Form 3581 Tax Deposit Refund and Transfer Request Form 3581 Tax Deposit Refund and Transfer Request 2022

Understanding the Form 3581 Tax Deposit Refund and Transfer Request

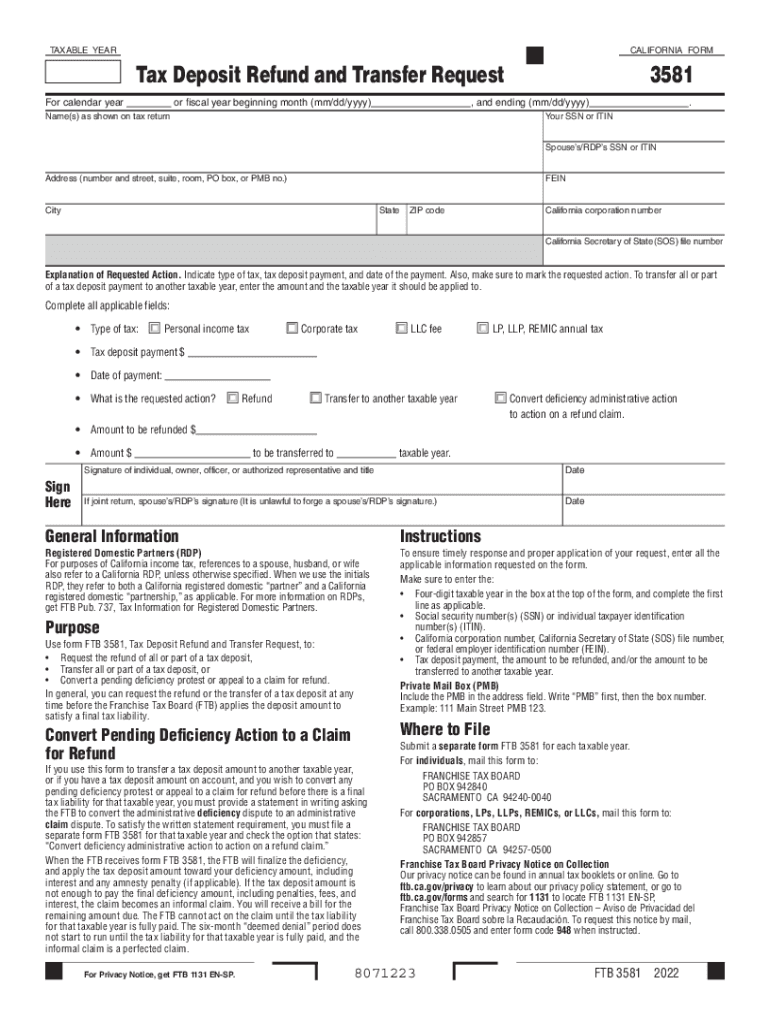

The Form 3581 Tax Deposit Refund and Transfer Request is a specific tax form used by individuals and businesses in the United States to request refunds or transfers of tax deposits. This form is essential for those who have overpaid their taxes or need to reallocate funds between different tax accounts. Understanding its purpose and function can help streamline the tax management process.

How to Complete the Form 3581 Tax Deposit Refund and Transfer Request

Completing the Form 3581 requires careful attention to detail. Start by entering your personal information, including your name, address, and taxpayer identification number. Next, specify the type of tax deposit you are requesting a refund or transfer for. Ensure that you provide accurate amounts and any relevant account numbers. Finally, sign and date the form to validate your request.

Obtaining the Form 3581 Tax Deposit Refund and Transfer Request

The Form 3581 can be obtained directly from the Internal Revenue Service (IRS) website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to avoid any issues with your submission. Additionally, some tax software may offer the form as part of their package, making it easier for users to fill out and submit electronically.

Key Elements of the Form 3581 Tax Deposit Refund and Transfer Request

Several key elements must be included in the Form 3581 to ensure it is processed correctly. These include:

- Your personal identification information

- The specific tax period related to the deposit

- The amount of the deposit you are requesting to refund or transfer

- Any relevant account numbers

- Your signature and date

Providing complete and accurate information in these sections helps facilitate a smoother processing experience.

Filing Deadlines for the Form 3581 Tax Deposit Refund and Transfer Request

It is crucial to be aware of the filing deadlines associated with the Form 3581. Generally, requests for refunds or transfers should be submitted within a specific timeframe after the tax deposit was made. Missing these deadlines may result in delays or denial of your request. Always check the IRS guidelines for the most current deadlines to ensure compliance.

Digital Submission of the Form 3581 Tax Deposit Refund and Transfer Request

Submitting the Form 3581 electronically can significantly expedite the process. Many tax software programs offer features that allow users to fill out and submit the form directly to the IRS. This method not only saves time but also reduces the risk of errors that can occur with paper submissions. Ensure that you have the necessary software compatibility to facilitate this process.

Quick guide on how to complete form 3581 tax deposit refund and transfer request form 3581 tax deposit refund and transfer request

Prepare Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, since you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, amend, and eSign your documents quickly without complications. Manage Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to alter and eSign Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request with ease

- Obtain Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Adjust and eSign Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3581 tax deposit refund and transfer request form 3581 tax deposit refund and transfer request

Create this form in 5 minutes!

How to create an eSignature for the form 3581 tax deposit refund and transfer request form 3581 tax deposit refund and transfer request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3581 Tax Deposit Refund And Transfer Request?

The Form 3581 Tax Deposit Refund And Transfer Request is a form used by businesses and individuals to request a refund or transfer of overpaid tax deposits. Understanding how to properly complete and submit the Form 3581 Tax Deposit Refund And Transfer Request can streamline your tax processes and ensure you reclaim your funds efficiently.

-

How can airSlate SignNow assist with the Form 3581 Tax Deposit Refund And Transfer Request?

airSlate SignNow provides an intuitive platform for managing, completing, and eSigning the Form 3581 Tax Deposit Refund And Transfer Request. With easy-to-use templates and secure digital signatures, airSlate SignNow enhances your experience by reducing paperwork and expediting your request.

-

Is there a cost associated with using airSlate SignNow for the Form 3581 Tax Deposit Refund And Transfer Request?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. By choosing airSlate SignNow, you're investing in a cost-effective solution for managing the Form 3581 Tax Deposit Refund And Transfer Request along with all your document workflows.

-

What features does airSlate SignNow offer for the Form 3581 Tax Deposit Refund And Transfer Request?

airSlate SignNow offers several features including document templates, real-time collaboration, and tracking capabilities for the Form 3581 Tax Deposit Refund And Transfer Request. These features help ensure that you can manage your requests efficiently and stay updated throughout the process.

-

Can I track the status of my Form 3581 Tax Deposit Refund And Transfer Request?

Absolutely! With airSlate SignNow, you can easily track the status of your Form 3581 Tax Deposit Refund And Transfer Request. The platform provides notifications and updates, giving you peace of mind knowing where your document stands at any time.

-

What are the benefits of using airSlate SignNow for my tax documentation needs?

Using airSlate SignNow allows for faster processing and greater efficiency when handling documents like the Form 3581 Tax Deposit Refund And Transfer Request. The benefits include reduced turnaround times, enhanced security for your documents, and an overall simplified tax management process.

-

Does airSlate SignNow integrate with other software for managing the Form 3581 Tax Deposit Refund And Transfer Request?

Yes, airSlate SignNow offers seamless integrations with various cloud storage and productivity platforms, making it simple to manage the Form 3581 Tax Deposit Refund And Transfer Request alongside other tools you may already be using. These integrations help centralize your workflow for better efficiency.

Get more for Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request

- Cps family income information form

- Planned parenthood abortion paperwork form

- Drug screen report forms new confirm biosciences

- Cannabis funding ppm cannabis funding group lp is a private form

- Dmepos setup and proof of delivery pharmacarewicom form

- Cnca application form

- Delta zeta recruitment introduction form

- 2015 fun luncheon reservation form west tech

Find out other Form 3581 Tax Deposit Refund And Transfer Request Form 3581 Tax Deposit Refund And Transfer Request

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document