Homeowners Verification of and Property Taxes for Use with Form PTR 1 Homeowners Verification of and Property Taxes for Use with 2021

Understanding the Homeowners Verification of and Property Taxes for Use with Form PTR 1

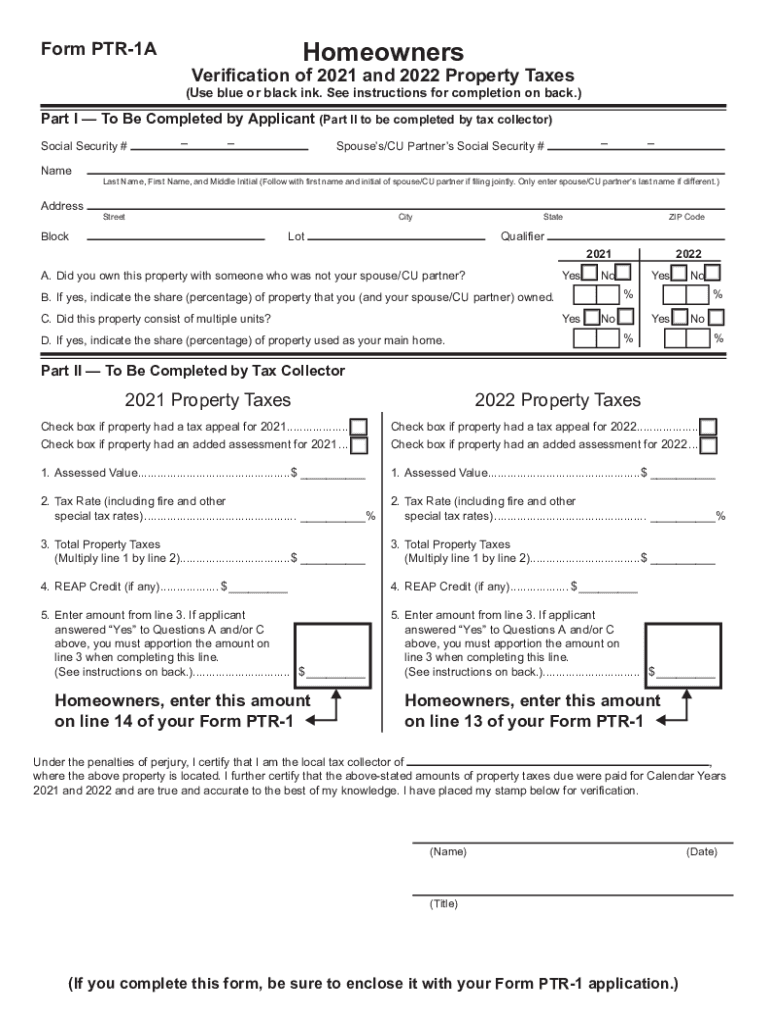

The Homeowners Verification of and Property Taxes for Use with Form PTR 1 is a crucial document for homeowners seeking to verify their property tax status. This form is typically used to confirm eligibility for various tax benefits, including property tax exemptions. By providing accurate information regarding property taxes, homeowners can ensure they receive the appropriate financial relief. This form is essential for maintaining compliance with state regulations and can significantly impact a homeowner's financial obligations.

How to Complete the Homeowners Verification of and Property Taxes for Use with Form PTR 1

Completing the Homeowners Verification of and Property Taxes for Use with Form PTR 1 involves several key steps. Homeowners must gather relevant documentation, including proof of residency and property tax statements. The form requires detailed information about the property, such as the address, tax identification number, and assessed value. It is important to ensure that all information is accurate and up-to-date to avoid delays in processing. Once completed, the form should be submitted to the appropriate local tax authority for review.

Required Documents for the Homeowners Verification of and Property Taxes for Use with Form PTR 1

To successfully complete the Homeowners Verification of and Property Taxes for Use with Form PTR 1, homeowners need to provide specific documents. These may include:

- Proof of ownership, such as a deed or mortgage statement

- Recent property tax statements

- Identification documents, such as a driver's license or state ID

- Any additional documentation required by local tax authorities

Having these documents ready will facilitate a smoother application process and help ensure that the information submitted is accurate.

Legal Use of the Homeowners Verification of and Property Taxes for Use with Form PTR 1

The Homeowners Verification of and Property Taxes for Use with Form PTR 1 serves a legal purpose in confirming property tax status. It is often required by local governments to determine eligibility for tax relief programs. Homeowners must ensure that they use the form in accordance with state laws to avoid any potential legal issues. Misrepresentation or failure to provide accurate information can lead to penalties and loss of tax benefits.

Steps to Submit the Homeowners Verification of and Property Taxes for Use with Form PTR 1

Submitting the Homeowners Verification of and Property Taxes for Use with Form PTR 1 requires following specific steps to ensure proper processing:

- Complete the form accurately, ensuring all required fields are filled out.

- Attach all necessary documentation to support the information provided.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the designated local tax authority, either online, by mail, or in person, depending on local guidelines.

Following these steps will help ensure that the form is processed efficiently and that homeowners receive any applicable benefits in a timely manner.

Eligibility Criteria for the Homeowners Verification of and Property Taxes for Use with Form PTR 1

Eligibility for using the Homeowners Verification of and Property Taxes for Use with Form PTR 1 typically depends on several factors. Homeowners must reside in the property for which they are seeking verification and must be the legal owner. Additionally, there may be income limits or other criteria established by local jurisdictions that determine eligibility for property tax exemptions or reductions. It is important for homeowners to review these criteria carefully to ensure they meet all necessary requirements before submitting the form.

Quick guide on how to complete homeowners verification of and property taxes for use with form ptr 1 homeowners verification of and property taxes for use

Complete Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the proper form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hold-ups. Manage Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With effortlessly

- Locate Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homeowners verification of and property taxes for use with form ptr 1 homeowners verification of and property taxes for use

Create this form in 5 minutes!

How to create an eSignature for the homeowners verification of and property taxes for use with form ptr 1 homeowners verification of and property taxes for use

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Homeowners Verification Of And Property Taxes For Use With Form PTR 1?

The Homeowners Verification Of And Property Taxes For Use With Form PTR 1 is a crucial document that verifies property taxes for homeowners seeking tax benefits. By utilizing airSlate SignNow, you can quickly eSign this form, ensuring its compliance and accuracy in a cost-effective manner.

-

How can airSlate SignNow help me with the Homeowners Verification Of And Property Taxes For Use With Form PTR 1?

AirSlate SignNow streamlines the process of completing the Homeowners Verification Of And Property Taxes For Use With Form PTR 1. With our user-friendly platform, you can easily fill out, eSign, and send the form, reducing the hassle often associated with paperwork.

-

What are the pricing options for using airSlate SignNow for Homeowners Verification Of And Property Taxes For Use With Form PTR 1?

AirSlate SignNow offers flexible pricing plans designed to cater to various business needs. Each plan provides access to features that support the eSigning and management of documents, including the Homeowners Verification Of And Property Taxes For Use With Form PTR 1, ensuring you find a suitable option without breaking the bank.

-

Are there any integrations available for airSlate SignNow when handling Homeowners Verification Of And Property Taxes For Use With Form PTR 1?

Yes, airSlate SignNow offers various integrations with popular business applications, enhancing your workflow. This allows you to seamlessly manage documents related to the Homeowners Verification Of And Property Taxes For Use With Form PTR 1 across platforms, improving efficiency in your operations.

-

What benefits can I expect from using airSlate SignNow for my Homeowners Verification Of And Property Taxes For Use With Form PTR 1?

Using airSlate SignNow for your Homeowners Verification Of And Property Taxes For Use With Form PTR 1 provides numerous benefits, including time savings, enhanced security, and easy access to your documents. This solution ensures that you can manage your forms quickly while maintaining a professional appearance to stakeholders.

-

Is airSlate SignNow secure for completing the Homeowners Verification Of And Property Taxes For Use With Form PTR 1?

Absolutely! AirSlate SignNow employs industry-standard security measures, including encryption, to protect your documents. When completing the Homeowners Verification Of And Property Taxes For Use With Form PTR 1, you can be assured that your data remains safe and confidential.

-

Can I track the status of my Homeowners Verification Of And Property Taxes For Use With Form PTR 1 with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Homeowners Verification Of And Property Taxes For Use With Form PTR 1. This means you can see when your document is viewed or signed, providing you with peace of mind throughout the process.

Get more for Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With

- Sjcca open records brequest formb san juan county bb sjcounty911

- Youth group registration form 2013 2014 mjc

- Poinsettia sale st john xxiii college preparatory sj23lions form

- Employer information sheet we do books

- Sample fire watch log kahcf form

- Indiana wh 4 2015 2019 form

- Pdf brukner amp khans clinical sports medicine injuries vol form

- Loan rehabilitation income and expense information form

Find out other Homeowners Verification Of And Property Taxes For Use With Form PTR 1 Homeowners Verification Of And Property Taxes For Use With

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF