Form 2917 2014

What is the Form 2917

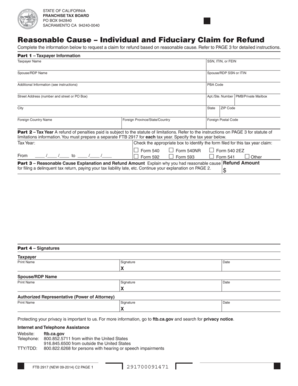

The Form 2917, also known as the FTB 2917 form, is a tax document used by individuals in California to claim a refund for overpaid taxes. This form is specifically designed for taxpayers who have made excess payments and are seeking to recover those funds. It is essential for ensuring that taxpayers receive the correct refund amount owed to them based on their tax filings.

How to use the Form 2917

Using the Form 2917 involves several straightforward steps. First, gather all relevant financial documents, including prior tax returns and payment records. Next, accurately fill out the form with the required information, ensuring that all entries are correct to avoid delays. Once completed, submit the form through the appropriate channels, either online or via mail, depending on your preference and the guidelines provided by the California Franchise Tax Board.

Steps to complete the Form 2917

Completing the Form 2917 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are claiming a refund.

- Provide details about your income and any deductions or credits you are claiming.

- Calculate the total amount of overpayment and ensure it aligns with your records.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 2917

The legal use of the Form 2917 is governed by tax regulations set forth by the California Franchise Tax Board. To be considered valid, the form must be completed accurately and submitted within the designated time frames. Additionally, any claims made must be substantiated with appropriate documentation to support the request for a refund. Compliance with these regulations ensures that the form is legally binding and that the taxpayer's rights are protected.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 2917. Generally, taxpayers must submit their claims within four years from the original due date of the tax return. This timeline ensures that claims are processed in a timely manner, allowing taxpayers to receive their refunds without unnecessary delays. Keeping track of these important dates can help prevent missed opportunities for recovery.

Required Documents

When filing the Form 2917, certain documents are necessary to support your claim. These may include:

- Previous tax returns for the relevant year.

- Proof of payment, such as bank statements or canceled checks.

- Any correspondence with the California Franchise Tax Board related to your tax payments.

Having these documents ready can facilitate a smoother filing process and help ensure that your claim is processed efficiently.

Quick guide on how to complete form 2917

Complete Form 2917 seamlessly on any device

Web-based document management has become favored among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly, without any hold-ups. Manage Form 2917 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 2917 effortlessly

- Locate Form 2917 and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 2917 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2917

Create this form in 5 minutes!

How to create an eSignature for the form 2917

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2917, and how is it used in business?

Form 2917 is a document used for specific tax-related purposes and can be crucial for businesses managing submissions and compliance. By utilizing airSlate SignNow, businesses can streamline the process of electronically signing and sending form 2917, ensuring timely submissions and reducing paperwork.

-

How does airSlate SignNow make it easy to manage form 2917?

AirSlate SignNow offers a user-friendly interface that simplifies the process of handling form 2917. With a few clicks, users can upload the form, set up e-signatures, and send it to recipients, enhancing workflow efficiency and minimizing delays.

-

Is airSlate SignNow a cost-effective solution for processing form 2917?

Yes, airSlate SignNow is a cost-effective solution for businesses of all sizes looking to process form 2917. With competitive pricing plans and no hidden fees, organizations can sign and manage documents without breaking the bank.

-

What features does airSlate SignNow offer for form 2917 processing?

AirSlate SignNow provides features like customizable templates, automated reminders, and secure e-signature capabilities specifically for form 2917. These features help ensure that the document is completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other tools for managing form 2917?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRMs and cloud storage services to enhance the management of form 2917. This allows users to centralize their document workflows and improve productivity across platforms.

-

What are the benefits of using airSlate SignNow for form 2917?

Using airSlate SignNow for form 2917 provides numerous benefits, including faster processing times, reduced errors, and improved legal compliance. The platform’s digital signature technology also ensures that documents are securely signed and stored.

-

Is there a mobile app for airSlate SignNow that can handle form 2917?

Yes, airSlate SignNow offers a mobile app that allows users to manage form 2917 on the go. The app provides full access to document signing and management features, making it easy to handle important forms anytime, anywhere.

Get more for Form 2917

- Permitting and registration support rg 373 revised april 2014 tceq texas form

- Cos004 cosmetology esthetician and manicurist specialty license applicationpub read only form

- Tceq form 20405

- Va insurance guide form

- Dmme dm form

- Sbe 701 rev07 2017 form

- Vadoc 2012 form

- Maryland concealed handgun permit application 2012 form

Find out other Form 2917

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe