Va760cg Form

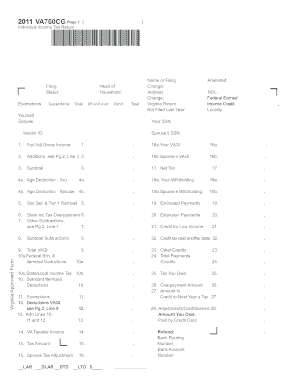

What is the VA-760CG?

The VA-760CG is the Virginia Individual Income Tax Return form specifically designed for taxpayers who are claiming a credit for taxes paid to other states. This form allows individuals to report their income and calculate the amount of tax owed to the state of Virginia while considering any credits for taxes already paid elsewhere. Understanding the purpose of the VA-760CG is essential for ensuring accurate tax reporting and compliance with Virginia tax laws.

How to Use the VA-760CG

Using the VA-760CG involves several steps to ensure that all required information is accurately reported. Taxpayers must first gather their financial documentation, including W-2 forms, 1099s, and any other relevant income statements. Next, individuals should carefully fill out the form, providing details about their income, deductions, and credits. It is important to double-check all calculations and ensure that the form is signed before submission. Taxpayers can use this form to claim any allowable credits for taxes paid to other states, which can significantly reduce their overall tax liability.

Steps to Complete the VA-760CG

Completing the VA-760CG requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Calculate your deductions to determine your taxable income.

- Claim any credits for taxes paid to other states, ensuring you have supporting documentation.

- Review the form for errors and ensure all calculations are correct.

- Sign and date the form before submitting it.

Required Documents

To successfully complete the VA-760CG, certain documents are essential. Taxpayers should have the following on hand:

- W-2 forms from employers showing wages earned.

- 1099 forms for any additional income, such as freelance work or interest.

- Documentation of taxes paid to other states, if applicable.

- Records of any deductions you plan to claim, such as receipts for charitable contributions.

- Previous year’s tax return for reference, if necessary.

Form Submission Methods

The VA-760CG can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file the form electronically using approved tax software, which often simplifies the process and reduces errors. Alternatively, taxpayers can print the completed form and mail it to the appropriate Virginia Department of Taxation address. For those who prefer a personal touch, in-person submissions are also accepted at designated tax offices throughout the state.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for avoiding penalties. The due date for submitting the VA-760CG is typically May 1st of each year for the previous tax year. If May 1st falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be mindful of any extensions that may apply, as well as deadlines for estimated tax payments if applicable.

Quick guide on how to complete va760cg 391629115

Complete Va760cg effortlessly on any device

Web-based document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can find the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Va760cg on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Va760cg without any hassle

- Find Va760cg and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal value as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, time-consuming document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Va760cg and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va760cg 391629115

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia income tax return form and why is it important?

The Virginia income tax return form is a document that residents must file annually to report their income, deductions, and tax liabilities to the state. It is important because it ensures compliance with state tax laws and helps determine how much tax you owe or are due for a refund.

-

How can airSlate SignNow assist with the Virginia income tax return form?

airSlate SignNow can help you streamline the process of preparing and submitting your Virginia income tax return form by allowing you to securely eSign documents and send them electronically. This reduces the time spent on paperwork and increases the efficiency of tax submissions.

-

Is there a cost associated with using airSlate SignNow for filing the Virginia income tax return form?

Yes, airSlate SignNow offers various pricing plans that provide different features tailored to your needs. The cost is competitive and can be particularly cost-effective compared to traditional methods of filing the Virginia income tax return form with paper.

-

What features does airSlate SignNow offer for managing the Virginia income tax return form?

airSlate SignNow offers features such as document templates, cloud storage, and secure eSigning to simplify the management of your Virginia income tax return form. These tools enhance collaboration and ensure that your documents are always accessible and compliant.

-

Can I integrate airSlate SignNow with other tax software for my Virginia income tax return form?

Absolutely! airSlate SignNow supports integrations with popular tax software, making it easier to import and manage the information needed for your Virginia income tax return form. This flexibility helps save time and reduces errors during the filing process.

-

What are the benefits of using airSlate SignNow for my Virginia income tax return form?

Using airSlate SignNow for your Virginia income tax return form offers numerous benefits, including enhanced security, reduced turnaround times, and the convenience of managing documents online. This allows for a smoother and more efficient filing experience.

-

How secure is the data I provide in the Virginia income tax return form when using airSlate SignNow?

airSlate SignNow prioritizes security and employs industry-standard encryption to protect your data while you prepare your Virginia income tax return form. Your sensitive information is safeguarded throughout the entire process, giving you peace of mind.

Get more for Va760cg

- Bfairgroundsb u18 consent form

- Www textnow commessaging texting ampamp calling app phone servicetextnow form

- 2934 death registration 8 form

- Macquarie university request academic transcript form

- Orthema orthotic prescription form v2014 09 04

- Emergency transport claim form emergency ambulance

- Cy medicare advantage and part d proposed rule cms 4192 p form

- Missing receipts declaration finance curtin edu form

Find out other Va760cg

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online