How Do I Complete Step 1 Basic Information? 2022

Understanding the AZ 140V Form

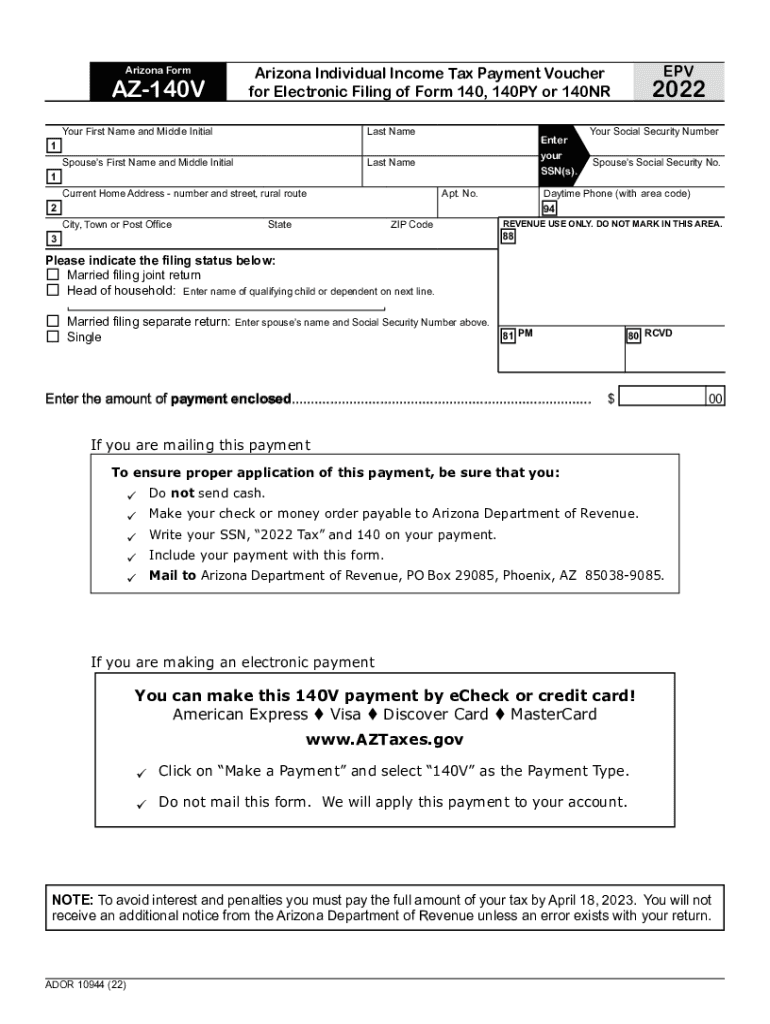

The AZ 140V form, also known as the Arizona Income Tax Payment Voucher, is a crucial document for taxpayers in Arizona. This form is specifically designed for individuals who need to submit their income tax payments directly to the Arizona Department of Revenue. It is essential for ensuring that your tax payments are properly credited to your account.

Key Elements of the AZ 140V Form

The AZ 140V form includes several important sections that taxpayers must complete accurately. Key elements include:

- Taxpayer Information: This section requires your name, address, and Social Security number.

- Payment Amount: You must indicate the total amount of tax you are paying with this voucher.

- Tax Year: Specify the tax year for which you are making the payment.

- Signature: Your signature certifies that the information provided is accurate and complete.

Steps to Complete the AZ 140V Form

Completing the AZ 140V form involves a few straightforward steps:

- Gather your tax information, including your income and any deductions.

- Fill out your personal details in the taxpayer information section.

- Calculate the total payment amount and enter it in the designated field.

- Indicate the tax year for which the payment applies.

- Sign the form to validate your submission.

Form Submission Methods

Once you have completed the AZ 140V form, you have several options for submitting it:

- By Mail: Send the completed form along with your payment to the Arizona Department of Revenue.

- In-Person: You may also submit the form at designated Arizona Department of Revenue offices.

Filing Deadlines for the AZ 140V Form

It is important to be aware of the filing deadlines associated with the AZ 140V form. Generally, payments are due on or before the tax return due date. For most taxpayers, this is typically April 15 of each year. Ensure that your payment is submitted by this date to avoid penalties.

Legal Use of the AZ 140V Form

The AZ 140V form is legally recognized by the Arizona Department of Revenue as a valid method for submitting income tax payments. Failure to use this form correctly may result in delays in processing your payment or potential penalties for late payment. It is advisable to retain a copy of the completed form for your records.

Quick guide on how to complete how do i complete step 1 basic information

Prepare How Do I Complete Step 1 Basic Information? effortlessly on any device

The management of online documents has gained prominence among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any holdups. Handle How Do I Complete Step 1 Basic Information? on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to edit and eSign How Do I Complete Step 1 Basic Information? with ease

- Locate How Do I Complete Step 1 Basic Information? and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, a process that takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details thoroughly and click the Done button to finalize your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign How Do I Complete Step 1 Basic Information? to ensure optimal communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how do i complete step 1 basic information

Create this form in 5 minutes!

How to create an eSignature for the how do i complete step 1 basic information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az 140v form?

The az 140v form is a government document used in Arizona for specific purposes, ranging from tax to legal acknowledgments. With airSlate SignNow, you can easily eSign and manage your az 140v form online, streamlining the process signNowly.

-

How can airSlate SignNow help me with the az 140v form?

airSlate SignNow provides a secure and efficient way to send, receive, and eSign the az 140v form. Our platform eliminates printing and mailing hassles, allowing you to complete the document electronically and save valuable time.

-

What are the pricing options for using airSlate SignNow with the az 140v form?

airSlate SignNow offers several cost-effective pricing plans suitable for different business sizes. Each plan allows you to eSign the az 140v form along with a range of additional features, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with my existing systems for the az 140v form?

Yes, airSlate SignNow features robust integrations with popular applications like Google Drive, Salesforce, and more. This means you can seamlessly manage your az 140v form alongside other documents within your existing workflow.

-

Is airSlate SignNow secure for handling the az 140v form?

Absolutely! airSlate SignNow prioritizes security and complies with relevant regulations to protect your sensitive data. When working with the az 140v form, you can trust our platform to keep your information safe and confidential.

-

What features does airSlate SignNow offer to enhance the process of using the az 140v form?

airSlate SignNow includes features such as template creation, real-time tracking, and multi-party signing, which enhance your experience when handling the az 140v form. These tools simplify the workflow and increase your overall efficiency.

-

Can I use airSlate SignNow on mobile for the az 140v form?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to manage the az 140v form anytime, anywhere. Our mobile application provides you with the same powerful features as the desktop version, making it convenient to eSign documents on the go.

Get more for How Do I Complete Step 1 Basic Information?

- Name date class note taking magnetism and its uses worksheet robeson k12 nc form

- Dpa 2390 abortion payment application pdf form

- Dod form dod va 3075

- Verification form2011doc pylusd

- Sunday end date form

- Jose berrocal auditorium bascom palmer eye institute miami fl form

- Individual behavior learning packets form

- Commercial driver application linscot form

Find out other How Do I Complete Step 1 Basic Information?

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile