Form 600 541 2

What is Form 54?

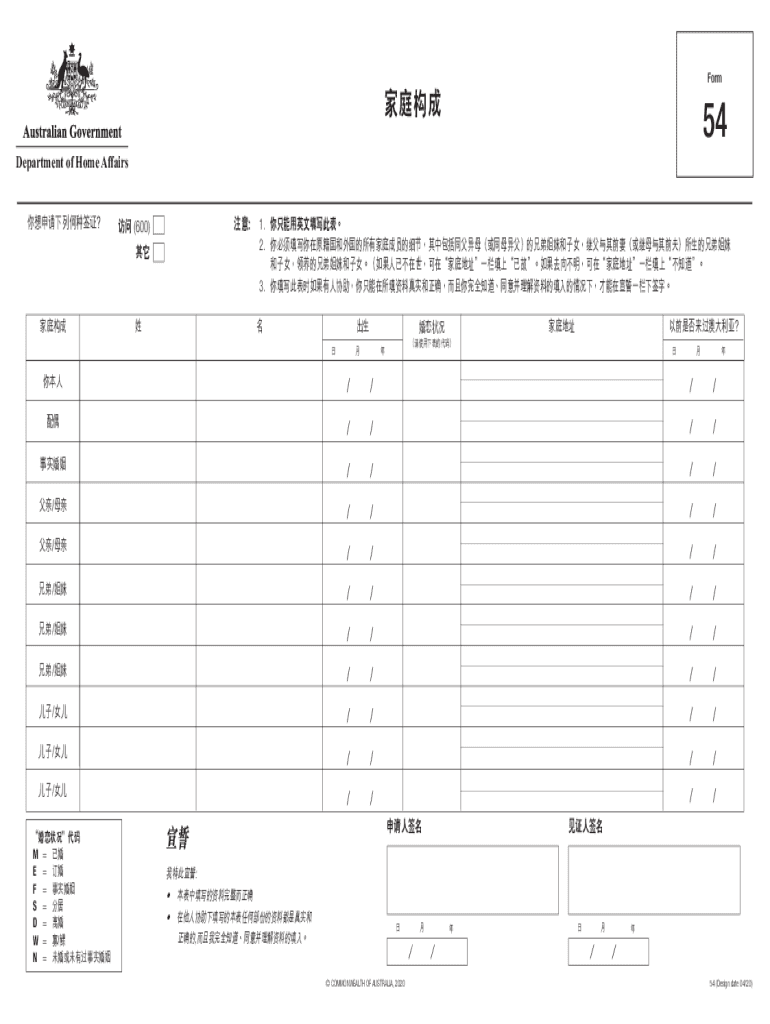

Form 54, also known as the Family Composition Form, is a document used in Australia to provide details about a family's structure. It is often required for various legal and administrative purposes, such as immigration applications or social services. This form captures essential information about family members, including their names, relationships, and other relevant details.

How to Obtain Form 54

To obtain Form 54, individuals can visit the official government website where the form is hosted. It is typically available for download in PDF format, allowing users to print and fill it out. In some cases, physical copies may be available at local government offices or community centers. Ensure you have the most recent version of the form to avoid any issues during submission.

Steps to Complete Form 54

Completing Form 54 involves several straightforward steps:

- Begin by entering your personal details, including your full name and contact information.

- Provide information about each family member, such as their names, ages, and relationships to you.

- Ensure that all information is accurate and up to date, as discrepancies can lead to delays.

- Review the form thoroughly before submission to confirm that all sections are completed.

Legal Use of Form 54

Form 54 is legally recognized in Australia and is often required for immigration processes, family reunification, and other legal matters. It serves as an official record of family relationships and may be used to verify claims in various legal contexts. It is important to fill out the form truthfully, as providing false information can result in legal consequences.

Key Elements of Form 54

Key elements of Form 54 include:

- Personal Information: Details about the applicant and family members.

- Relationship Details: Clear descriptions of how each family member is related.

- Signatures: Required signatures from the applicant and possibly other family members.

Examples of Using Form 54

Form 54 is commonly used in various scenarios, including:

- Submitting an immigration application to demonstrate family ties.

- Applying for social services that require proof of family composition.

- Documenting family relationships for legal proceedings, such as custody cases.

Quick guide on how to complete form 600 541 2

Complete Form 600 541 2 with ease on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly and without hassle. Manage Form 600 541 2 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 600 541 2 effortlessly

- Obtain Form 600 541 2 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to store your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 600 541 2 while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 600 541 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 54 in English and how can it be used?

Form 54 in English refers to a standardized document often required for specific regulatory or operational purposes. It allows businesses to provide essential information in a clear manner. Using airSlate SignNow, you can easily fill out and eSign form 54 in English, streamlining your workflow and ensuring compliance.

-

How does airSlate SignNow support the completion of form 54 in English?

airSlate SignNow simplifies the process of completing form 54 in English by providing user-friendly templates and eSignature capabilities. You can customize the document to fit your needs, and the platform allows for quick access and collaboration among team members. This efficiency saves time and reduces errors in document handling.

-

What are the pricing options for using airSlate SignNow for form 54 in English?

airSlate SignNow offers flexible pricing plans suitable for different business needs when handling documents like form 54 in English. You can choose from monthly or annual subscriptions based on the volume of documents you handle. This affordability makes it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for handling form 54 in English?

The platform provides a variety of features tailored for form 54 in English, including customizable templates, workflow automation, and advanced security measures. Additionally, users can track the signing process in real-time and send reminders to signers, ensuring that documents are completed promptly.

-

Can I integrate airSlate SignNow with other applications to manage form 54 in English?

Absolutely! airSlate SignNow offers integrations with popular business applications, allowing you to seamlessly manage form 54 in English alongside other tools you use. This means you can streamline document workflows across platforms such as CRM systems and project management tools.

-

What are the benefits of using airSlate SignNow for form 54 in English?

Using airSlate SignNow for form 54 in English enhances efficiency and accuracy in document management. The platform’s eSignature capabilities speed up the signing process, while its templates help maintain consistency across forms. Furthermore, businesses benefit from improved tracking and compliance, minimizing the risks associated with manual processes.

-

Is it easy to train employees to use airSlate SignNow for form 54 in English?

Yes, airSlate SignNow is designed to be user-friendly, which simplifies the onboarding process for employees. Training resources, including tutorials and customer support, make it easy to understand how to effectively manage form 54 in English. Most users can quickly adapt to the platform, ensuring a smooth transition to digital document management.

Get more for Form 600 541 2

Find out other Form 600 541 2

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later