Hotel Tax Collection in Muskegon County Hits All Time High Form

Understanding Hotel Tax Collection in Muskegon County

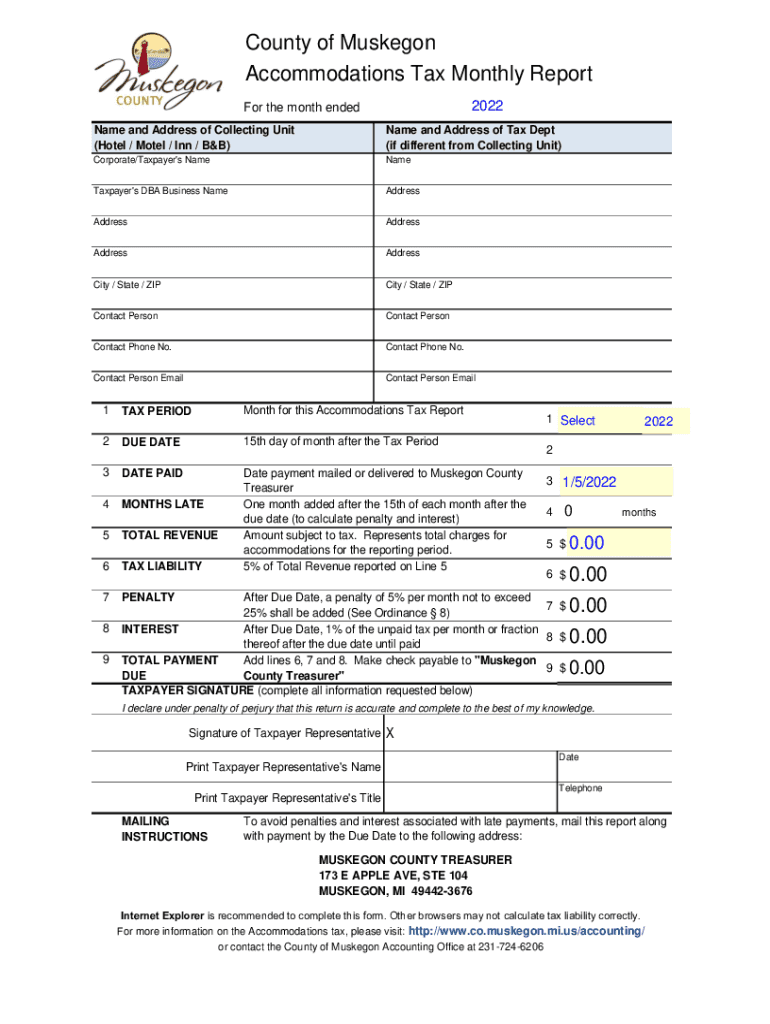

The hotel tax collection in Muskegon County refers to the revenue generated from taxes imposed on lodging establishments within the county. This tax is typically levied on guests who stay in hotels, motels, and other short-term rental properties. The funds collected are often used to promote tourism, support local infrastructure, and enhance community services. Recently, the tax collection has reached an all-time high, indicating a robust growth in tourism and hospitality in the area.

Key Elements of Hotel Tax Collection

Several key elements define the hotel tax collection process in Muskegon County. These include:

- Tax Rate: The specific percentage charged on the total cost of lodging.

- Eligible Properties: All types of accommodations, including hotels, motels, and bed-and-breakfasts.

- Collection Process: Hotels are responsible for collecting the tax from guests and remitting it to the county.

- Use of Funds: Collected taxes are typically allocated for tourism promotion and local development projects.

Steps to Complete Hotel Tax Collection

Completing the hotel tax collection involves several steps:

- Determine the Applicable Tax Rate: Check the current tax rate for Muskegon County.

- Inform Guests: Ensure that guests are aware of the tax being applied to their stay.

- Collect the Tax: Add the tax amount to the guest's bill upon checkout.

- Remit the Tax: Submit the collected taxes to the county by the designated deadlines.

Legal Use of Hotel Tax Collection

The legal framework surrounding hotel tax collection is governed by state and local laws. It is essential for lodging operators to comply with these regulations to avoid penalties. This includes accurate reporting and timely remittance of collected taxes. Failure to adhere to these legal requirements can result in fines and other legal repercussions.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for compliance. Typically, hotel tax collections must be reported and paid on a monthly or quarterly basis, depending on local regulations. Operators should maintain a calendar of important dates to ensure timely submissions and avoid penalties.

Examples of Using Hotel Tax Collection

Hotel tax collection can be illustrated through various scenarios. For instance, a hotel that collects $100 in taxes from guests over a month must accurately report this amount to the county. Additionally, the funds can be used for local tourism initiatives, such as advertising campaigns or community events that attract visitors.

Quick guide on how to complete hotel tax collection in muskegon county hits all time high

Prepare Hotel Tax Collection In Muskegon County Hits All time High effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Hotel Tax Collection In Muskegon County Hits All time High on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Hotel Tax Collection In Muskegon County Hits All time High with ease

- Locate Hotel Tax Collection In Muskegon County Hits All time High and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Hotel Tax Collection In Muskegon County Hits All time High to guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hotel tax collection in muskegon county hits all time high

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What factors contributed to the Hotel Tax Collection In Muskegon County Hits All time High?

The increase in tourism, a boost in hotel occupancy rates, and new hotel openings have signNowly contributed to the Hotel Tax Collection In Muskegon County Hits All time High. The region has become a popular destination for visitors, enhancing the overall hospitality industry. Additionally, the local government's promotional efforts have increased awareness and interest in Muskegon County as a travel destination.

-

How can businesses benefit from increased hotel tax collections?

Increased hotel tax collections can lead to better funding for local infrastructure, tourism initiatives, and community projects. Businesses can leverage these improvements to enhance their offerings and attract more visitors. Moreover, as the Hotel Tax Collection In Muskegon County Hits All time High, reinvestments can lead to better amenities that benefit the hospitality industry.

-

What are the compliance requirements for hotels concerning hotel tax in Muskegon County?

Hotels in Muskegon County are required to collect hotel taxes on the nightly rates charged to guests. It's essential for hotel owners to stay compliant with local tax regulations to avoid penalties. Understanding the Hotel Tax Collection In Muskegon County Hits All time High will help ensure that hotels meet these requirements and contribute to community funding.

-

How does airSlate SignNow help streamline document management for hotels?

airSlate SignNow simplifies the document management process for hotels by enabling easy eSigning and document sharing. This can enhance the efficiency of tax-related paperwork, contracts, and guest communication. As the Hotel Tax Collection In Muskegon County Hits All time High, having a streamlined process in place can save time and resources for hotel management.

-

What features of airSlate SignNow can assist in hotel tax documentation?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage which simplify the management of hotel tax documentation. These tools can ensure that all necessary forms related to Hotel Tax Collection In Muskegon County Hits All time High are accurately completed and filed on time. This also reduces human error, ensuring compliance with local regulations.

-

What pricing options does airSlate SignNow offer for hotels?

airSlate SignNow provides flexible pricing plans to accommodate different business sizes, including hotels of various capacities. As hotel tax collections soar, utilizing such a cost-effective solution can be beneficial for managing expenses. The plans are designed to scale according to the specific needs of each hotel while optimizing operational efficiency.

-

Which integrations does airSlate SignNow support for hotel management software?

airSlate SignNow integrates seamlessly with several hotel management systems, ensuring a smooth collaboration between document signing and operational software. This can signNowly aid in managing the effects of increased Hotel Tax Collection In Muskegon County Hits All time High by enhancing workflow efficiency. Integrating these solutions allows hotel staff to focus on guest experience rather than paperwork.

Get more for Hotel Tax Collection In Muskegon County Hits All time High

- Forms department of land and natural resources hawaiigov dobor ehawaii

- Name your consultants name occupation date address phone h w c email do you use mk products form

- Signalofficesupply office supply line card form

- Credit card authorization form silkscreen suppliescom

- Hcbs rent subsidy application iowa finance authority iowafinanceauthority form

- Free texas small estate affidavit form pdf word eforms collincountytx

- Gender marker and name change travis county law library form

- Card children s ministry program registration form fbcswan

Find out other Hotel Tax Collection In Muskegon County Hits All time High

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile