State of California Franchise Tax Board Tax Information Center

Understanding the State Of California Franchise Tax Board Tax Information Center

The State Of California Franchise Tax Board (FTB) Tax Information Center serves as a comprehensive resource for individuals and businesses seeking information about their tax obligations in California. It provides essential details regarding tax laws, filing requirements, and available forms. The center is designed to assist taxpayers in navigating the complexities of California's tax system, ensuring compliance and understanding of various tax responsibilities.

How to Access the State Of California Franchise Tax Board Tax Information Center

Accessing the State Of California Franchise Tax Board Tax Information Center is straightforward. Taxpayers can visit the official FTB website, where they will find a dedicated section for tax information. This section includes links to various resources, such as frequently asked questions, downloadable forms, and guidelines for filing taxes. Users can also contact the FTB directly for personalized assistance through phone or email.

Steps to Utilize the State Of California Franchise Tax Board Tax Information Center

To effectively utilize the Tax Information Center, follow these steps:

- Visit the FTB website and navigate to the Tax Information Center section.

- Identify the specific tax topic or form you need assistance with.

- Review the provided information, including guidelines and requirements.

- Download or print any necessary forms for your records.

- If further assistance is needed, reach out to FTB representatives through the provided contact methods.

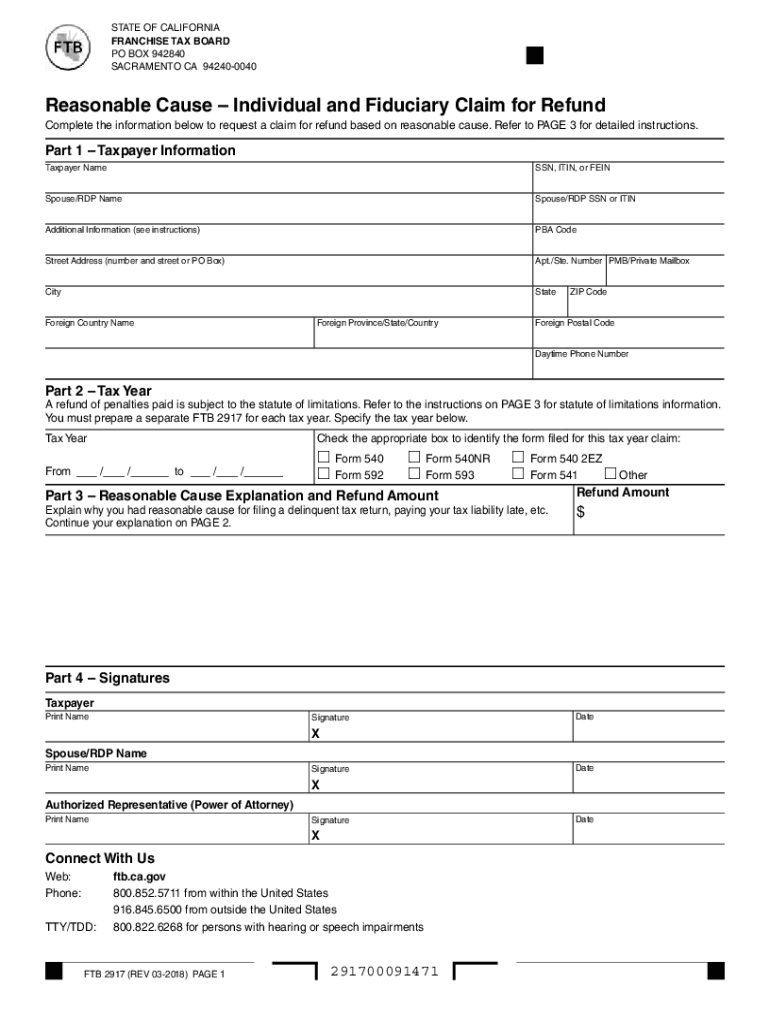

Required Documents for Filing with the State Of California Franchise Tax Board

When filing taxes in California, certain documents are essential to ensure a smooth process. Commonly required documents include:

- W-2 forms from employers for income verification.

- 1099 forms for other income sources, such as freelance work.

- Records of deductible expenses, including receipts and invoices.

