Government Entity Diesel Fuel Tax Return, BOE 501 DG Board of Boe Ca 2012

What is the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca

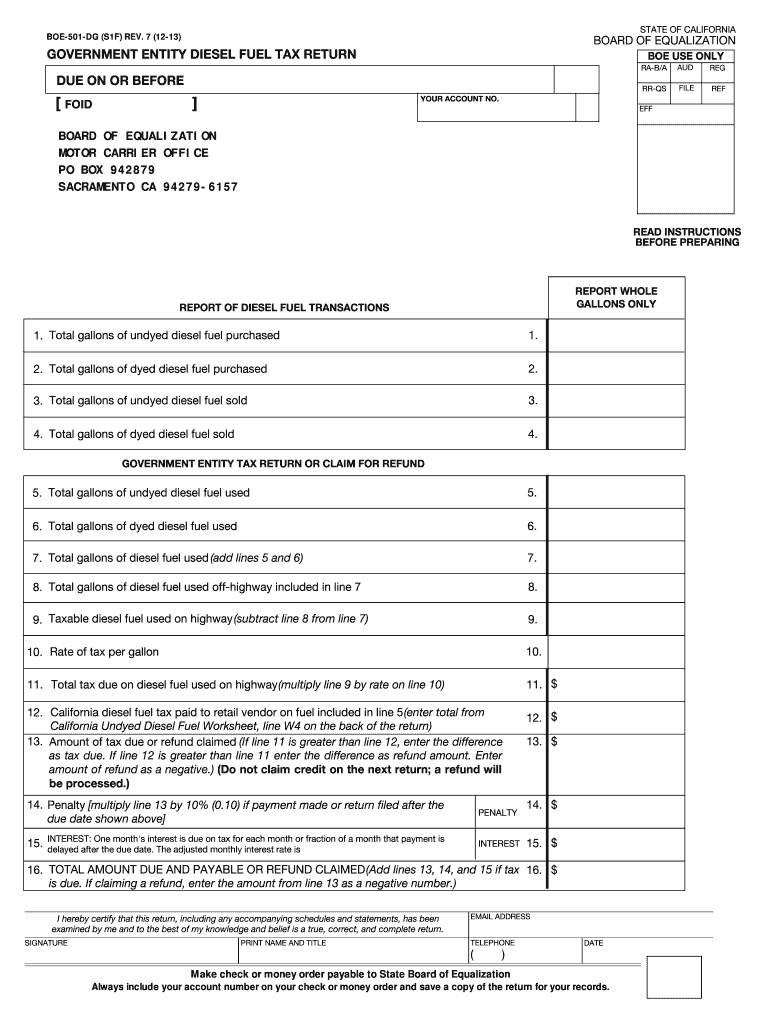

The Government Entity Diesel Fuel Tax Return, known as BOE 501 DG, is a specific tax form utilized by government entities in California to report and remit diesel fuel taxes. This form is essential for compliance with state tax regulations, ensuring that government bodies accurately account for diesel fuel consumption and associated taxes. The form captures crucial data regarding the amount of diesel fuel purchased, used, or sold, and helps maintain transparency in fuel tax reporting.

Steps to Complete the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca

Completing the BOE 501 DG form involves several key steps to ensure accurate reporting:

- Gather necessary documentation, including invoices and receipts for diesel fuel purchases.

- Fill out the form, providing details such as the total gallons of diesel fuel purchased and the applicable tax rates.

- Review the completed form for accuracy, ensuring all required fields are filled.

- Sign the form electronically using a secure eSignature platform to validate the submission.

- Submit the form by the designated filing deadline, either online or via mail, depending on your preference.

Legal Use of the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca

The BOE 501 DG form is legally binding and must be used in accordance with California state tax laws. Government entities are required to file this form to comply with tax regulations concerning diesel fuel usage. Accurate completion and timely submission of this form help avoid potential penalties and ensure that entities remain in good standing with tax authorities. The form is also designed to support electronic signatures, which are recognized legally under the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for the Government Entity Diesel Fuel Tax Return, BOE 501 DG, vary based on the reporting period. Typically, forms are due on a quarterly basis, with specific deadlines set by the California Department of Tax and Fee Administration. It is crucial for entities to stay informed about these dates to ensure timely submissions and avoid late fees. Marking these deadlines on a calendar can help in maintaining compliance.

Form Submission Methods (Online / Mail / In-Person)

The BOE 501 DG form can be submitted through various methods to accommodate different preferences:

- Online Submission: Utilize an eSignature platform for a quick and secure online filing process.

- Mail Submission: Print the completed form and send it to the appropriate tax authority address.

- In-Person Submission: Deliver the form directly to a local tax office, if preferred.

Penalties for Non-Compliance

Failure to file the Government Entity Diesel Fuel Tax Return, BOE 501 DG, by the deadline can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential audits. It is essential for government entities to understand the importance of compliance and to take proactive measures to ensure timely and accurate submissions. Regular training and updates on tax regulations can help mitigate the risk of non-compliance.

Quick guide on how to complete government entity diesel fuel tax return boe 501 dg board of boe ca

Your assistance manual on how to prepare your Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca

If you’re wondering how to finalize and submit your Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca, here are some brief guidelines to facilitate tax processing.

To begin, all you need is to create your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and complete your tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to amend entries as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finish your Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in paper form can lead to increased errors and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct government entity diesel fuel tax return boe 501 dg board of boe ca

Create this form in 5 minutes!

How to create an eSignature for the government entity diesel fuel tax return boe 501 dg board of boe ca

How to make an electronic signature for your Government Entity Diesel Fuel Tax Return Boe 501 Dg Board Of Boe Ca in the online mode

How to generate an electronic signature for your Government Entity Diesel Fuel Tax Return Boe 501 Dg Board Of Boe Ca in Chrome

How to make an electronic signature for putting it on the Government Entity Diesel Fuel Tax Return Boe 501 Dg Board Of Boe Ca in Gmail

How to generate an electronic signature for the Government Entity Diesel Fuel Tax Return Boe 501 Dg Board Of Boe Ca right from your smart phone

How to create an electronic signature for the Government Entity Diesel Fuel Tax Return Boe 501 Dg Board Of Boe Ca on iOS devices

How to make an electronic signature for the Government Entity Diesel Fuel Tax Return Boe 501 Dg Board Of Boe Ca on Android

People also ask

-

What is the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca.?

The Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca. is a specialized form used by specific governmental entities in California to report diesel fuel tax information. This form ensures compliance with state regulations while providing a streamlined process for tax reporting. Understanding this form is crucial for accurate tax filings related to diesel fuel usage.

-

How can airSlate SignNow help with the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca.?

airSlate SignNow simplifies the process of filling out and submitting the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca. With our electronic signature capabilities, you can complete these documents efficiently and ensure that they are securely submitted to the appropriate authorities. Our platform enhances productivity while maintaining compliance.

-

What are the costs associated with using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to suit different business needs when handling forms like the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca. Our plans are cost-effective and designed to provide value, ensuring you can manage your tax documents without breaking the bank. You can choose a plan that fits your usage frequency and team size.

-

Is airSlate SignNow suitable for large government organizations?

Yes, airSlate SignNow is an ideal solution for large government organizations that need to manage the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca. Our platform supports multiple users and offers advanced features such as document templates and integrations to facilitate efficient document management and workflow automation.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features specifically tailored for managing tax documents, including templates for the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca., secure electronic signatures, and real-time tracking of document status. These features streamline the workflow and enhance efficiency, ultimately saving time in the tax submission process.

-

Can I integrate airSlate SignNow with my existing software for tax filing?

Absolutely, airSlate SignNow offers integrations with popular accounting and tax filing software, enhancing your ability to manage the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca. seamlessly. This integration allows for a more cohesive workflow, making it easy to access and send documents without switching between different platforms.

-

What are the benefits of using airSlate SignNow for government tax returns?

Using airSlate SignNow for government tax returns, such as the Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca., provides numerous benefits. It increases efficiency by allowing quick electronic completions, enhances security through encryption, and ensures compliance with electronic signature laws. This results in fewer delays and more accurate filing.

Get more for Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca

Find out other Government Entity Diesel Fuel Tax Return, BOE 501 DG Board Of Boe Ca

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple