Desktop Form 8689 Allocation of Individual Income Tax to

Understanding the Desktop Form 8689 Allocation of Individual Income Tax

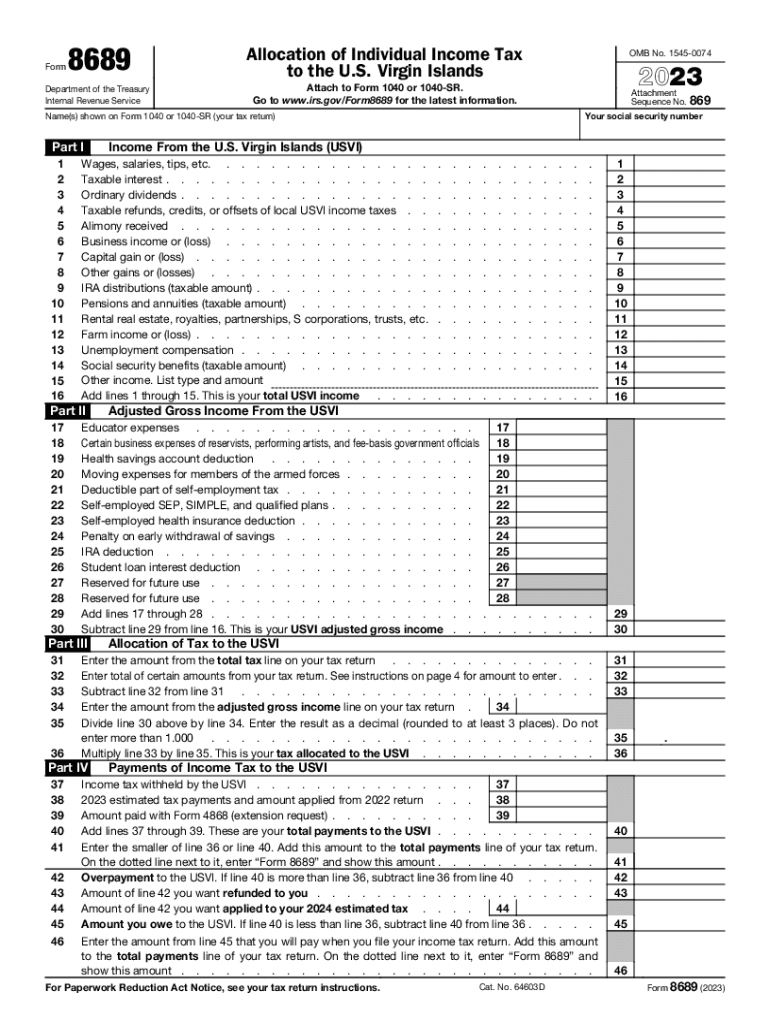

The Desktop Form 8689 is essential for individuals who need to allocate their income tax between the United States and the U.S. Virgin Islands. This form is particularly relevant for residents of the U.S. Virgin Islands who earn income from sources outside the territory. By completing this form, taxpayers can ensure that they comply with both U.S. and U.S. Virgin Islands tax obligations, thereby avoiding double taxation on their income.

Steps to Complete the Desktop Form 8689

Completing the Desktop Form 8689 involves several key steps:

- Gather necessary financial documents, including income statements and any previous tax returns.

- Determine the total income earned during the tax year, including both U.S. and U.S. Virgin Islands sources.

- Calculate the allocation of income based on the percentage of time spent in each jurisdiction.

- Fill out the form accurately, ensuring all calculations are correct and all required information is provided.

- Review the completed form for any errors or omissions before submitting it.

Filing Deadlines for the Desktop Form 8689

It is crucial to be aware of the filing deadlines for the Desktop Form 8689 to avoid penalties. Typically, the form must be filed by the same deadline as your federal income tax return. For most taxpayers, this means the form is due on April 15. However, if you are unable to meet this deadline, you may apply for an extension, which usually extends the deadline by six months.

Required Documents for Filing the Desktop Form 8689

To complete the Desktop Form 8689, you will need to gather several documents:

- W-2 forms from all employers.

- 1099 forms for any additional income.

- Records of any deductions or credits you plan to claim.

- Documentation of residency status in the U.S. Virgin Islands.

IRS Guidelines for Using the Desktop Form 8689

The IRS provides specific guidelines for completing the Desktop Form 8689. These guidelines include instructions on how to calculate your income allocation, details on what qualifies as U.S. and U.S. Virgin Islands income, and how to report any tax credits or deductions. It is advisable to refer to the IRS instructions to ensure compliance with all regulations and to avoid potential issues during the filing process.

Penalties for Non-Compliance with the Desktop Form 8689

Failure to file the Desktop Form 8689 correctly or on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential to ensure accuracy and timeliness when submitting this form to avoid these consequences. Understanding the implications of non-compliance can help motivate taxpayers to complete their forms diligently.

Quick guide on how to complete desktop form 8689 allocation of individual income tax to

Effortlessly Complete Desktop Form 8689 Allocation Of Individual Income Tax To on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Desktop Form 8689 Allocation Of Individual Income Tax To on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Desktop Form 8689 Allocation Of Individual Income Tax To hassle-free

- Find Desktop Form 8689 Allocation Of Individual Income Tax To and click on Get Form to initiate.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to share your form — via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Desktop Form 8689 Allocation Of Individual Income Tax To and ensure exceptional communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the desktop form 8689 allocation of individual income tax to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to form 8594 instructions?

airSlate SignNow offers a variety of features tailored to enhance your experience with form 8594 instructions. Users can easily create, edit, and send documents for eSignature while ensuring compliance with IRS requirements. The platform also allows for template creation, making repetitive tasks more efficient in managing form 8594.

-

How can I use airSlate SignNow to simplify the process of completing form 8594 instructions?

You can simplify the process of completing form 8594 instructions by using airSlate SignNow's user-friendly interface. Our platform enables you to fill out the form electronically, saving time and reducing errors. Additionally, the electronic signature feature ensures that all necessary signatures are obtained quickly and securely.

-

Is there a cost associated with using airSlate SignNow for form 8594 instructions?

Yes, there is a cost associated with using airSlate SignNow, which varies based on the plan you choose. Each plan offers features tailored to your business needs, including those specifically for handling form 8594 instructions. We also provide a free trial so you can explore how our solutions fit your requirements before committing to a subscription.

-

What benefits does using airSlate SignNow provide for form 8594 instructions?

Using airSlate SignNow for form 8594 instructions streamlines the paperwork process, ensuring that you complete and file documents accurately and efficiently. You benefit from built-in compliance checks, automatic reminders for signatures, and a secure cloud storage option for all your completed forms. Overall, this enhances workflow and reduces the risk of mistakes.

-

Can airSlate SignNow integrate with other applications for handling form 8594 instructions?

Yes, airSlate SignNow seamlessly integrates with various applications to improve your management of form 8594 instructions. By connecting with tools like CRM systems and cloud storage services, you can enhance your productivity and keep all related documents organized. This integration ensures that your eSigning processes are part of a larger workflow.

-

Are there any tutorials available for understanding form 8594 instructions on airSlate SignNow?

Absolutely! airSlate SignNow provides detailed tutorials and resources on how to effectively use our platform for form 8594 instructions. These tutorials cover all aspects of document management, eSigning, and tips for compliance, making it easier for users to get started. We also offer customer support for any specific inquiries.

-

What kind of security measures does airSlate SignNow implement for form 8594 instructions?

airSlate SignNow prioritizes the security of your documents, especially when handling sensitive information like form 8594 instructions. We implement advanced encryption protocols and secure data storage solutions to protect your documents. Each signature is also digitally verified to ensure authenticity and integrity.

Get more for Desktop Form 8689 Allocation Of Individual Income Tax To

- Hershey medical center medical records release form

- Program application 2015 california institute of medical science form

- Safety cover measuring form dohenyamp39s

- Paternity and post decree financial declaration form

- Trade reference form alliedbarton

- Form 14 field trip waiver for volunteer

- Petition for stalking ojd state or form

- Oftec cd 12 form

Find out other Desktop Form 8689 Allocation Of Individual Income Tax To

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later