South Carolina Fs Form

What is the South Carolina FS?

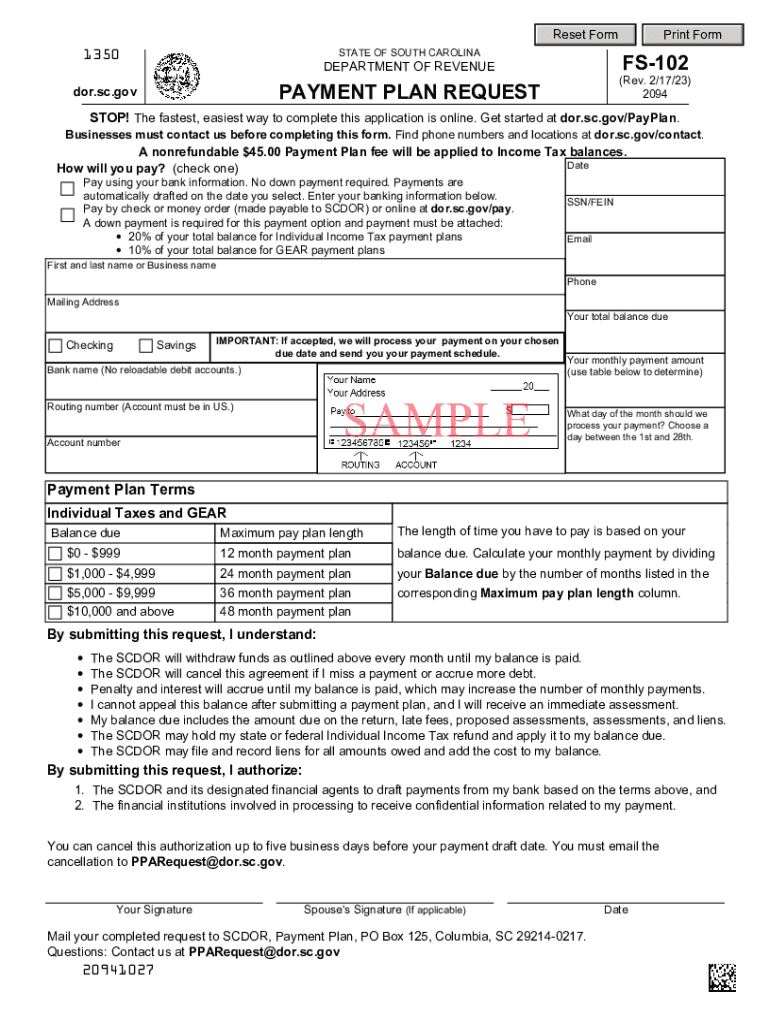

The South Carolina FS refers to specific forms used for tax-related purposes in the state. These forms, including the FS-102 and FS-147, are essential for taxpayers who wish to set up payment plans for state tax obligations. The FS forms help facilitate communication between the taxpayer and the South Carolina Department of Revenue, ensuring that both parties are clear on payment terms and expectations.

Steps to Complete the South Carolina FS

Completing the South Carolina FS forms involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out the FS-102 or FS-147 form accurately, providing all required information regarding your financial situation.

- Review the completed form for any errors or omissions to ensure accuracy.

- Submit the form either online, by mail, or in person at your local Department of Revenue office.

Eligibility Criteria

To qualify for a South Carolina state tax payment plan, taxpayers must meet certain eligibility criteria. Generally, individuals must demonstrate financial hardship or an inability to pay their tax liabilities in full. This may include providing documentation of income, expenses, and any other relevant financial information. It is essential to consult the specific requirements outlined by the South Carolina Department of Revenue to ensure compliance.

Form Submission Methods

Taxpayers can submit the South Carolina FS forms through various methods, making it convenient to fulfill their tax obligations:

- Online: Many forms can be completed and submitted electronically via the South Carolina Department of Revenue website.

- By Mail: Forms can be printed, filled out, and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Taxpayers may also choose to visit their local Department of Revenue office to submit forms directly.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the South Carolina FS forms can result in various penalties. Taxpayers may face additional fees, interest on unpaid taxes, or legal action from the state. It is crucial to adhere to the terms outlined in the payment plan and maintain open communication with the Department of Revenue to avoid these consequences.

Key Elements of the South Carolina FS

Understanding the key elements of the South Carolina FS forms is vital for successful completion. Important components include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Financial Details: Information regarding income, expenses, and assets to assess the taxpayer's ability to pay.

- Payment Terms: Proposed payment amounts and schedules, which must be agreed upon by both the taxpayer and the state.

Quick guide on how to complete south carolina fs

Complete South Carolina Fs effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage South Carolina Fs on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest method to alter and electronically sign South Carolina Fs with ease

- Obtain South Carolina Fs and click Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign South Carolina Fs to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south carolina fs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC state tax payment plan?

The SC state tax payment plan is a structured way for taxpayers in South Carolina to pay their tax liabilities over time, avoiding penalties and interest. This plan allows individuals and businesses to manage their taxes more effectively by breaking down their payments into manageable installments.

-

How can airSlate SignNow assist with the SC state tax payment plan?

airSlate SignNow provides an easy-to-use platform for signing and sending documents related to the SC state tax payment plan. With features like eSigning and document management, users can quickly finalize their payment plan agreements and ensure compliance with state regulations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the SC state tax payment plan, offers several benefits. It simplifies the signing process, saves time, and enhances security, ensuring that all communications and documents are protected and easily accessible.

-

How much does airSlate SignNow cost for handling the SC state tax payment plan?

airSlate SignNow offers competitive pricing plans that cater to various business needs, making it cost-effective for managing the SC state tax payment plan. You can choose from different subscription tiers based on your document volume and feature requirements.

-

Can I integrate airSlate SignNow with other software for my SC state tax payment plan?

Yes, airSlate SignNow allows integration with various software tools, enhancing your workflow for the SC state tax payment plan. This ensures that all relevant documents and data are seamlessly connected, improving efficiency in your tax management process.

-

Is airSlate SignNow secure for tax-related documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your tax-related documents, including those for the SC state tax payment plan. This includes encryption and secure storage, ensuring that sensitive information remains confidential.

-

How quickly can I set up my SC state tax payment plan using airSlate SignNow?

Setting up your SC state tax payment plan using airSlate SignNow can be done in minutes. The platform's user-friendly design allows you to upload, edit, and sign documents efficiently, expediting the entire process so you can get back to focusing on your business.

Get more for South Carolina Fs

- Student directed functional assessment interview ed gov nl form

- Vendor ach authorization form template

- Information sheet application for an authorization to transport restricted

- Company authorization letter template ampamp samplesample of authorization letter template with examplesample of authorization form

- Splash international catalogue form

- Knrh true cleanse intake form

- Form 3953 06 09

- Eforms all documents kane county illinois

Find out other South Carolina Fs

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed