Form 1096

What is the Form 1096

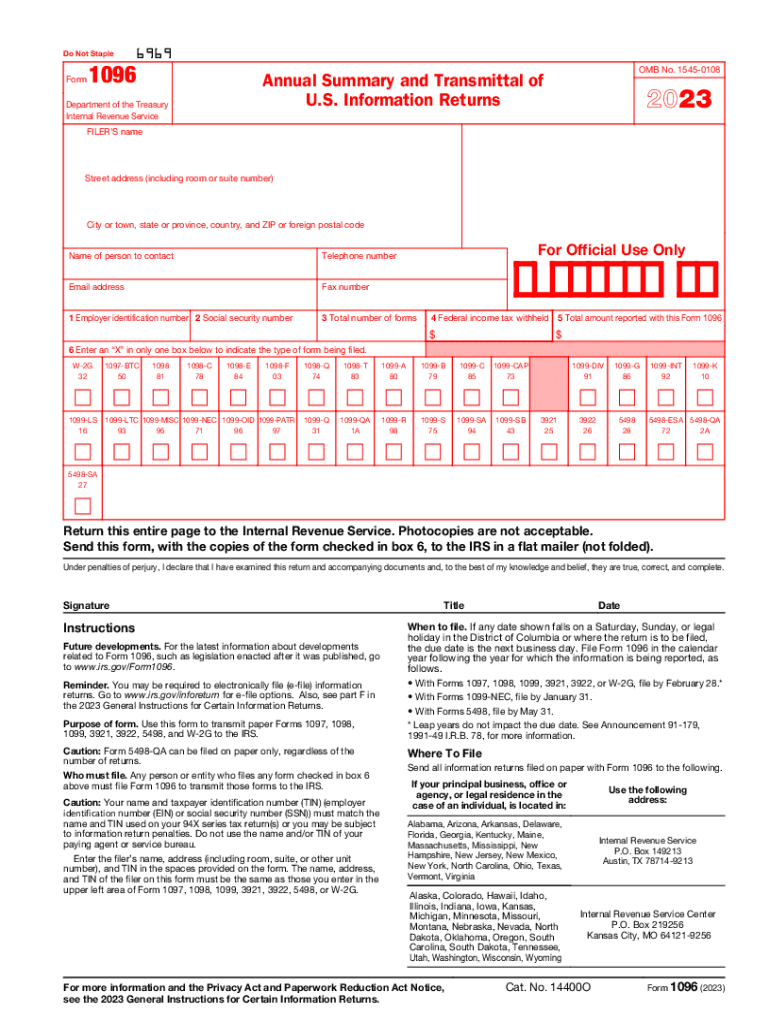

The Form 1096 is an annual summary of information returns filed with the Internal Revenue Service (IRS). It is used to report various types of income, including payments made to independent contractors and other entities. The 1096 form serves as a cover sheet for transmitting paper forms such as 1099s, which detail specific income information. Businesses and organizations must file this form if they are submitting paper copies of these information returns.

How to obtain the Form 1096

To obtain the 1096 form for 2023, individuals can visit the IRS website to download a printable version. The form is available in PDF format, making it easy to print and fill out. Additionally, businesses can request physical copies from the IRS by calling their helpline or visiting a local IRS office. It is important to ensure that the correct version of the form is used, as updates may occur annually.

Steps to complete the Form 1096

Completing the Form 1096 involves several key steps:

- Gather necessary information: Collect all relevant data from the information returns you are submitting, such as the total amounts paid and the recipients' details.

- Fill out the form: Enter your business information, including name, address, and Employer Identification Number (EIN). Then, provide the total number of forms being submitted and the total amount reported.

- Review for accuracy: Double-check all entries for accuracy to avoid any potential issues with the IRS.

- Sign and date: Ensure that the form is signed by an authorized individual within your organization.

Filing Deadlines / Important Dates

The filing deadline for the Form 1096 typically aligns with the deadlines for the information returns it covers. For the 2023 tax year, the deadline to file the form with the IRS is usually at the end of February if submitting paper forms. If you are filing electronically, the deadline may extend to March. It is essential to confirm specific dates each year, as they can vary based on IRS announcements.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1096. These guidelines include instructions on the types of information returns that require a 1096, formatting requirements, and submission methods. Businesses should refer to the IRS instructions for Form 1096 to ensure compliance with all regulations. Adhering to these guidelines helps avoid penalties and ensures smooth processing of filed forms.

Penalties for Non-Compliance

Failure to file the Form 1096 or submitting incorrect information can result in penalties from the IRS. The penalties vary based on the severity of the non-compliance, including late filing, incorrect information, or failure to file altogether. Businesses should be aware of these potential penalties and take proactive steps to ensure timely and accurate submissions. Understanding the risks associated with non-compliance can help mitigate financial repercussions.

Quick guide on how to complete form 1096 701761441

Effortlessly Prepare Form 1096 on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed forms, allowing you to locate the needed template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without hassles. Manage Form 1096 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Modify and Electronically Sign Form 1096 with Ease

- Locate Form 1096 and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1096 and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1096 701761441

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1096 form 2023 and why is it important?

The 1096 form 2023 is a summary form used by businesses to report various types of tax forms to the IRS. It aggregates the information from other forms, such as 1099s, and ensures compliance with tax reporting requirements. Understanding its importance helps businesses avoid penalties and ensures proper reporting.

-

How can airSlate SignNow help with the 1096 form 2023?

airSlate SignNow simplifies the process of signing and sending the 1096 form 2023 securely. Our platform allows users to eSign documents and collect signatures electronically, ensuring you meet deadlines without hassle. This streamlines your paperwork and helps you focus on your core business activities.

-

Is there a cost associated with using airSlate SignNow for the 1096 form 2023?

Yes, airSlate SignNow offers various pricing plans to cater to different business sizes and needs. Each plan includes features that can assist with the 1096 form 2023, making it a cost-effective solution for managing documentation. You can choose a plan based on the volume of documents you typically process.

-

What features does airSlate SignNow offer for the 1096 form 2023?

airSlate SignNow provides a range of features that enhance the completion of the 1096 form 2023, such as customizable templates, automated reminders, and real-time tracking. These features guarantee that you stay organized and compliant when preparing tax forms. Additionally, our user-friendly interface makes the process straightforward.

-

Can I integrate airSlate SignNow with other software for the 1096 form 2023?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and management software, which can be beneficial for handling the 1096 form 2023. This integration streamlines your workflows, allowing for a more efficient process from document creation to signing.

-

What are the benefits of using airSlate SignNow for managing the 1096 form 2023?

By using airSlate SignNow for the 1096 form 2023, businesses benefit from increased efficiency, enhanced security, and improved compliance with IRS regulations. Our platform allows you to manage documents in one place, reducing errors and expediting the filing process. This not only saves time but also minimizes stress during tax season.

-

How secure is submitting the 1096 form 2023 through airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive forms like the 1096 form 2023. Our platform employs encryption and advanced authentication measures to protect your documents. You can submit and store your forms securely, knowing that your data is protected.

Get more for Form 1096

- San mateo care advantage vision insurance forms

- Gde research form

- Fair trading residential tenancy agreement form

- 2015 asme files asme form

- Borang permohonan spkk cidb form

- Il form wage

- Turpin spartans book store spirit wear order form foresthills

- Form 33 109f1 notice of termination enter the service nl

Find out other Form 1096

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple