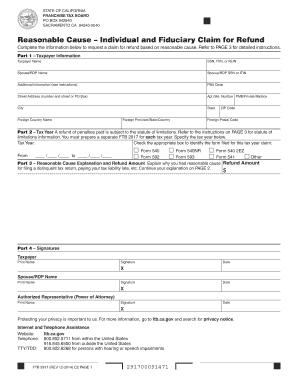

Reasonable Cause Individual and Fiduciary Claim for Refund Reasonable Cause Individual and Fiduciary Claim for Refund Ftb Ca 2018-2026

Understanding the Reasonable Cause Claim for Refund

The Reasonable Cause Individual and Fiduciary Claim for Refund is a form used by taxpayers in California to request a refund for taxes paid under certain circumstances. This claim is particularly relevant for individuals and fiduciaries who believe they have a valid reason for not meeting tax obligations on time. The California Franchise Tax Board (FTB) evaluates these claims based on specific criteria that demonstrate the taxpayer's reasonable cause for the delay or error.

Steps to Complete the Claim for Refund

Filling out the Reasonable Cause Claim involves several key steps:

- Gather necessary documentation that supports your claim, such as tax returns, payment records, and any correspondence with the FTB.

- Complete the FTB 2917 form, ensuring that all required fields are filled accurately to avoid delays.

- Clearly explain the reason for your claim in the designated section, providing detailed information about the circumstances that led to your tax issue.

- Review your completed form for accuracy and completeness before submission.

- Submit the form according to the FTB guidelines, either online, by mail, or in person.

Required Documents for Submission

When submitting the Reasonable Cause Claim for Refund, taxpayers must include specific documents to support their request. These may include:

- Copies of relevant tax returns for the years in question.

- Proof of payment or correspondence with the FTB.

- Any documentation that substantiates the reason for the claim, such as medical records or financial statements.

Eligibility Criteria for Filing a Claim

To qualify for the Reasonable Cause Claim for Refund, taxpayers must meet certain eligibility criteria. These include:

- Demonstrating that the failure to comply with tax obligations was due to circumstances beyond their control.

- Providing evidence that they acted in good faith and took reasonable steps to comply with tax laws.

- Filing the claim within the appropriate time frame, typically within four years from the date the tax was paid.

Legal Use of the Claim for Refund

The Reasonable Cause Claim for Refund is legally recognized under California tax law. Taxpayers can invoke this claim when they believe that their circumstances justify a refund due to reasonable cause. It is essential for taxpayers to understand the legal framework surrounding this claim to ensure compliance and to enhance the likelihood of approval.

Examples of Reasonable Cause Situations

Common examples that may qualify as reasonable cause include:

- Serious illness or medical emergencies that hindered timely tax filing.

- Natural disasters that affected the taxpayer's ability to meet tax obligations.

- Errors made by tax professionals that were beyond the taxpayer's control.

Quick guide on how to complete reasonable cause individual and fiduciary claim for refund reasonable cause individual and fiduciary claim for refund ftb ca

Effortlessly create Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and electronically sign your documents quickly and without hassle. Manage Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca without any difficulty

- Find Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about losing or misplacing files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reasonable cause individual and fiduciary claim for refund reasonable cause individual and fiduciary claim for refund ftb ca

Create this form in 5 minutes!

How to create an eSignature for the reasonable cause individual and fiduciary claim for refund reasonable cause individual and fiduciary claim for refund ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Franchise Tax Board website?

The California Franchise Tax Board website is the official online portal for managing tax-related services in California. It provides resources for individuals and businesses to file taxes, check their tax status, and access various tax forms. Utilizing this website can streamline your tax processes and ensure compliance with state regulations.

-

How can airSlate SignNow help with documents related to the California Franchise Tax Board website?

airSlate SignNow offers a seamless way to eSign and send documents that may be required for submission to the California Franchise Tax Board website. With its user-friendly interface, you can easily prepare and sign tax documents electronically, saving time and reducing paperwork. This ensures that your submissions are timely and organized.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while still allowing you to manage documents related to the California Franchise Tax Board website efficiently. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents. These features help ensure that your documents are compliant with requirements from the California Franchise Tax Board website. Additionally, you can collaborate with team members in real-time to streamline the document preparation process.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates with various software applications that can enhance your tax management processes. This includes popular accounting and financial software that can help you manage your documents related to the California Franchise Tax Board website more effectively. These integrations allow for a smoother workflow and better data management.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents offers numerous benefits, including increased efficiency and reduced turnaround times. You can sign documents from anywhere, which is particularly useful when dealing with submissions to the California Franchise Tax Board website. Additionally, the platform ensures that your documents are secure and legally binding.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with the California Franchise Tax Board website?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses. Whether you are filing personal taxes or managing corporate tax documents for the California Franchise Tax Board website, our platform provides the tools you need to simplify the eSigning process and ensure compliance.

Get more for Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca

- Ca request special form

- Laciv 211 form

- Supplement to petition for probate re spouse or domestic partner form

- Order for publication of summons citation or notice of hearing form

- Hearing status report form

- Arrest report no form

- Ex parte petition for amended letters to issue los angeles form

- Laciv 098 form

Find out other Reasonable Cause Individual And Fiduciary Claim For Refund Reasonable Cause Individual And Fiduciary Claim For Refund Ftb Ca

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit