FTB 4107 Mandatory E Pay Requirement Waiver Request Form

What is the FTB 4107 Mandatory E Pay Requirement Waiver Request

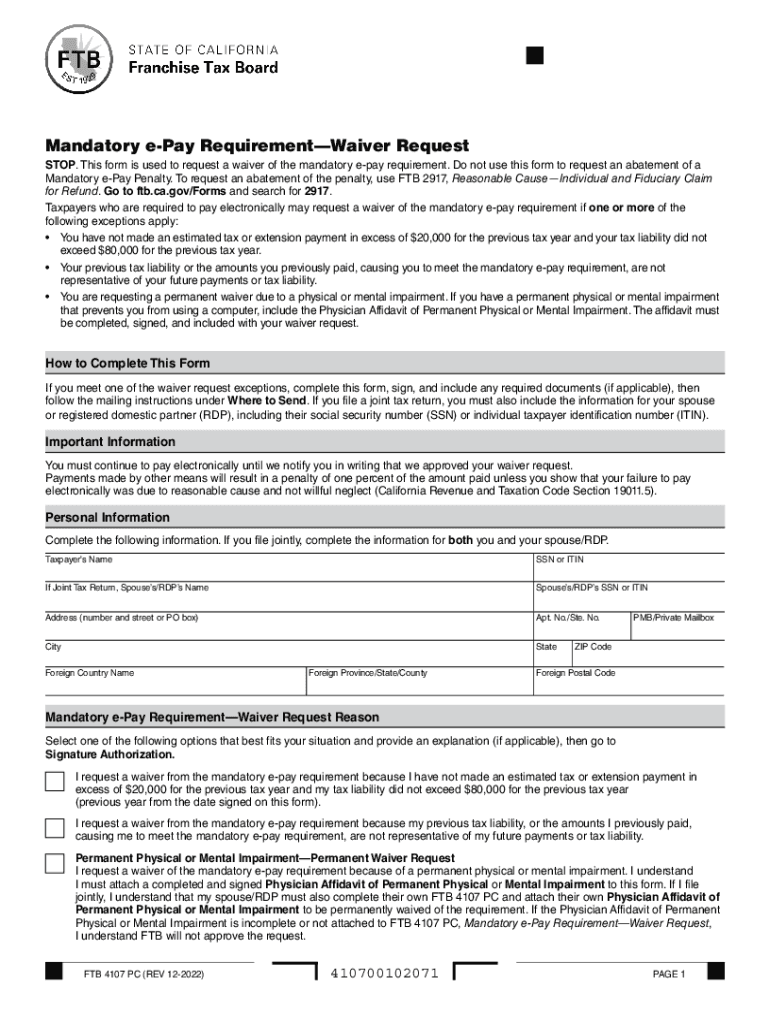

The FTB 4107 Mandatory E Pay Requirement Waiver Request is a form used by California taxpayers to request a waiver from the mandatory electronic payment requirement imposed by the Franchise Tax Board (FTB). This requirement typically applies to certain business entities and individuals who meet specific criteria regarding their tax obligations. By submitting this form, taxpayers can explain their reasons for seeking an exemption, which may include financial hardship or other compelling circumstances.

How to use the FTB 4107 Mandatory E Pay Requirement Waiver Request

To utilize the FTB 4107 form, taxpayers must first ensure they meet the eligibility criteria for a waiver. Once eligibility is confirmed, the form should be completed with accurate information detailing the reasons for the waiver request. It is essential to provide all necessary documentation that supports the request, as this will help the FTB assess the situation more effectively. After completing the form, it can be submitted online, by mail, or in person, depending on the taxpayer's preference.

Steps to complete the FTB 4107 Mandatory E Pay Requirement Waiver Request

Completing the FTB 4107 form involves several key steps:

- Gather necessary information, including your taxpayer identification number and details about your tax situation.

- Clearly state the reasons for your waiver request in the designated section of the form.

- Attach any supporting documents that validate your claims, such as financial statements or letters from financial institutions.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through your preferred method: online via the FTB website, by mail, or in person at an FTB office.

