Divorce Form Criteria AZCourtHelp Org 2023-2026

Understanding the AZ 140V Form

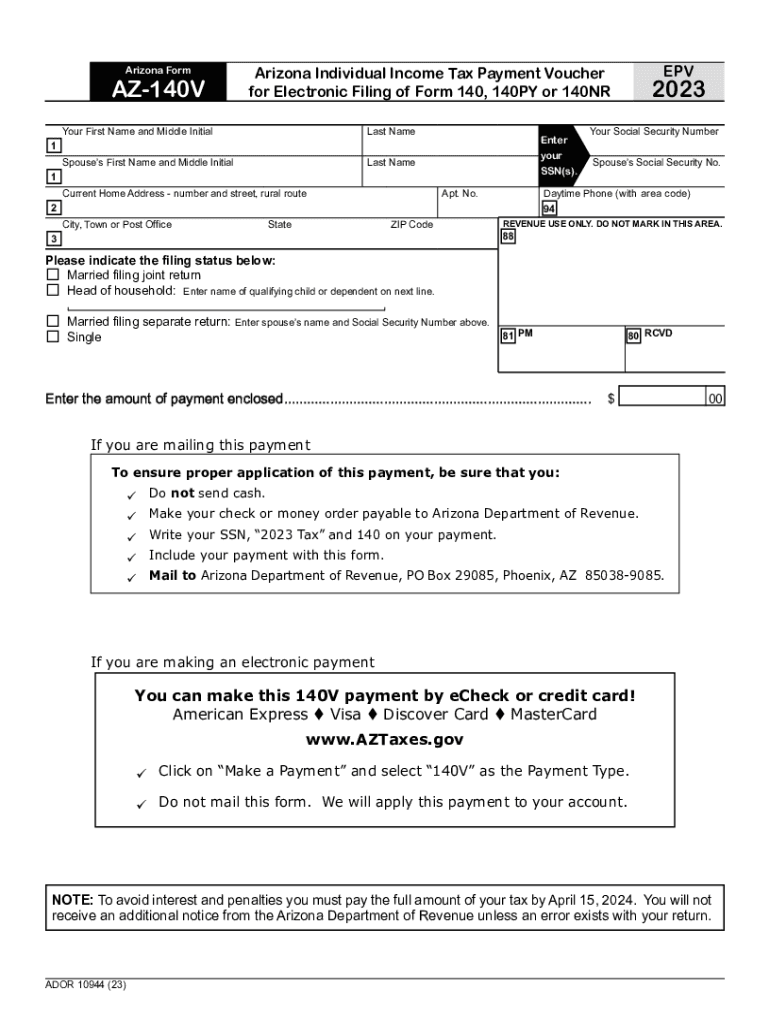

The AZ 140V form, also known as the Arizona Individual Income Tax Return Verification Form, is essential for individuals filing their state taxes. This document serves as a verification of income and other relevant tax information for residents of Arizona. It is particularly important for ensuring that all reported income is accurate and compliant with state tax regulations.

Key Elements of the AZ 140V Form

When completing the AZ 140V form, several key elements must be included:

- Personal Information: This includes your name, address, and Social Security number.

- Income Details: Report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Include any applicable deductions or tax credits that may reduce your taxable income.

- Signature: A signature is required to validate the information provided on the form.

Steps to Complete the AZ 140V Form

Filling out the AZ 140V form involves several straightforward steps:

- Gather all necessary documents, including W-2s, 1099s, and any supporting tax documents.

- Fill in your personal information accurately at the top of the form.

- Detail your income sources in the designated sections.

- List any deductions or credits you qualify for.

- Review the form for accuracy and completeness before signing.

Legal Use of the AZ 140V Form

The AZ 140V form is legally required for individuals filing their Arizona state income taxes. It serves as a declaration of the taxpayer's income and ensures compliance with state tax laws. Failing to submit this form can result in penalties or delays in processing your tax return.

Form Submission Methods

Once you have completed the AZ 140V form, you can submit it through various methods:

- Online Submission: Many taxpayers prefer to file electronically through the Arizona Department of Revenue's online portal.

- Mail: You can print the form and send it via postal mail to the appropriate tax office.

- In-Person: For those who prefer face-to-face interaction, you can submit the form at designated tax offices.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the AZ 140V form. Typically, the deadline for submitting your state income tax return is April 15. However, extensions may be available under certain circumstances. Always check the Arizona Department of Revenue for the most current information on deadlines and any changes that may occur.

Quick guide on how to complete divorce form criteria azcourthelp org

Prepare Divorce Form Criteria AZCourtHelp org effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed forms, as you can easily locate the appropriate template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Divorce Form Criteria AZCourtHelp org on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Divorce Form Criteria AZCourtHelp org without any hassle

- Obtain Divorce Form Criteria AZCourtHelp org and click on Get Form to begin.

- Utilize the tools available to submit your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Divorce Form Criteria AZCourtHelp org and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct divorce form criteria azcourthelp org

Create this form in 5 minutes!

How to create an eSignature for the divorce form criteria azcourthelp org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AZ 140V form?

The AZ 140V form is a specific document used in the state of Arizona for vehicle registration and other related processes. It is essential for ensuring compliance with state regulations. airSlate SignNow provides an easy way to fill and eSign this form efficiently.

-

How can I fill out the AZ 140V form using airSlate SignNow?

Filling out the AZ 140V form with airSlate SignNow is straightforward. You can upload the form, fill it digitally, and add your eSignature. This platform streamlines the signing process and saves you time.

-

Is there a cost associated with using airSlate SignNow for the AZ 140V form?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses. The pricing varies based on features and user needs, ensuring you get the best value for managing documents like the AZ 140V form.

-

What features does airSlate SignNow offer for the AZ 140V form?

airSlate SignNow offers features like document templates, secure cloud storage, and seamless eSignature capabilities for the AZ 140V form. These functionalities enhance user experience and ensure that the documentation process is efficient.

-

Can I integrate airSlate SignNow with other applications for the AZ 140V form?

Yes, airSlate SignNow supports a variety of integrations with other software platforms. This allows users to manage the AZ 140V form along with their existing tools, making the process smoother and more efficient.

-

What are the benefits of using airSlate SignNow for the AZ 140V form?

Using airSlate SignNow for the AZ 140V form provides numerous benefits, including enhanced security, ease of use, and quick turnaround times. It enables businesses to handle document signing at their convenience, improving overall workflow.

-

How secure is airSlate SignNow when handling the AZ 140V form?

airSlate SignNow prioritizes security by offering encrypted document storage and secure access to the AZ 140V form. You can trust that your sensitive information remains protected throughout the signing process.

Get more for Divorce Form Criteria AZCourtHelp org

- Seizure logdoc form

- Sample wrestling waiver forms

- Fillable online mhf pharmacy prior authorization request form

- Generic florida prior authorization form cigna

- Form living will and durable power of attorney for health care

- School clinic log sheet form

- Georgia ems agency fillable data management policy form

- Dph gas fired heating form edit 12 22 14 doc 3 1docx

Find out other Divorce Form Criteria AZCourtHelp org

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document