Get Form or TM V, TriMet Self Employment Tax Payment

What is the Get Form OR TM V, TriMet Self Employment Tax Payment

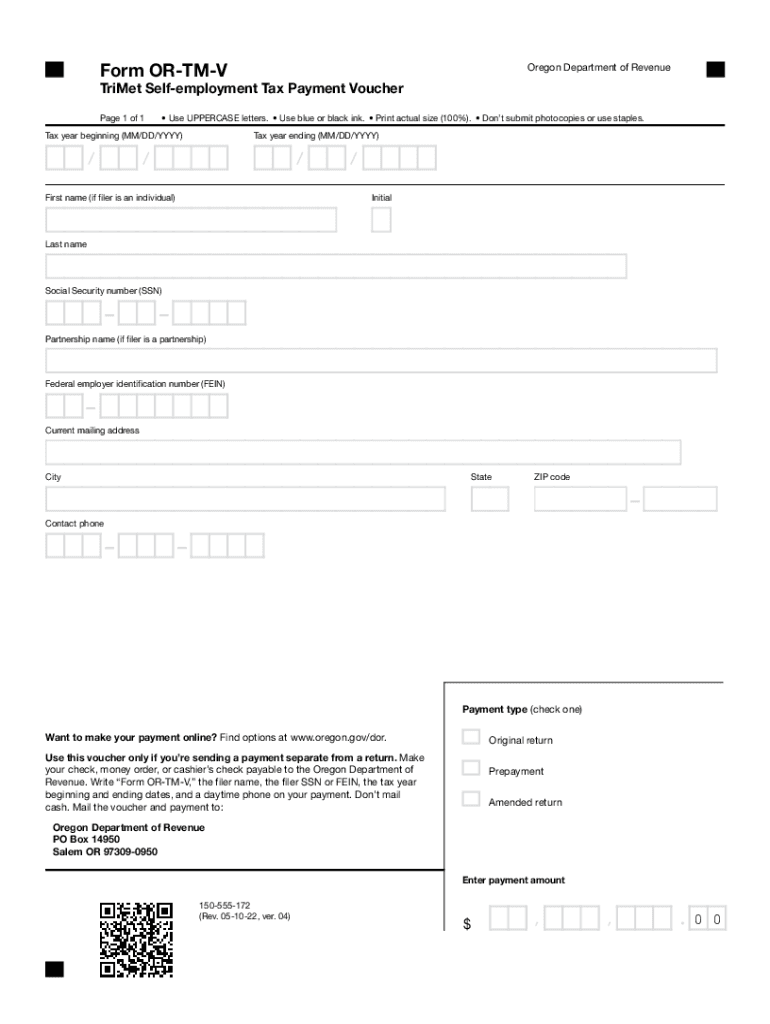

The Get Form OR TM V, TriMet Self Employment Tax Payment is a specific tax form used by self-employed individuals in the TriMet service area. This form is essential for reporting and paying self-employment taxes related to income earned within the jurisdiction. It ensures compliance with local tax regulations and contributes to funding public transportation services. Understanding the purpose and requirements of this form is crucial for self-employed taxpayers to avoid penalties and ensure proper tax reporting.

How to use the Get Form OR TM V, TriMet Self Employment Tax Payment

Using the Get Form OR TM V, TriMet Self Employment Tax Payment involves several straightforward steps. First, gather all necessary financial documents that reflect your self-employment income. Next, accurately fill out the form with your income details, ensuring all figures are correct. After completing the form, review it for accuracy before submission. It is advisable to keep a copy for your records. The completed form can be submitted online, by mail, or in person, depending on your preference and the submission guidelines.

Steps to complete the Get Form OR TM V, TriMet Self Employment Tax Payment

Completing the Get Form OR TM V, TriMet Self Employment Tax Payment requires careful attention to detail. Follow these steps:

- Collect your income statements and any relevant financial records.

- Access the form through the appropriate channels, either online or by obtaining a physical copy.

- Fill out the form, ensuring all income is reported accurately.

- Double-check your entries for any errors or omissions.

- Submit the form according to the specified method: online, by mail, or in person.

Required Documents

To complete the Get Form OR TM V, TriMet Self Employment Tax Payment, certain documents are necessary. These typically include:

- Income statements, such as 1099 forms or profit and loss statements.

- Records of any business expenses that may be deductible.

- Identification documents, if required by local regulations.

Having these documents ready will streamline the process and ensure accurate reporting of your self-employment income.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Get Form OR TM V, TriMet Self Employment Tax Payment. Typically, self-employment tax payments are due on April fifteenth for the previous tax year. However, if you are making estimated payments, these are usually due quarterly. Keeping track of these dates helps avoid late fees and penalties, ensuring compliance with tax obligations.

Penalties for Non-Compliance

Failing to comply with the requirements of the Get Form OR TM V, TriMet Self Employment Tax Payment can result in significant penalties. Common consequences include:

- Late fees for overdue payments.

- Interest on unpaid taxes.

- Potential legal actions for continued non-compliance.

Understanding these penalties emphasizes the importance of timely and accurate filing, helping to maintain good standing with tax authorities.

Quick guide on how to complete get form or tm v trimet self employment tax payment

Effortlessly prepare Get Form OR TM V, TriMet Self Employment Tax Payment on any device

Managing documents online has become increasingly popular among both companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct forms and securely store them on the internet. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Manage Get Form OR TM V, TriMet Self Employment Tax Payment on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and eSign Get Form OR TM V, TriMet Self Employment Tax Payment with ease

- Find Get Form OR TM V, TriMet Self Employment Tax Payment and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information with the tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Get Form OR TM V, TriMet Self Employment Tax Payment to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get form or tm v trimet self employment tax payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'Get Form OR TM V, TriMet Self Employment Tax Payment'?

'Get Form OR TM V, TriMet Self Employment Tax Payment' is a necessary document for self-employed individuals to report and pay their self-employment taxes in the TriMet region. This form helps you comply with local tax regulations and is essential for managing your business finances effectively.

-

How can I obtain 'Get Form OR TM V, TriMet Self Employment Tax Payment'?

You can easily obtain 'Get Form OR TM V, TriMet Self Employment Tax Payment' through the airSlate SignNow platform. Our service provides a seamless process to access, complete, and submit the form online, ensuring you stay compliant with local tax requirements.

-

What are the key features of airSlate SignNow for managing tax documents?

airSlate SignNow offers several essential features for managing tax documents, including eSigning, document templates, and secure cloud storage. With these tools, you can efficiently handle forms, including 'Get Form OR TM V, TriMet Self Employment Tax Payment', in a user-friendly environment.

-

Is airSlate SignNow a cost-effective solution for my business?

Yes, airSlate SignNow is a cost-effective solution for businesses of all sizes. With flexible pricing plans that cater to different needs, you can ensure that managing forms, like 'Get Form OR TM V, TriMet Self Employment Tax Payment', fits within your budget while maintaining quality service.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow supports integrations with various software tools, allowing you to streamline processes across your business. This feature enables seamless document management, including handling 'Get Form OR TM V, TriMet Self Employment Tax Payment', alongside your existing systems.

-

How does eSigning work for 'Get Form OR TM V, TriMet Self Employment Tax Payment'?

eSigning with airSlate SignNow is fast and secure. Simply upload 'Get Form OR TM V, TriMet Self Employment Tax Payment', add the necessary signatures, and send it for approval. Recipients can sign remotely, which saves time and simplifies the tax payment process.

-

What are the benefits of using airSlate SignNow for tax management?

Using airSlate SignNow for tax management allows you to save time and improve accuracy. Our platform ensures that you can easily complete and file crucial documents like 'Get Form OR TM V, TriMet Self Employment Tax Payment', while minimizing errors and enhancing compliance.

Get more for Get Form OR TM V, TriMet Self Employment Tax Payment

- Pdf esdc emp55942014 09 003 service canada servicecanada gc form

- Thirty one order form

- Canada lmia image form

- Hpcsa form 12

- Texas peace officeramp39s crash report form cr 3 112015 mail to

- Fpgec application form

- Td fillable forms sce w8

- Miscellaneous services form consulate general of india chicago miscellaneous services form consulate general of india chicago

Find out other Get Form OR TM V, TriMet Self Employment Tax Payment

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile