Irs Apa Annual Report Summary Form

What is the Irs Apa Annual Report Summary Form

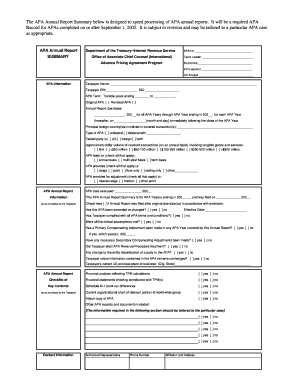

The Irs Apa Annual Report Summary Form is a crucial document that organizations must submit to the Internal Revenue Service (IRS) to report the activities and financial status of their APA (Advance Pricing Agreement) arrangements. This form provides a summary of the transactions covered under the APA, ensuring compliance with U.S. tax regulations. It is designed to facilitate transparency and accountability in international tax matters, particularly for businesses engaged in cross-border transactions.

How to use the Irs Apa Annual Report Summary Form

Using the Irs Apa Annual Report Summary Form involves several steps to ensure accurate and compliant reporting. First, gather all relevant financial documents and transaction details related to the APA. Next, complete the form by filling out the required fields, including information about the parties involved, the nature of the transactions, and any adjustments made during the reporting period. Finally, review the completed form for accuracy before submission to the IRS.

Steps to complete the Irs Apa Annual Report Summary Form

Completing the Irs Apa Annual Report Summary Form requires careful attention to detail. Here are the essential steps:

- Collect necessary documentation, including financial statements and transaction records.

- Fill in the identifying information for all parties involved in the APA.

- Detail the transactions covered by the APA, including pricing methods and adjustments.

- Ensure all calculations are accurate and reflect the actual transactions.

- Review the form thoroughly for completeness and correctness.

- Submit the form to the IRS by the specified deadline.

Legal use of the Irs Apa Annual Report Summary Form

The legal use of the Irs Apa Annual Report Summary Form is governed by IRS regulations that outline the requirements for APA reporting. This form must be completed accurately to ensure compliance with tax laws. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is essential for organizations to understand their legal obligations when using this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Apa Annual Report Summary Form are critical for compliance. Typically, the form must be submitted annually, with the due date aligning with the tax return deadline for the organization. For most businesses, this means the form is due on or before the fifteenth day of the fourth month following the end of the tax year. It is advisable to mark important dates on the calendar to ensure timely submission and avoid penalties.

Required Documents

To complete the Irs Apa Annual Report Summary Form accurately, several documents are required. These include:

- Financial statements for the reporting period.

- Transaction records related to the APA.

- Any prior APAs or amendments that may impact the current report.

- Supporting documentation for pricing methods used.

Having these documents readily available will streamline the completion process and enhance accuracy.

Quick guide on how to complete irs apa annual report summary form

Effortlessly Prepare Irs Apa Annual Report Summary Form on Any Device

Digital document administration has gained traction among companies and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to design, alter, and eSign your documents promptly without delays. Manage Irs Apa Annual Report Summary Form on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Modify and eSign Irs Apa Annual Report Summary Form Easily

- Find Irs Apa Annual Report Summary Form and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details carefully and then click the Done button to save your alterations.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Apa Annual Report Summary Form and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs apa annual report summary form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Irs Apa Annual Report Summary Form?

The Irs Apa Annual Report Summary Form is a document that provides a summary of annual reports of organizations participating in certain IRS programs. It is essential for compliance with IRS regulations and helps entities maintain proper records.

-

How can airSlate SignNow assist with the Irs Apa Annual Report Summary Form?

airSlate SignNow provides a digital platform that allows users to easily create, send, and eSign the Irs Apa Annual Report Summary Form. Its user-friendly interface enables quick and efficient completion of necessary documentation, ensuring compliance and saving time.

-

Is there a cost associated with using airSlate SignNow for the Irs Apa Annual Report Summary Form?

Yes, airSlate SignNow offers a variety of pricing plans, including affordable options suitable for businesses of all sizes. The pricing plans provide access to features tailored for efficiently managing legal documents like the Irs Apa Annual Report Summary Form.

-

What features does airSlate SignNow offer for managing the Irs Apa Annual Report Summary Form?

airSlate SignNow includes features such as customizable templates, electronic signatures, and document tracking, which are beneficial for managing the Irs Apa Annual Report Summary Form. These features enhance efficiency by streamlining the entire signing process.

-

How can I integrate airSlate SignNow with other tools for the Irs Apa Annual Report Summary Form?

airSlate SignNow easily integrates with various popular applications and services, allowing you to connect your workflow for the Irs Apa Annual Report Summary Form. Integration capabilities help ensure that your document management aligns seamlessly with other business processes.

-

What are the benefits of using airSlate SignNow for the Irs Apa Annual Report Summary Form?

Using airSlate SignNow makes it easier to manage the Irs Apa Annual Report Summary Form with its secure eSigning features. This results in faster turnarounds, reduced paperwork, and enhanced compliance, ultimately making the entire process more efficient for businesses.

-

Is airSlate SignNow secure for handling the Irs Apa Annual Report Summary Form?

Absolutely, airSlate SignNow implements advanced security measures, including encryption and secure data storage, to protect your Irs Apa Annual Report Summary Form. Businesses can trust that their confidential information remains safe throughout the signing process.

Get more for Irs Apa Annual Report Summary Form

- Test card template form

- Expected graduation certificate form

- Marriott explore rate authorization form 2022

- Accounting level 4 coc exam pdf form

- Medicare annual wellness visit questionnaire 387737512 form

- Httpscfr forms gov ab caformadmincs12142

- Credit application famous supply form

- Name of ppec physician plan of care for ppec form

Find out other Irs Apa Annual Report Summary Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document