- Previous year’s tax return for reference and consistency.

Gathering these documents in advance can help streamline the filing process and minimize errors.

Filing Deadlines and Important Dates for California Taxes

Staying informed about filing deadlines is crucial for compliance. Key dates for California tax filings typically include:

- April 15 for individual income tax returns.

- March 15 for corporate tax returns.

- Quarterly estimated tax payment deadlines for self-employed individuals.

Taxpayers should mark these dates on their calendars to avoid penalties and ensure timely submissions.

Penalties for Non-Compliance with California Tax Regulations

Failing to comply with California tax regulations can result in significant penalties. Common penalties include:

- Late filing penalties, which can accumulate daily until the return is filed.

- Late payment penalties for unpaid taxes after the due date.

- Interest charges on any outstanding tax balance.

Understanding these penalties emphasizes the importance of timely and accurate tax filings.

Quick guide on how to complete state of california franchise tax board tax information center

Effortlessly complete State Of California Franchise Tax Board Tax Information Center on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and store it securely online. airSlate SignNow provides you with all the tools necessary to swiftly create, edit, and electronically sign your documents without any delays. Manage State Of California Franchise Tax Board Tax Information Center on any platform using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to modify and electronically sign State Of California Franchise Tax Board Tax Information Center with ease

- Find State Of California Franchise Tax Board Tax Information Center and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and electronically sign State Of California Franchise Tax Board Tax Information Center and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of california franchise tax board tax information center

Create this form in 5 minutes!

How to create an eSignature for the state of california franchise tax board tax information center

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of California Franchise Tax Board Tax Information Center?

The State Of California Franchise Tax Board Tax Information Center is an online platform that provides essential tax information and resources for California taxpayers. It offers comprehensive guides on tax obligations, forms, and deadlines, ensuring you stay informed and compliant with state regulations.

-

How can the State Of California Franchise Tax Board Tax Information Center help my business?

Using the State Of California Franchise Tax Board Tax Information Center can signNowly simplify the tax filing process for your business. It provides access to important tax resources, filing tools, and guidance that can help ensure your business adheres to state tax laws, potentially saving you time and money.

-

What features does the State Of California Franchise Tax Board Tax Information Center offer?

The State Of California Franchise Tax Board Tax Information Center offers features such as tax form downloads, payment options, filing instructions, and frequently asked questions. These features are designed to help taxpayers navigate their responsibilities effectively and reduce confusion during tax season.

-

Is the State Of California Franchise Tax Board Tax Information Center free to use?

Yes, the State Of California Franchise Tax Board Tax Information Center is free to use for all California taxpayers. It provides valuable tools and resources at no cost, allowing you to access important tax information without any financial burden.

-

What are the benefits of using the State Of California Franchise Tax Board Tax Information Center?

The primary benefits of using the State Of California Franchise Tax Board Tax Information Center include easy access to tax information, user-friendly tools, and reliable support. These resources help ensure tax compliance and can guide you through the complexities of California tax laws.

-

Can I find information about tax deadlines on the State Of California Franchise Tax Board Tax Information Center?

Absolutely! The State Of California Franchise Tax Board Tax Information Center provides detailed information about all pertinent tax deadlines. Staying informed about these deadlines is crucial to avoid late fees and maintain compliance with state tax regulations.

-

How frequently is the information updated on the State Of California Franchise Tax Board Tax Information Center?

The information on the State Of California Franchise Tax Board Tax Information Center is regularly updated to reflect the latest tax laws and guidelines. You can rely on this platform for current and accurate tax information essential for your compliance and reporting needs.

Get more for State Of California Franchise Tax Board Tax Information Center

- Testimony of designated sponsor form

- Deed of full reconveyance know all men by these presents that trustee under the deed of trust mentioned below having duly form

- Chm 102 exam ii spring 2010 form a name key raw score t uncw

- Transcript request mountainside hospital form

- Declaration of nil income form

- Ages amp stages questionnaires third edition asq 3 squires amp bricker form

- Fax number for ga mv20 2016 2019 form

- Mo 108 2017 2019 form

Find out other State Of California Franchise Tax Board Tax Information Center

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement