Form 1065

What is the Form 1065

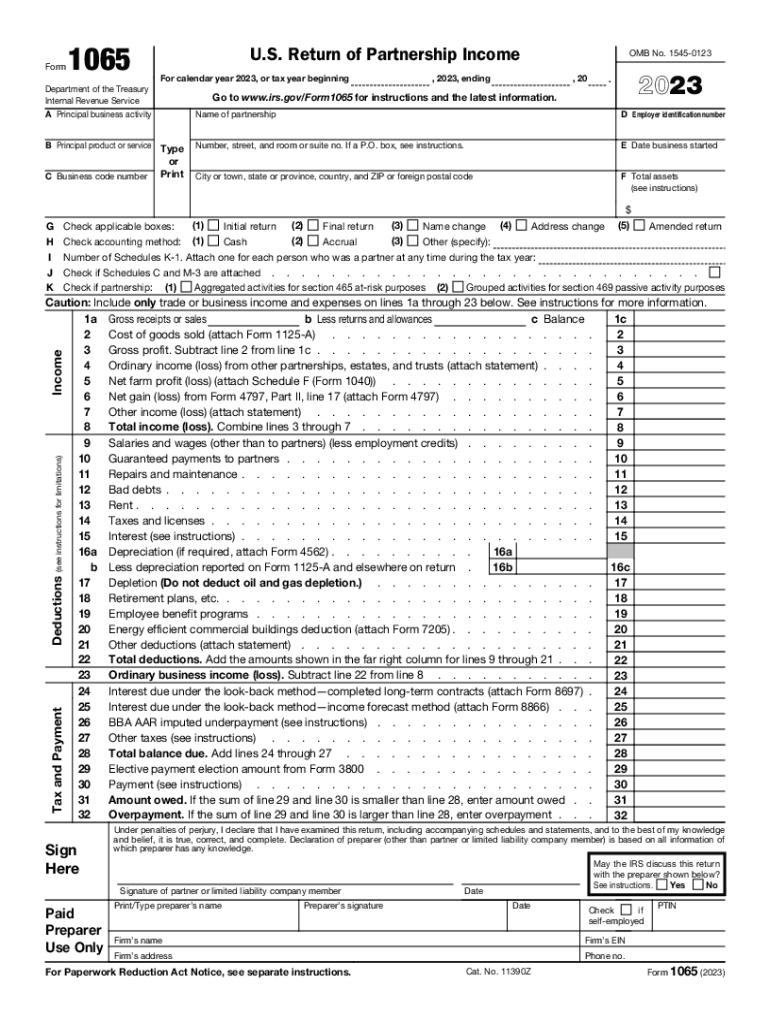

The Form 1065 is a U.S. federal tax return used by partnerships to report income, deductions, gains, and losses from their operations. Unlike individual tax returns, Form 1065 does not calculate tax owed. Instead, it provides the IRS with information about the partnership's financial activities. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits. This form is essential for ensuring that all partners report their income accurately on their personal tax returns.

How to use the Form 1065

To use Form 1065, partnerships must gather all relevant financial information, including income, expenses, and any other deductions. The form requires specific details about the partnership, such as its name, address, and Employer Identification Number (EIN). Each partner's information must also be included. After completing the form, partnerships must file it with the IRS, ensuring that all income and expenses are accurately reported. The completed Form 1065 must be submitted by the due date to avoid penalties.

Steps to complete the Form 1065

Completing Form 1065 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the basic information section, including the partnership's name, address, and EIN.

- Report income and deductions on the appropriate lines of the form.

- Complete Schedule B, which includes questions about the partnership's operations.

- Prepare Schedule K and K-1 for each partner, detailing their share of income and deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The filing deadline for Form 1065 is typically March 15 of the year following the tax year being reported. If the partnership requires additional time, it can file for an extension, which typically extends the deadline by six months. However, it is essential to note that an extension to file does not extend the time to pay any taxes owed. Partnerships should ensure they meet these deadlines to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 1065 can be submitted to the IRS through various methods. Partnerships can file electronically using IRS-approved software, which is often the quickest method. Alternatively, the form can be mailed to the appropriate IRS address based on the partnership's location and whether it includes a payment. In-person submissions are generally not an option for Form 1065. Partnerships should ensure they follow the correct submission method to avoid delays in processing.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and filing Form 1065. These guidelines include detailed instructions on what information is required, how to report income and deductions, and the necessary schedules to complete. Partnerships should refer to the IRS instructions for Form 1065 for the most current information and any changes that may affect their filing. Adhering to these guidelines is crucial for compliance and to minimize the risk of audits or penalties.

Quick guide on how to complete form 1065 701764148

Easily prepare Form 1065 on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Form 1065 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

Steps to alter and eSign Form 1065 effortlessly

- Obtain Form 1065 and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 1065 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1065 701764148

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of partnership options does airSlate SignNow offer?

airSlate SignNow offers various partnership options to cater to businesses of different sizes and needs. Whether you are looking for reseller partnerships, affiliate programs, or strategic alliances, our partnership opportunities are designed to enhance your business model. Joining our partnership program can also provide additional resources and support for your clients.

-

How can a partnership with airSlate SignNow benefit my business?

A partnership with airSlate SignNow allows your business to leverage our easy-to-use and cost-effective eSigning solutions. By offering our services to your clients, you can enhance your value proposition while generating additional revenue streams. Our partnership not only helps in expanding your service offerings but also positions you as a key player in the digital transformation space.

-

What are the pricing models available for partners of airSlate SignNow?

airSlate SignNow provides flexible pricing models for our partners, allowing them to choose a structure that best fits their business strategy. Our models include commission-based pricing, volume discounts, and customized pricing for larger enterprises. This flexibility ensures that our partners can maximize their profitability while providing competitive offerings to their customers.

-

Are there specific features of airSlate SignNow that partners should highlight?

Absolutely! Partners should emphasize key features such as advanced document management, customizable templates, and secure eSigning capabilities. These features enhance workflow efficiency and ensure compliance, making them attractive selling points for businesses looking to streamline their processes through our partnership. Highlighting user-friendliness and integration capabilities will further appeal to prospective customers.

-

How does airSlate SignNow support its partners?

airSlate SignNow is committed to providing ongoing support to our partners through dedicated account managers and tailored resources. Partners have access to training materials, marketing collateral, and technical support to ensure they can effectively promote and implement our solutions. This level of support strengthens our partnership and helps you achieve success in your sales efforts.

-

Can airSlate SignNow integrate with other software through partnerships?

Yes, airSlate SignNow offers seamless integration capabilities with a multitude of software applications, enhancing our partnerships. This interoperability means that you can offer your clients a comprehensive solution that fits into their existing technology stack. Easy integrations with CRM, project management, and collaboration tools can signNowly improve user adoption and satisfaction.

-

What is the process to become a partner of airSlate SignNow?

To become a partner of airSlate SignNow, you can start by filling out our partnership application on our website. Our team will review your application and signNow out to discuss potential partnership opportunities tailored to your business needs. It's a straightforward process designed to align with your goals and help maximize the benefits of our partnership.

Get more for Form 1065

Find out other Form 1065

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors