Form W 2G Rev December

What is the Form W-2G?

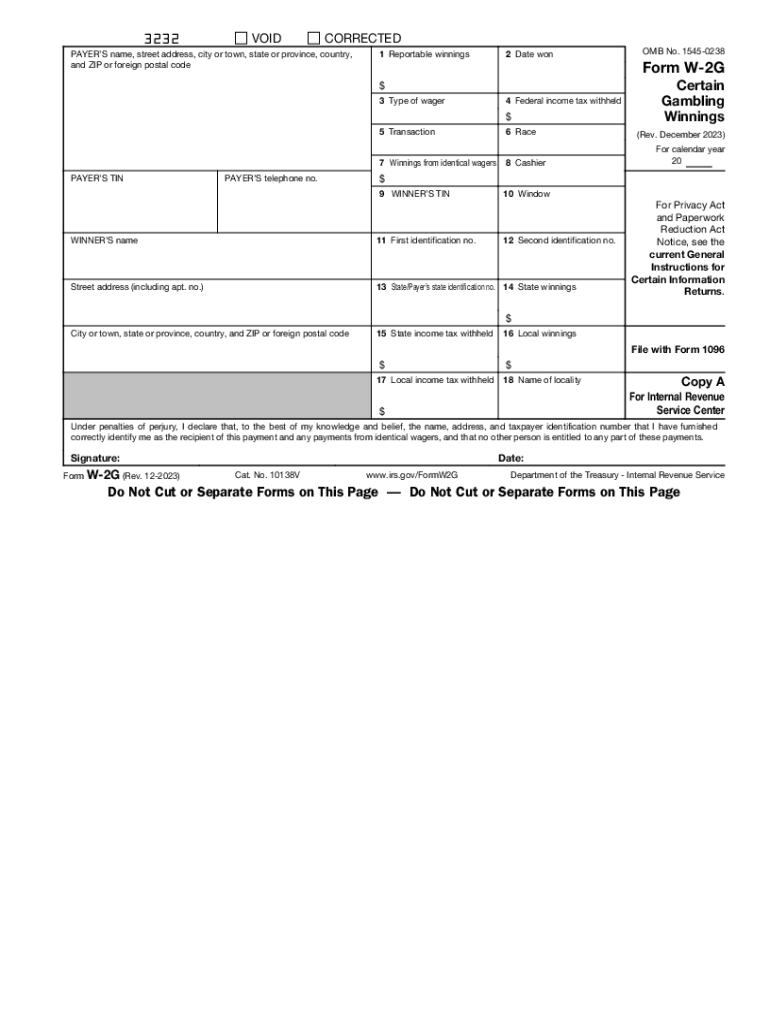

The Form W-2G is an Internal Revenue Service (IRS) document used to report certain gambling winnings. This form is essential for both the payer and the recipient, as it ensures that all applicable taxes on gambling income are accurately reported. The W-2G form is typically issued by casinos, racetracks, and other gambling establishments when winnings exceed specific thresholds. These thresholds include $600 or more in winnings from a game or $1,200 or more from a slot machine or bingo game, among others.

How to Use the Form W-2G

To use the Form W-2G, recipients must first receive it from the gambling establishment where they won. This form provides crucial information, including the amount won, the type of gambling, and any taxes withheld. Recipients should keep the W-2G for their records and use it when filing their federal income tax returns. It is important to report all gambling winnings, even if they are below the reporting threshold, to avoid potential issues with the IRS.

Steps to Complete the Form W-2G

Completing the Form W-2G involves several straightforward steps:

- Gather necessary information, including your name, address, and Social Security number.

- Enter the payer's information, including the name and address of the gambling establishment.

- Fill in the amount of winnings and any federal income tax withheld.

- Indicate the type of gambling activity that generated the winnings.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form W-2G

The IRS has specific guidelines regarding the use of Form W-2G. It is important to understand the reporting requirements and the types of gambling that necessitate the form. The IRS mandates that gambling winnings must be reported, and the W-2G serves as a record of this income. Additionally, taxpayers should be aware of the potential for penalties if they fail to report winnings, even if they do not receive a W-2G.

Filing Deadlines for Form W-2G

The filing deadlines for Form W-2G align with the general tax filing deadlines set by the IRS. Payers must submit the form to the IRS by the end of January following the year in which the winnings were paid. Recipients should include the information from the W-2G when filing their tax returns, which are typically due on April 15. It is advisable to keep a copy of the W-2G for personal records.

Who Issues the Form W-2G?

The Form W-2G is issued by gambling establishments, including casinos, racetracks, and other venues where gambling occurs. These establishments are responsible for providing the form to winners who meet the reporting thresholds. It is essential for recipients to ensure they receive their W-2G in a timely manner to accurately report their gambling income.

Quick guide on how to complete form w 2g rev december

Accomplish Form W 2G Rev December effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary format and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Handle Form W 2G Rev December on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and electronically sign Form W 2G Rev December without hassle

- Obtain Form W 2G Rev December and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Form W 2G Rev December and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 2g rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form W-2G?

A form W-2G is used to report gambling winnings and any federal income tax withheld on those winnings. It's essential for gamblers to understand how to fill out a form W-2G to ensure compliance with tax regulations. By using airSlate SignNow, you can easily eSign and send your completed form W-2G securely.

-

How does airSlate SignNow help with form W-2G?

airSlate SignNow simplifies the process of filling out and eSigning your form W-2G, making it accessible from anywhere. Our platform allows you to upload your document, add signatures, and share it electronically. This ensures that your form W-2G is completed quickly and efficiently.

-

Is airSlate SignNow affordable for small businesses needing to manage form W-2G?

Yes, airSlate SignNow offers a cost-effective solution for small businesses looking to manage forms like W-2G. Our pricing plans are designed to accommodate various business sizes and needs without sacrificing quality. You can easily scale your usage as your business grows.

-

Can I integrate airSlate SignNow with other software for managing form W-2G?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, helping you manage your form W-2G alongside your existing workflows. Integrating with tools like CRM systems or accounting software can streamline your processes and improve efficiency.

-

What are the key benefits of using airSlate SignNow for form W-2G?

Using airSlate SignNow for your form W-2G provides numerous benefits, including increased efficiency and enhanced security. With our easy-to-use interface, you can quickly prepare and eSign your documents while ensuring that sensitive information is protected. Additionally, our audit trails provide peace of mind.

-

How does electronic signing of form W-2G work?

With airSlate SignNow, electronic signing of your form W-2G is straightforward and secure. You can upload your document, add eSignatures, and send it directly to any recipient without the need for printing. Our platform complies with legal standards for electronic signatures, making it a reliable choice.

-

What types of documents can I manage alongside form W-2G using airSlate SignNow?

In addition to form W-2G, you can manage a variety of documents with airSlate SignNow, such as contracts, NDAs, and other tax forms. Our platform is flexible and supports various document types, allowing you to keep all your important paperwork organized in one place.

Get more for Form W 2G Rev December

- Form 19 application for registration of overseas company on the tongan register form 19 application for registration of

- Preschool intake form for children with special needs mcleanbible

- Customer servicesunited states air force academy form

- I agree this form to allow four points by sheraton oran to have a third party expenses charged to

- Nbiservices pumping unit inspection maintainance report form

- Immigration clearance form

- Land disposal notification and certification regen form

- Form os 3105 monthly business gross revenue tax return

Find out other Form W 2G Rev December

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now