Eligibility Criteria

Eligibility for the FTB 4107 Mandatory E Pay Requirement Waiver is determined by specific criteria set forth by the FTB. Generally, taxpayers who face financial difficulties, such as those experiencing unemployment or significant medical expenses, may qualify. Additionally, certain small businesses may be exempt if their tax liability does not exceed a specified amount. It is crucial to review the FTB guidelines to ensure that your situation aligns with these eligibility requirements.

Required Documents

When submitting the FTB 4107 Mandatory E Pay Requirement Waiver Request, it is important to include all required documents to support your application. Commonly required documents may include:

- Proof of income, such as pay stubs or tax returns.

- Financial statements that outline your current financial situation.

- Any relevant correspondence that demonstrates your need for a waiver.

Including comprehensive documentation will enhance the likelihood of your waiver being approved.

Form Submission Methods (Online / Mail / In-Person)

The FTB 4107 form can be submitted through various methods, providing flexibility for taxpayers. The available options include:

- Online: Submit the form electronically through the FTB's official website, which may offer a faster processing time.

- Mail: Send the completed form and any supporting documents to the designated address provided by the FTB.

- In-Person: Deliver the form directly to a local FTB office, where staff can assist with any questions.

Quick guide on how to complete ftb 4107 mandatory e pay requirement waiver request

Complete FTB 4107 Mandatory E Pay Requirement Waiver Request effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle FTB 4107 Mandatory E Pay Requirement Waiver Request on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign FTB 4107 Mandatory E Pay Requirement Waiver Request with ease

- Obtain FTB 4107 Mandatory E Pay Requirement Waiver Request and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign FTB 4107 Mandatory E Pay Requirement Waiver Request and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 4107 mandatory e pay requirement waiver request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franchise tax board epay and how does it work?

The franchise tax board epay is an online payment system that allows businesses to efficiently pay their tax obligations electronically. By utilizing this service, users can ensure their payments are processed quickly and securely, streamlining the tax payment process and eliminating paper checks.

-

How can I integrate airSlate SignNow with the franchise tax board epay?

Integrating airSlate SignNow with the franchise tax board epay can simplify your document signing and payment processes. By leveraging the seamless integration capabilities, users can manage eSignatures alongside their tax payments, enhancing overall workflow efficiency.

-

What are the benefits of using airSlate SignNow with franchise tax board epay?

Using airSlate SignNow in conjunction with the franchise tax board epay provides a comprehensive solution for managing documents and payments. This combination helps reduce errors, saves time on administrative tasks, and ensures compliance with tax regulations through efficient electronic signatures.

-

Is there a cost associated with using franchise tax board epay?

While the franchise tax board epay itself may have certain fees associated with tax payments, using it in conjunction with airSlate SignNow offers a cost-effective solution for document management. The transparent pricing model of airSlate SignNow helps users control costs effectively while benefiting from streamlined operations.

-

Can franchise tax board epay be used for all types of taxes?

Yes, the franchise tax board epay can generally be used for various state tax obligations, including personal and corporate taxes. This flexibility allows users to address multiple tax payment needs efficiently while ensuring all their payments are managed in one unified platform.

-

How secure is the franchise tax board epay when used with airSlate SignNow?

Security is a top priority for both the franchise tax board epay and airSlate SignNow. Both platforms utilize advanced encryption and secure protocols to protect sensitive information, ensuring that your transactions and document management processes remain confidential and secure.

-

What features does airSlate SignNow offer for managing documents related to franchise tax board epay?

AirSlate SignNow provides a range of features such as customizable templates, real-time tracking, and automated reminders for document signing. These features allow users to streamline their workflow when managing documents associated with franchise tax board epay payments, ensuring timely and efficient processing.

Get more for FTB 4107 Mandatory E Pay Requirement Waiver Request

- Installment agreement to pay accident damages ernestoromero ernestoromero form

- 150824 experience standardsdocx form

- Chm 130ll molecular models gcc web gccaz form

- State of california public utilities commission cpuc form of intent state of california public utilities commission cpuc form

- Government entity diesel fuel tax return boe 501 dg board of boe ca form

- Mark downey rentals form

- Bryan yancey 8th grade history form

- Special program supplemental form

Find out other FTB 4107 Mandatory E Pay Requirement Waiver Request

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free