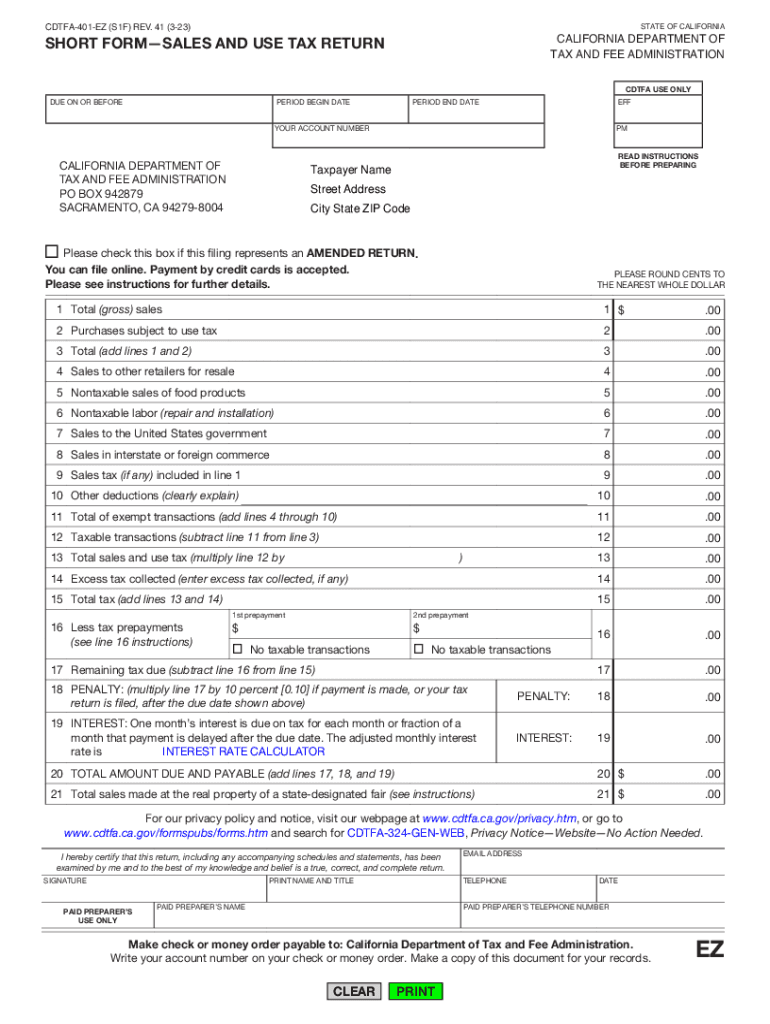

CDTFA 401 EZ, Short Form Sales and Use Tax Return

What is the CDTFA 401 EZ, Short Form Sales And Use Tax Return

The CDTFA 401 EZ is a simplified version of the California sales and use tax return, designed for businesses with straightforward tax obligations. This form allows eligible taxpayers to report their sales and use tax liabilities in a more efficient manner. Typically, it is suitable for businesses that have a limited amount of taxable sales and meet specific criteria set by the California Department of Tax and Fee Administration (CDTFA).

The CDTFA 401 EZ is particularly beneficial for small businesses, as it reduces the complexity of tax reporting. By using this form, taxpayers can streamline their filing process and ensure compliance with state tax regulations.

Steps to complete the CDTFA 401 EZ, Short Form Sales And Use Tax Return

Completing the CDTFA 401 EZ involves several key steps to ensure accurate reporting of sales and use tax. First, gather all relevant financial records, including sales receipts and purchase invoices. Next, follow these steps:

- Fill out the business information section, including your name, address, and account number.

- Report total sales and use tax collected during the reporting period.

- Calculate any applicable deductions, such as exempt sales or returns.

- Determine the total tax due by subtracting deductions from the total sales tax collected.

- Sign and date the form to certify the accuracy of the information provided.

Ensure that all figures are accurate to avoid penalties and interest for underreporting.

How to obtain the CDTFA 401 EZ, Short Form Sales And Use Tax Return

The CDTFA 401 EZ form can be obtained directly from the California Department of Tax and Fee Administration's website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, taxpayers may request a physical copy by contacting the CDTFA office. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal use of the CDTFA 401 EZ, Short Form Sales And Use Tax Return

The CDTFA 401 EZ can be legally used by eligible businesses to report sales and use tax. To qualify, businesses must meet specific criteria, such as having a limited number of transactions and a certain threshold of taxable sales. Using this form helps ensure compliance with California tax laws, and it is crucial for businesses to adhere to the guidelines provided by the CDTFA to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 401 EZ are typically aligned with the reporting periods established by the CDTFA. Most businesses are required to file either monthly, quarterly, or annually, depending on their sales volume. It is essential to stay informed about specific due dates to avoid late fees and penalties. Taxpayers should regularly check the CDTFA website for updates on filing deadlines and any changes to reporting requirements.

Penalties for Non-Compliance

Failure to file the CDTFA 401 EZ on time or inaccuracies in reporting can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. To mitigate these risks, businesses should ensure timely filing and accurate reporting. Understanding the consequences of non-compliance can help businesses maintain good standing with tax authorities.

Quick guide on how to complete cdtfa 401 ez short form sales and use tax return

Accomplish CDTFA 401 EZ, Short Form Sales And Use Tax Return effortlessly on any device

Digital document management has gained signNow traction among both companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly and without complications. Manage CDTFA 401 EZ, Short Form Sales And Use Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most effective method to modify and electronically sign CDTFA 401 EZ, Short Form Sales And Use Tax Return with ease

- Obtain CDTFA 401 EZ, Short Form Sales And Use Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign CDTFA 401 EZ, Short Form Sales And Use Tax Return and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 401 ez short form sales and use tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California 401 form sales use tax?

The California 401 form sales use tax is a tax form required for businesses that sell goods in California. It helps to track and report sales and use taxes collected from customers. Understanding this form is crucial for compliance and proper tax filing.

-

How does airSlate SignNow help with the California 401 form sales use tax?

airSlate SignNow streamlines the process of sending and eSigning documents related to the California 401 form sales use tax. With our easy-to-use interface, users can quickly access necessary tax forms and get them signed electronically, reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow for the California 401 form sales use tax?

airSlate SignNow offers flexible pricing plans tailored to various business needs, making it affordable for anyone needing to handle the California 401 form sales use tax. Plans typically include features like document tracking and advanced eSigning options.

-

Is airSlate SignNow compliant with California 401 form sales use tax regulations?

Yes, airSlate SignNow ensures compliance with all relevant regulations, including those related to the California 401 form sales use tax. We regularly update our platform to meet legal requirements, so you can rest assured that your eSigning process is secure.

-

Can I integrate airSlate SignNow with other accounting software for the California 401 form sales use tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software. This allows users to easily manage their financial documents and ensure all aspects of the California 401 form sales use tax are accurately tracked and filed.

-

What are the benefits of using airSlate SignNow for the California 401 form sales use tax filing?

Using airSlate SignNow for filing the California 401 form sales use tax offers multiple benefits, including reduced paperwork, improved efficiency, and enhanced record-keeping. Our eSigning solution eliminates delays, allowing businesses to focus on their core operations.

-

How secure is airSlate SignNow for handling the California 401 form sales use tax?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and security protocols to protect your documents related to the California 401 form sales use tax, ensuring that sensitive information stays confidential and secure.

Get more for CDTFA 401 EZ, Short Form Sales And Use Tax Return

- Disclaimer form

- Table 6 template for cspap implementation plan table 6 template for cspap implementation plan cdc form

- Goat registration form american dairy goat association

- Declaration of conformity outboard tmc jun 11

- Mecklenburg court equitable distribution form

- To download the service learning hours form lane technical lanetech

- Enrollment oglala sioux tribe form

- Income tax and benefit return t1 general 2011 all in one index form

Find out other CDTFA 401 EZ, Short Form Sales And Use Tax Return

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe