Oregon Form 40 ESV Estimated Income Tax Payment

What is the Oregon Form 40 ESV Estimated Income Tax Payment

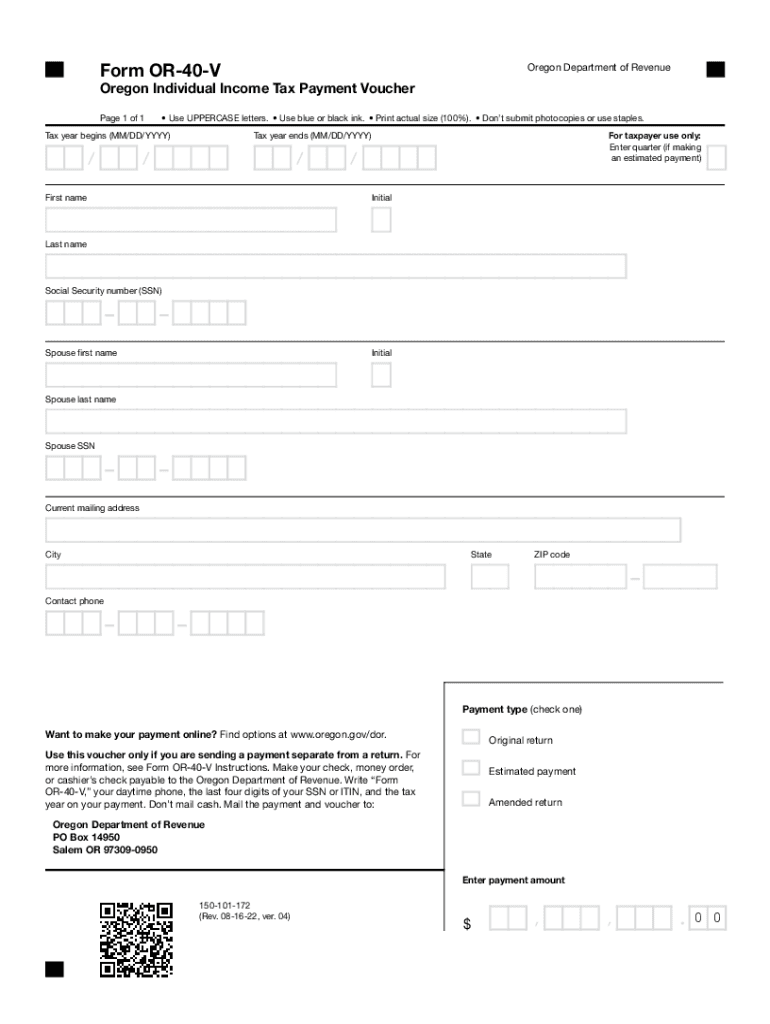

The Oregon Form 40 ESV Estimated Income Tax Payment is a tax form used by individuals and businesses in Oregon to report and pay estimated income taxes. This form is specifically designed for taxpayers who expect to owe taxes of $500 or more when filing their annual return. It allows for the prepayment of taxes throughout the year, which can help taxpayers manage their tax liabilities more effectively and avoid penalties for underpayment.

How to use the Oregon Form 40 ESV Estimated Income Tax Payment

To use the Oregon Form 40 ESV, taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax is determined, taxpayers can fill out the form, indicating the amount they plan to pay. The form can be submitted in installments, aligning with the quarterly payment schedule set by the Oregon Department of Revenue.

Steps to complete the Oregon Form 40 ESV Estimated Income Tax Payment

Completing the Oregon Form 40 ESV involves several steps:

- Gather financial information, including income sources and deductions.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the form with your personal information and estimated payment amounts.

- Review the form for accuracy before submission.

- Submit the form by the designated deadlines to avoid penalties.

Key elements of the Oregon Form 40 ESV Estimated Income Tax Payment

The key elements of the Oregon Form 40 ESV include personal identification information, estimated income figures, and the calculation of tax owed. Taxpayers must also provide details on any previous payments made during the year. Ensuring that all information is accurate is crucial, as errors can lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form 40 ESV typically align with the quarterly tax payment schedule. Payments are generally due on the 15th of April, June, September, and January of the following year. It is essential for taxpayers to mark these dates on their calendars to ensure timely payments and avoid interest or penalties for late submissions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Oregon Form 40 ESV. The form can be filed online through the Oregon Department of Revenue's website, mailed to the appropriate address, or submitted in person at designated locations. Each method has its own processing times, so taxpayers should choose the one that best fits their needs.

Quick guide on how to complete oregon form 40 esv estimated income tax payment

Complete Oregon Form 40 ESV Estimated Income Tax Payment effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed forms, as it allows you to find the correct template and securely store it online. airSlate SignNow provides all the resources you require to create, alter, and electronically sign your documents swiftly without delays. Handle Oregon Form 40 ESV Estimated Income Tax Payment on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to alter and electronically sign Oregon Form 40 ESV Estimated Income Tax Payment with ease

- Find Oregon Form 40 ESV Estimated Income Tax Payment and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Oregon Form 40 ESV Estimated Income Tax Payment and promote exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon form 40 esv estimated income tax payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Form 40 ESV Estimated Income Tax Payment?

The Oregon Form 40 ESV Estimated Income Tax Payment is a tax form used by individuals and businesses to report estimated income tax payments owed to the state of Oregon. It helps taxpayers stay compliant with state tax obligations throughout the year. Properly filling out this form can prevent penalties associated with underpayment.

-

How can airSlate SignNow help with the Oregon Form 40 ESV Estimated Income Tax Payment?

airSlate SignNow streamlines the process of completing and submitting the Oregon Form 40 ESV Estimated Income Tax Payment by allowing users to electronically sign and send documents securely. The platform's user-friendly interface simplifies document management and ensures your forms are sent and received promptly. With airSlate SignNow, you can minimize errors and enhance efficiency in your tax filing process.

-

Is airSlate SignNow cost-effective for managing tax documents like Oregon Form 40 ESV?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents, including the Oregon Form 40 ESV Estimated Income Tax Payment. The subscription plans are designed to fit various budgets, allowing small businesses and individual taxpayers to access advanced document management features without breaking the bank. Investing in airSlate SignNow can save you both time and money in the long run.

-

What features does airSlate SignNow provide for tax form management?

airSlate SignNow provides advanced features such as electronic signatures, document templates, cloud storage, and integration with popular productivity tools. These features streamline the process of managing tax forms like the Oregon Form 40 ESV Estimated Income Tax Payment. Users can easily collaborate on documents, ensuring accuracy and compliance while saving time.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow seamlessly integrates with various tax and accounting software, making it easy to manage your Oregon Form 40 ESV Estimated Income Tax Payment alongside other financial documents. This integration allows for smoother workflows and better organization of tax-related information. Combining airSlate SignNow with your existing tools can enhance your overall productivity.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards to protect your sensitive tax documents, including the Oregon Form 40 ESV Estimated Income Tax Payment. The platform offers secure cloud storage and access controls, ensuring that your documents are safe from unauthorized access. You can trust airSlate SignNow to keep your information secure.

-

What are the benefits of using airSlate SignNow for estimated tax payments?

Using airSlate SignNow for your Oregon Form 40 ESV Estimated Income Tax Payment provides numerous benefits, including enhanced efficiency, reduced paperwork, and increased accuracy. The ability to eSign documents electronically speeds up the approval process, and automated reminders ensure you never miss a deadline. Overall, adopting airSlate SignNow can simplify your tax management signNowly.

Get more for Oregon Form 40 ESV Estimated Income Tax Payment

- Mmm application form how to fill

- D401 driving form

- Boundary line adjustment mason county form

- Application and order to change or add a juvenile court legalfill form

- Nc 130g decree changing name change free legal forms

- Shakeys job application pdf form

- Employment application moeamp39s southwest grill myjobappscom form

- Request to terminatemodify probation form courts state co

Find out other Oregon Form 40 ESV Estimated Income Tax Payment

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed