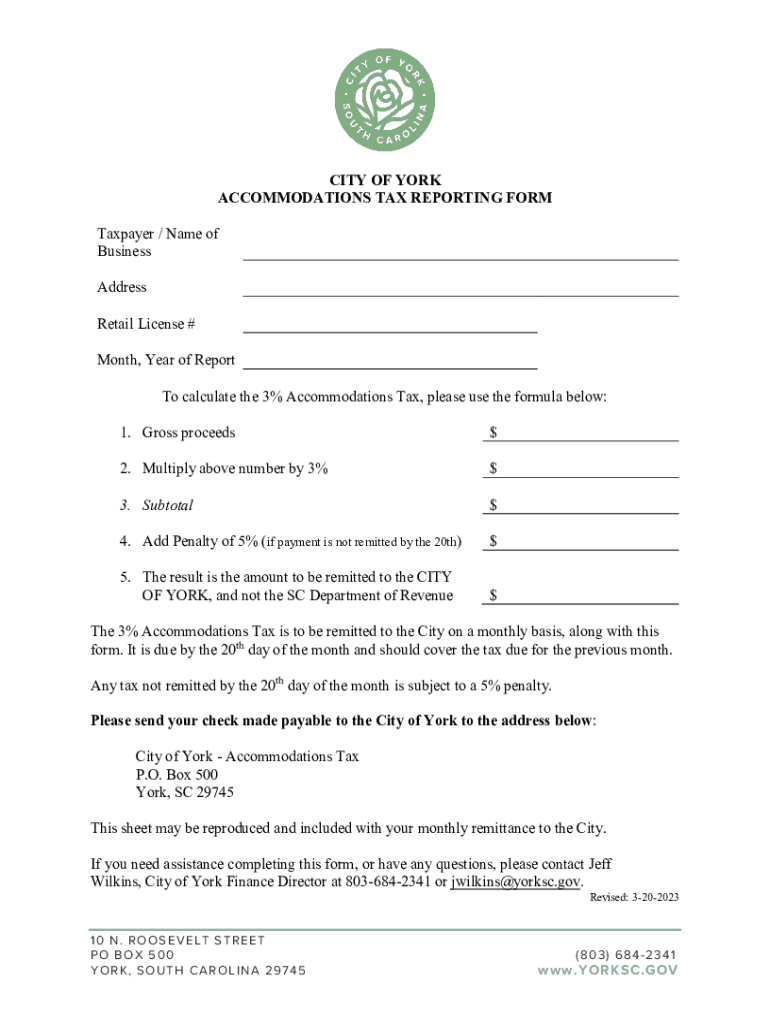

The CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM is a specific tax form used by businesses and individuals engaged in providing accommodations within the City of York. This form is essential for reporting the accommodations tax collected from guests and ensuring compliance with local tax regulations. The accommodations tax is typically levied on short-term rentals, hotels, and other lodging services, contributing to local revenue that supports various community services and initiatives.

How to use the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

Using the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM involves several straightforward steps. First, gather all relevant financial data, including the total amount of accommodations tax collected during the reporting period. Next, accurately fill out the form by entering the required information, such as your business details, tax identification number, and the total tax due. Finally, review the completed form for accuracy before submitting it to the appropriate local tax authority.

Steps to complete the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

Completing the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM requires careful attention to detail. Follow these steps:

- Collect all necessary financial records, including invoices and receipts related to accommodations provided.

- Fill in your business name, address, and tax identification number at the top of the form.

- Report the total accommodations tax collected during the specified reporting period.

- Calculate any adjustments or credits that may apply, ensuring to document these accurately.

- Sign and date the form to certify that the information provided is true and accurate.

- Submit the completed form to the designated local tax authority by the specified deadline.

Legal use of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

The legal use of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM is crucial for compliance with local tax laws. Businesses must use this form to report the accommodations tax they collect, as failure to do so can result in penalties or fines. It is important to understand the legal obligations associated with this form, including accurate reporting and timely submission to avoid any legal repercussions.

Key elements of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

Several key elements are essential for completing the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM. These include:

- Business Information: Name, address, and tax identification number.

- Reporting Period: The specific time frame for which the tax is being reported.

- Total Tax Collected: The total amount of accommodations tax collected from guests.

- Adjustments: Any credits or adjustments that may affect the total tax due.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for compliance with the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM. Typically, forms must be submitted on a quarterly basis, with specific due dates that vary based on the reporting period. It is essential to check local regulations for the exact deadlines to ensure timely submission and avoid late fees or penalties.

Quick guide on how to complete city of york accommodations tax reporting form tax 645783811

Effortlessly Manage CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax on Any Device

Digital document organization has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without any hold-ups. Manage CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax Effortlessly

- Find CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the stress of searching for forms, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and electronically sign CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of york accommodations tax reporting form tax 645783811

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

The CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax is a specific form that businesses must use to report accommodations taxes to the City of York. This form ensures compliance with local tax regulations and helps businesses accurately calculate their tax liabilities, simplifying their financial processes.

-

How can airSlate SignNow assist with the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign your CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. This streamlines the often complex process of tax filing, ensuring that you stay compliant while saving valuable time and resources.

-

Is there a pricing plan available for using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Each plan includes access to features that facilitate the completion and submission of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax, making it a cost-effective solution for managing your tax documentation.

-

What features does airSlate SignNow offer for the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

With airSlate SignNow, you get features like customizable templates, secure eSigning, and automated reminders tailored for the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. These features enhance productivity and reduce the risk of errors in your tax reporting processes.

-

Are there any integrations available with airSlate SignNow for financial software?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software, allowing for easy access to the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. This enhances data accuracy and makes it simpler to streamline your overall financial management.

-

Can airSlate SignNow help with document security for tax forms?

Absolutely! airSlate SignNow prioritizes document security with advanced encryption protocols and secure cloud storage for your CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. This ensures that all sensitive data remains protected throughout the signing and submission process.

-

How does airSlate SignNow automate the tax reporting process?

airSlate SignNow automates reminders and workflows for the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax, ensuring that you never miss a deadline. Automation reduces manual work and streamlines the entire reporting process, allowing you to focus more on growing your business.

Get more for CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

- Court sensitive form

- Motion maricopa county 2013 2019 form

- Motion to extend dismissal date superior court maricopa county superiorcourt maricopa form

- Your name superior court maricopa county superiorcourt maricopa form

- Cism certification form

- Affidavit gwinnett form

- Agreement information and summary form international ibew

- Manitoba hydro permit application form

Find out other CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free