Form 3581 Tax Deposit Refund and Transfer Request 2024-2026

What is the Form 3581 Tax Deposit Refund And Transfer Request

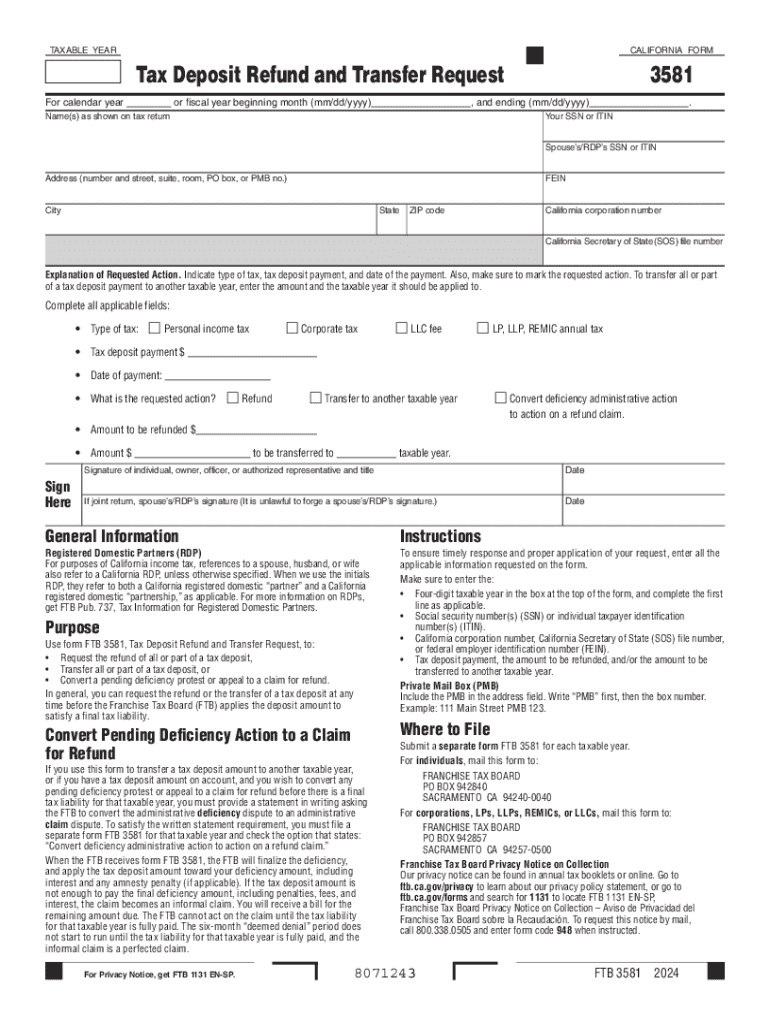

The Form 3581, known as the Tax Deposit Refund and Transfer Request, is a document used primarily in California for requesting refunds or transfers of tax deposits. This form is essential for taxpayers who have overpaid their taxes or wish to redirect their tax deposits to another account. It serves as a formal request to the California tax authorities, ensuring that the taxpayer's funds are managed accurately and efficiently. Understanding the purpose of this form is crucial for anyone looking to navigate the tax refund process effectively.

How to use the Form 3581 Tax Deposit Refund And Transfer Request

Using the Form 3581 involves several steps to ensure that the request is processed smoothly. First, obtain the form from the appropriate state tax website or office. Once you have the form, fill it out with accurate details, including your name, address, and the specific tax year related to the deposit. It is important to provide a clear reason for the refund or transfer request. After completing the form, review it for any errors before submitting it to the tax authority. Keeping a copy for your records is advisable.

Steps to complete the Form 3581 Tax Deposit Refund And Transfer Request

Completing the Form 3581 requires careful attention to detail. Here are the steps to follow:

- Download or obtain the Form 3581 from the California tax authority.

- Fill in your personal information, including your full name and contact details.

- Specify the tax year associated with the deposit you are requesting a refund for.

- Clearly state the reason for the refund or transfer request.

- Sign and date the form to validate your request.

- Submit the completed form to the designated tax office, either online or by mail.

Key elements of the Form 3581 Tax Deposit Refund And Transfer Request

The Form 3581 contains several key elements that must be filled out correctly to ensure proper processing. These include:

- Taxpayer Information: Your name, address, and taxpayer identification number.

- Tax Year: The specific year for which you are requesting a refund or transfer.

- Deposit Amount: The amount of tax deposit you are requesting to be refunded or transferred.

- Reason for Request: A clear explanation of why you are submitting the form.

- Signature: Your signature is required to authenticate the request.

Required Documents

When submitting the Form 3581, certain documents may be required to support your request. These can include:

- A copy of the original tax deposit receipt.

- Any correspondence from the tax authority regarding the deposit.

- Identification documents to verify your identity.

Providing these documents can help expedite the processing of your refund or transfer request.

Eligibility Criteria

To be eligible to use the Form 3581, taxpayers must meet specific criteria. Generally, you should have made a tax deposit with the California tax authority and be seeking a refund or transfer of that deposit. Additionally, the request must be submitted within the designated timeframe set by the tax authority. Ensuring that you meet these criteria can facilitate a smoother application process.

Create this form in 5 minutes or less

Find and fill out the correct form 3581 tax deposit refund and transfer request

Create this form in 5 minutes!

How to create an eSignature for the form 3581 tax deposit refund and transfer request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 3581?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The reference to '3581' highlights the specific features and capabilities that make our platform stand out in the market. With airSlate SignNow, you can streamline your document workflows efficiently.

-

How much does airSlate SignNow cost for users interested in 3581?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses looking to enhance their document management. The '3581' plan offers competitive rates that cater to different business sizes and needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer that are relevant to 3581?

airSlate SignNow includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. The '3581' features are designed to enhance user experience and improve efficiency in document handling, making it easier for businesses to manage their eSigning processes.

-

What are the benefits of using airSlate SignNow for 3581?

Using airSlate SignNow provides numerous benefits, including increased productivity, reduced turnaround times, and enhanced security for your documents. The '3581' solution empowers businesses to operate more efficiently, allowing teams to focus on core activities rather than administrative tasks.

-

Can airSlate SignNow integrate with other software for 3581 users?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing its functionality for '3581' users. This allows businesses to connect their existing tools and workflows, ensuring a smooth transition and improved overall efficiency.

-

Is airSlate SignNow secure for handling sensitive documents related to 3581?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents. The '3581' solution includes advanced encryption and authentication measures to protect your data and ensure that your eSigning processes are secure.

-

How can businesses benefit from the user-friendly interface of airSlate SignNow in relation to 3581?

The user-friendly interface of airSlate SignNow simplifies the eSigning process, making it accessible for all users, regardless of their technical expertise. For '3581' users, this means quicker onboarding and a smoother experience when managing documents, ultimately leading to higher satisfaction.

Get more for Form 3581 Tax Deposit Refund And Transfer Request

- Authorization for disclosure of patient medical beaumont form

- 5 pillars of islam worksheet pdf form

- Eu1 form 407258976

- Download form 42a806 formupack

- Permanent part time employment contract template form

- Permanent full time employment contract template form

- Personal trainer employment contract template form

- Physician assistant employment contract template form

Find out other Form 3581 Tax Deposit Refund And Transfer Request

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors