Wh 1612 Form

What is the WH 1612?

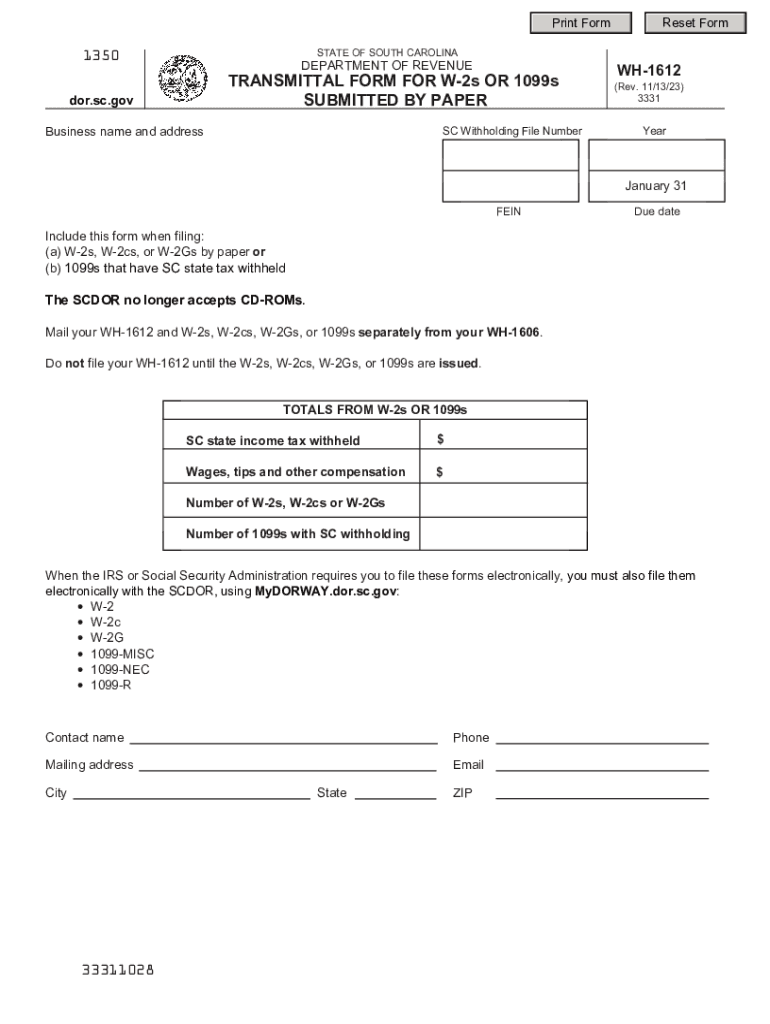

The WH 1612 is a form used in South Carolina for withholding tax purposes. Specifically, it is designed for employers to report and remit state income tax withheld from employees' wages. This form is essential for compliance with state tax regulations and ensures that the appropriate amount of tax is collected and submitted to the South Carolina Department of Revenue. Understanding the WH 1612 is crucial for businesses operating within the state, as it helps maintain accurate tax records and compliance with state law.

How to Obtain the WH 1612

To obtain the WH 1612 form, businesses can visit the South Carolina Department of Revenue's official website, where the form is available for download. It is also possible to request a physical copy by contacting the department directly. Additionally, many accounting software programs may offer the WH 1612 form as part of their tax reporting features, allowing for easier access and completion.

Steps to Complete the WH 1612

Completing the WH 1612 involves several key steps:

- Gather all necessary employee wage information, including total wages paid and the amount of state tax withheld.

- Fill out the form with accurate details, ensuring that all required fields are completed.

- Double-check the information for accuracy to avoid any potential issues with the South Carolina Department of Revenue.

- Submit the completed form by the designated filing deadline, either electronically or by mail.

Legal Use of the WH 1612

The WH 1612 form is legally required for employers in South Carolina who withhold state income tax from employees' wages. Proper use of this form ensures compliance with state tax laws and helps avoid penalties associated with non-compliance. It is important for employers to understand the legal implications of withholding taxes and to maintain accurate records of all submitted forms.

Key Elements of the WH 1612

Key elements of the WH 1612 include:

- Employer information, including name, address, and tax identification number.

- Employee wage details, such as total wages and state tax withheld.

- Filing period for the reported wages.

- Signature of the employer or authorized representative, certifying the accuracy of the information provided.

Form Submission Methods

The WH 1612 can be submitted through various methods, including:

- Online submission via the South Carolina Department of Revenue's e-filing system.

- Mailing a hard copy of the completed form to the appropriate state office.

- In-person submission at designated state revenue offices.

Quick guide on how to complete wh 1612

Effortlessly prepare Wh 1612 on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you need to rapidly create, modify, and eSign your files without delays. Handle Wh 1612 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Wh 1612 with minimal effort

- Find Wh 1612 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the stress of missing or lost documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Wh 1612 to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 1612

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is WH 1612 and how does it relate to airSlate SignNow?

WH 1612 is a key feature of airSlate SignNow that enables users to automate their document workflows. This functionality streamlines the process of sending and eSigning documents, making it easier for businesses to manage their paperwork efficiently.

-

How much does airSlate SignNow with WH 1612 cost?

The pricing for airSlate SignNow featuring WH 1612 varies depending on your business needs and selected plan. Generally, it offers a cost-effective solution that allows businesses of all sizes to benefit from eSigning and document management without breaking the bank.

-

What features does WH 1612 offer?

WH 1612 includes features like customizable templates, bulk sending, and robust eSignature options. This combination enhances user experience and maximizes efficiency by allowing businesses to streamline their document processes signNowly.

-

What are the benefits of using airSlate SignNow with WH 1612?

Using WH 1612 with airSlate SignNow provides several benefits such as improved document turnaround times and increased accuracy. Additionally, it helps businesses reduce operational costs by minimizing paper usage and enhancing overall productivity.

-

Can WH 1612 integrate with other business applications?

Yes, WH 1612 is designed to integrate seamlessly with various business applications. This allows you to enhance workflows and ensure that your document processes fit smoothly into your existing systems, providing a more cohesive experience.

-

How does WH 1612 enhance security for electronic signatures?

WH 1612 prioritizes security by using industry-standard encryption and authentication methods for electronic signatures. This ensures that your sensitive documents remain protected and compliant with legal standards for electronic signatures.

-

Is there a mobile app for airSlate SignNow with WH 1612 features?

Yes, airSlate SignNow offers a mobile app that includes WH 1612 functionality. This allows users to send, sign, and manage documents on the go, making it a versatile solution for busy professionals.

Get more for Wh 1612

- Family reunion registration form

- Htf 4 draw request request for payment sc state housing form

- Crane checklist form

- Pump alignment form

- Bewijs van garantstelling enof particuliere logiesverstrekking 1310 form

- Confirmation of standing by medical licensing authority form

- 2013 d 400x fillable form

- Visa order form g3 visas amp passports

Find out other Wh 1612

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free